Copart Inc (CPRT): Are Analysts Right About The Drop In Earnings?

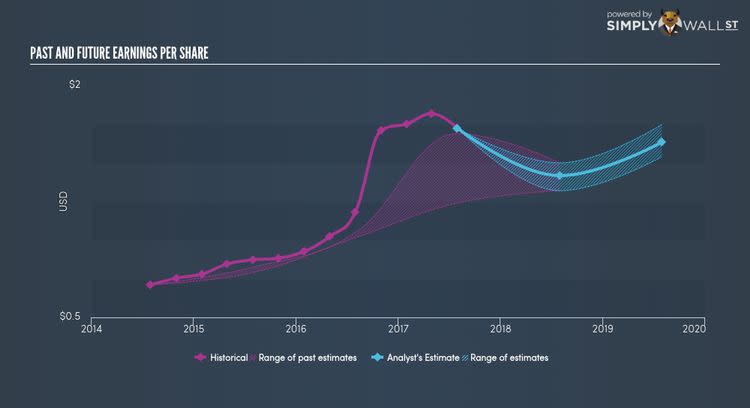

Copart Inc (NASDAQ:CPRT)’s earnings per share decline is expected to be a double-digit -17.77% over the next year. At a current EPS of $1.724, this decline means shareholders can expect an impending EPS of $1.417. Today I will look at the latest data in order to investigate whether this negative future growth rate is plausible. Check out our latest analysis for Copart

How is Copart going to perform in the future?

The bad news for investors of CPRT is that a drop in earnings is on the cards. This is based on 11 analysts who estimate earnings dropping to $1.417 from previous levels of around $1.724. This would be a drop of -17.77%, so it will be an interesting ride for any existing shareholders over the next year. In the same period revenue is predicted to grow from $1,448M $1,631M and profits (net income) are predicted to drop from $394M to $335M in the next couple of years. But, at this level of revenue and profit, margins are predicted to be extremely healthy as well.

Is the contraction built on solid basis?

The past can be an insightful indicator for future performance for a stock. We can determine whether this level of expected growth is too pessimistic or whether the company has consistently shown negative trend. CPRT is expected to face a significant change from a previous double-digit growth of 45.92%, over the past year, to a forecast double-digit decline by analysts. This is highly unencouraging and may be a sign of an investment period for CPRT, incurring higher expense growth than revenue.

Next Steps:

For CPRT, I’ve compiled three fundamental aspects you should look at:

1. Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

2. Valuation: What is CPRT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether CPRT is currently mispriced by the market.

3. Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of CPRT? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.