Construction Stock Q2 Earnings Due on Aug 4: VMC, BLD & More

The Zacks Construction sector has performed pretty well so far this earnings season despite COVID-19-induced disruptions. The overall sector benefited from a rebound in the residential housing market, increased demand for home improvement products, and rise in repair and remodeling activities. Also, increased importance of telecommunication networks amid the pandemic added to the positives.

The residential construction space witnessed solid demand on the back of favorable mortgage rates and lower supply of homes despite rising land and labor costs.

Increased number of projects associated with communications, transmission and power, along with infrastructural activities in domestic as well as international markets are likely to have contributed to growth. Again, increasing defense spending in major economies like the United States, rising public investment in water infrastructure and utility plants, as well as encouraging prospects in the healthcare market are expected to have been favorable. Moreover, increase in safety products raised hope in this unprecedented time.

Per the latest Earnings Preview, construction sector earnings are expected to grow 2.6% in the second quarter compared with 13.4% growth in the first quarter. Revenues are projected to decrease 2.1% year over year versus 12.1% growth in the prior quarter.

Some notable construction companies like Owens Corning OC, Masco Corporation MAS and MasTec, Inc. MTZ recently reported impressive second-quarter 2020 numbers. Another handful of companies from the same space are likely to release their respective quarterly numbers this week.

A Handful of Construction Stocks to Watch

Let’s take a quick glance at how the following construction stocks are poised ahead of their second-quarter earnings releases on Aug 4.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

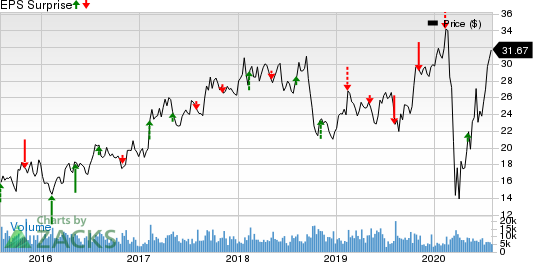

Vulcan Materials Company VMC is slated to report quarterly results before the opening bell. First-quarter 2020 earnings and revenues surpassed the Zacks Consensus Estimate by 14.6% and 4.1%, respectively. Its earnings surpassed the consensus estimate in two of the last four quarters, with the average positive surprise being 3%, as shown in the chart below:

Vulcan Materials Company Price and EPS Surprise

Vulcan Materials Company price-eps-surprise | Vulcan Materials Company Quote

Meanwhile, our proven model predicts an earnings beat for the company as it has the right combination of an Earnings ESP of +2.55% and a Zacks Rank #3. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Nonetheless, for the quarter to be reported, the Zacks Consensus Estimate for earnings has increased 3.8% to $1.38 per share over the past 30 days. This indicates a 6.8% decrease from the year-ago earnings of $1.48 per share. The consensus mark for revenues is $1.31 billion, suggesting a decrease of 1.4% year over year. (Read more: Is Vulcan Poised to Beat Earnings Estimates in Q2?)

TopBuild Corp. BLD is slated to report quarterly results before the opening bell. In the last reported quarter, the company’s earnings and revenues beat the Zacks Consensus Estimate by 7.9% and 0.5%, respectively. Its earnings topped analysts’ expectations in each of the last four quarters, with the average surprise being 8.7%, as shown in the chart below:

TopBuild Corp. Price and EPS Surprise

TopBuild Corp. price-eps-surprise | TopBuild Corp. Quote

The chances of TopBuild delivering an earnings beat are high this time around as it has an Earnings ESP of +29.11% and a Zacks Rank #1.

For the quarter to be reported, the Zacks Consensus Estimate for earnings has improved 11.2% to $1.19 per share in the past 30 days. The estimated figure implies a 16.8% year-over-year decline. The consensus estimate for revenues is $609.46 million, pointing to 7.7% year-over-year fall.

Louisiana-Pacific Corporation LPX is slated to report quarterly results before the opening bell. In the last reported quarter, earnings topped the Zacks Consensus Estimate by 13.3% but revenues lagged the same by 3.6%. However, the company reported lower-than-expected earnings in three of the last four quarters, with the average negative surprise being 37.1%, as shown in the chart below:

LouisianaPacific Corporation Price and EPS Surprise

LouisianaPacific Corporation price-eps-surprise | LouisianaPacific Corporation Quote

Unlike TopBuild, the chances of Louisiana-Pacific delivering an earnings beat in the second quarter are low as it has an Earnings ESP of -5.56% despite a Zacks Rank #2.

Nonetheless, for the quarter to be reported, the Zacks Consensus Estimate for earnings has increased 5.9% to 18 cents per share over the past 30 days. This indicates a 63.6% increase from the year-ago earnings of 11 cents per share. The consensus mark for revenues is $543 million, suggesting a decrease of 7.7% year over year.

JELD-WEN Holding, Inc. JELD is slated to report quarterly results before the opening bell. First-quarter 2020 earnings topped the Zacks Consensus Estimate by 8.3% but revenues missed the same by 0.1%. Its earnings lagged the consensus estimate in three of the last four quarters, with the average negative surprise being 12.6%, as shown in the chart below:

JELD-WEN Holding, Inc. Price and EPS Surprise

JELD-WEN Holding, Inc. price-eps-surprise | JELD-WEN Holding, Inc. Quote

However, our proven model predicts an earnings beat for the company as it has an Earnings ESP of +10.09% and a Zacks Rank #2.

For the quarter to be reported, the Zacks Consensus Estimate for earnings has been upwardly revised over the past 30 days to 18 cents per share. The estimated figure indicates a 60% decrease from the year-ago earnings. The Zacks Consensus Estimate for revenues is pegged at $973.43 million, suggesting a 13% year-over-year decline.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

LouisianaPacific Corporation (LPX) : Free Stock Analysis Report

Masco Corporation (MAS) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

JELDWEN Holding, Inc. (JELD) : Free Stock Analysis Report

To read this article on Zacks.com click here.