Are You Considering All The Risks For BGEO Group plc’s (LON:BGEO)?

BGEO Group plc (LSE:BGEO) is a small cap stock with a market capitalisation of GBP £1.32B. As a company operating in the financial services sector, it faces the risk of bad loans, also formally known as credit risk. The ability for borrowers to repay their loans depends on the stability of their salary and interest rate levels which is impacted by macroeconomic events and in turn impacts the profitability of small banks. This is because bad debt is written off as an expense and impacts BGEO Group’s bottom line and shareholders’ value. I will take you through some useful measures of bad debt and liabilities in order to properly analyse BGEO Group’s risk level before you invest in the stock. View our latest analysis for BGEO Group

How Good Is BGEO Group At Forecasting Its Risks?

The ability for BGEO Group to forecast and provision for its bad loans accurately serves as an indication for the bank’s understanding of its own level of risk. The bank has poorly anticipated the factors contributing to higher bad loan levels if it writes off more than 100% of the bad debt it provisioned for. This begs the question – does BGEO Group understand the risks it has taken on? BGEO Group’s low bad loan to bad debt ratio of 90.05% means the bank has under-provisioned by -9.95%, indicating either an unexpected one-off occurence with defaults or poor bad debt provisioning.

How Much Risk Is Too Much?

BGEO Group is seen as engaging in imprudent risky lending practices if bad loans make up more than 3% of its total loans. The bank’s profit is impacted by bad loans as these cannot be recovered by the bank and are expensed directly from its bottom line. Bad debt makes up 4.3% of the bank’s total assets which is above the appropriate level of 3%. Given that most banks are generally well-below this threshold, BGEO Group faces a much higher level of risk and exhibits below-average bad debt management.

Is There Enough Safe Form Of Borrowing?

BGEO Group operates by lending out its various forms of borrowings. Customers’ deposits tend to carry the smallest risk given the relatively stable interest rate and amount available. The general rule is the higher level of deposits a bank holds, the less risky it is considered to be. Since BGEO Group’s total deposit to total liabilities is within the sensible margin at 55.33% compared to other banks’ level of 50%, it shows a prudent level of the bank’s safer form of borrowing and an appropriate level of risk.

Final words

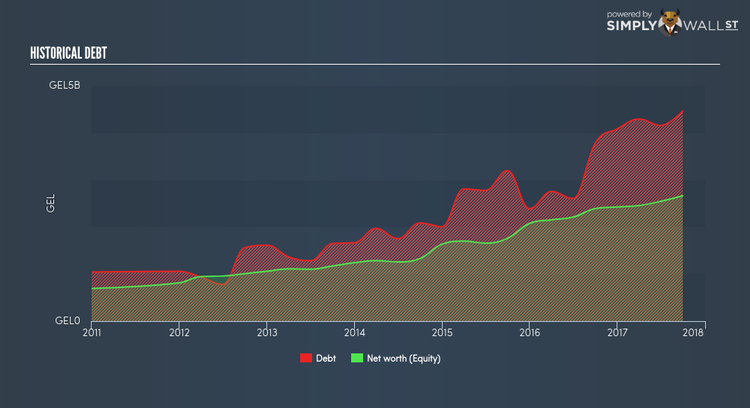

Even though BGEO Group’s level of deposits is sensible relative to its liabilities, it carries risk on the bad debt front by carrying a high level of the risky asset as well as exhibiting poor provisioning. Moving forward, this may mean its profits could be lower than expected. This possibility of an undesirable impact on cash flow lowers our conviction in BGEO Group as an investment.

Now that you know to keep in mind these risk factors when putting together your investment thesis, I recommend you check out our latest free analysis report on BGEO Group to see its growth prospects and whether it could be considered an undervalued opportunity.

PS. Interested in BGEO Group’s competitors instead? Take a look at our free platform for a deep dive into other bank stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.