Will Consumer Beauty Unit Continue to Hurt Coty's Stock?

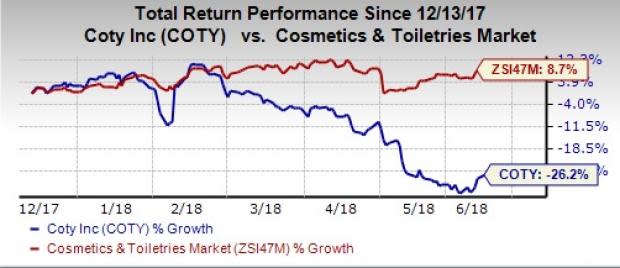

Coty Inc. COTY has been off investors’ radar for a while now, mainly due to persistent softness at its Consumer Beauty segment. In fact, strength at its Luxury and Professional Beauty businesses have not been enough to save this Zacks Rank #4 (Sell) stock that has lost 26.2% in the past six months as against the industry’s 8.7% increase.

Coty’s Consumer Beauty segment, which constituted nearly 46% of the company’s top line in the third quarter of fiscal 2018, has been posting soft organic sales for the past few quarters. The segment remained pressurized in the third quarter as well, wherein organic sales dropped 4.4%, which is much wider than a 1.3% dip recorded in the previous quarter. Consumer Beauty also witnessed a 19.9% plunge in adjusted operating income, which came in at $97.3 million.

Results in the third quarter were hurt by weak brands and pricing actions undertaken in Brazil. Also, persistent softness in the global mass beauty market and intense competition have been significant deterrents. Talking of competition, the beauty products industry is highly competitive with the number of competitors and degree of competition varying widely from country to country.

To this end, Coty faces competition from various products and product lines, in both domestic and international markets. Coty competes against products sold to consumers by other direct-selling and direct-sales companies and through the internet. It also contests against products sold through the mass market and prestige retail channels.

Apart from this, the Consumer Beauty segment has been consistently witnessing underlying challenges in North America and Europe. As Consumer Beauty forms a significant part of Coty’s business, softness in this segment weighed on the company’s overall organic sales. Incidentally, organic sales of this cosmetic big-wig rose just 0.2% in the third quarter of fiscal 2018, as robust growth in Luxury and continued strength in Professional Beauty segment was countered by a modest fall in Consumer Beauty organic sales.

Markedly, management has been undertaking solid efforts to improve the segment’s performance. In this regard, relaunch of various key brands like Clairol Nice 'n Easy has also helped the unit to some extent. While the segment is showing some signs of improvement, full recovery is likely to take time.

Nervous About Coty? Check These Solid Bets

Inter Parfums, Inc. IPAR, a Zacks Rank #1 (Strong Buy), has long-term earnings per share growth rate of 12.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Helen of Troy Limited HELE, with a solid earnings surprise history, flaunts a Zacks Rank #2 (Buy).

Conagra Brands CAG, with long-term earnings per share growth rate of 8%, carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty Inc. (COTY) : Free Stock Analysis Report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Conagra Brands Inc. (CAG) : Free Stock Analysis Report

To read this article on Zacks.com click here.