Consider This Before Buying Pacific Smiles Group Limited (ASX:PSQ) For The 3.3% Dividend

Could Pacific Smiles Group Limited (ASX:PSQ) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

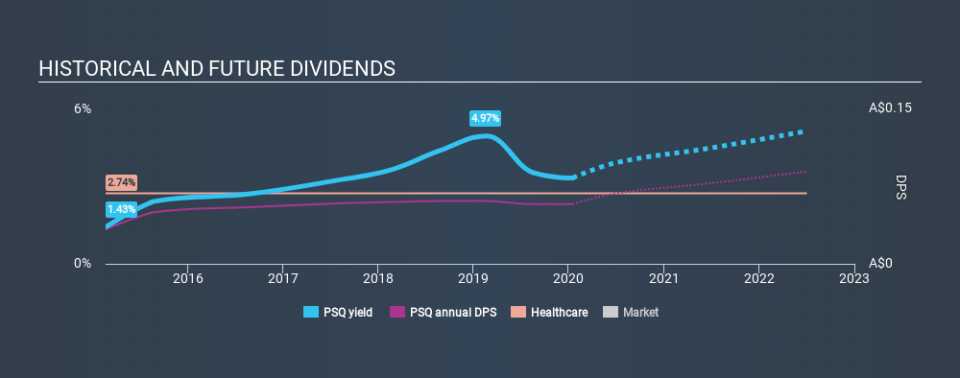

With a five-year payment history and a 3.3% yield, many investors probably find Pacific Smiles Group intriguing. It sure looks interesting on these metrics - but there's always more to the story . Some simple analysis can reduce the risk of holding Pacific Smiles Group for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Pacific Smiles Group!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 103% of Pacific Smiles Group's profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. With a cash payout ratio of 212%, Pacific Smiles Group's dividend payments are poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. As Pacific Smiles Group's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Is Pacific Smiles Group's Balance Sheet Risky?

As Pacific Smiles Group's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). With net debt of 0.45 times its EBITDA, Pacific Smiles Group has an acceptable level of debt.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. With EBIT of 19.49 times its interest expense, Pacific Smiles Group's interest cover is quite strong - more than enough to cover the interest expense.

Remember, you can always get a snapshot of Pacific Smiles Group's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Pacific Smiles Group has been paying a dividend for the past five years. During the past five-year period, the first annual payment was AU$0.033 in 2015, compared to AU$0.058 last year. Dividends per share have grown at approximately 12% per year over this time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Pacific Smiles Group's EPS are effectively flat over the past five years. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Pacific Smiles Group paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Earnings per share have been falling, and the company has a relatively short dividend history - shorter than we like, anyway. Using these criteria, Pacific Smiles Group looks quite suboptimal from a dividend investment perspective.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 3 analysts we track are forecasting for the future.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.