Copper Heads For 5th Straight Day Of Declines, China PMI In Spotlight

Talking Points

Copper falls further in Asian trading with support at 3.175

Precious metals recover lost ground as greenback drops

China official PMI and US GDP figures to offer cues

Crude oil weakened in US trading overnight as the commodity looks set to post its first weekly loss since the beginning of January. Meanwhile gold and silver have recovered some ground as broad US Dollar weakness has benefited the precious metals space. Upcoming revised fourth quarter US GDP figures and China manufacturing data are likely to give further bearings to the commodities space.

Growth-Sensitive Commodities Flounder

Despite a fresh record high for the S&P 500 overnight, suggesting improving investor sentiment, growth-sensitive commodities like crude oil, copper and natural gas suffered declines for the trading session. Profit-taking may be to blame for crude’s fall, given its string of 6 consecutive gains in preceding weeks. While, concerns of a Chinese economic slowdown have likely weighed on copper, and expectations for milder US weather conditions have weakened demand for natural gas.

Precious Metals Recover as Greenback Drops

The US Dollar continues to struggle as bullish investor sentiment is likely weakening safe-haven demand for the reserve currency, which in turn has benefited gold and silver. The greenback continued early declines during US trading following comments from Fed Chair Janet Yellen, suggesting that recent disappointing US economic data may be temporary and attributable to weather-related factors.

US GDP and China Manufacturing Data to Offer Commodities Further Guidance

Upcoming US fourth quarter GDP figures are tipped to be revised lower to 2.5% according to the median estimate from a Bloomberg survey of economists. A weaker-than-anticipated print would continue a string of recent downside surprises for US economic data. However, its potential impact on risk trends may be limited, given the market has largely shrugged off disappointing readings over the past month. Without a resurgence of risk-aversion, a greenback recovery may not gain traction, which would likely benefit gold and silver.

Official China manufacturing PMI figures set to be released over the weekend may also prove noteworthy for risk trends in light of mounting concerns over a potential slowdown in the world’s second largest economy. A miss would likely weigh on copper prices due to implications for weakening Chinese demand for the commodity.

CRUDE OIL TECHNICAL ANALYSIS – The 61.8% Fib Retracement level from the September High at $103.30 has acted to cap oil’s advance for the time-being. A Hanging Man candle formation on the daily is hinting at a reversal, however, a shift to a downtrend would be required before offering a bearish technical bias. Fading momentum signaled by the rate of change indicator suggests that such a shift is drawing closer.

Daily Chart - Created Using FXCM Marketscope 2.0

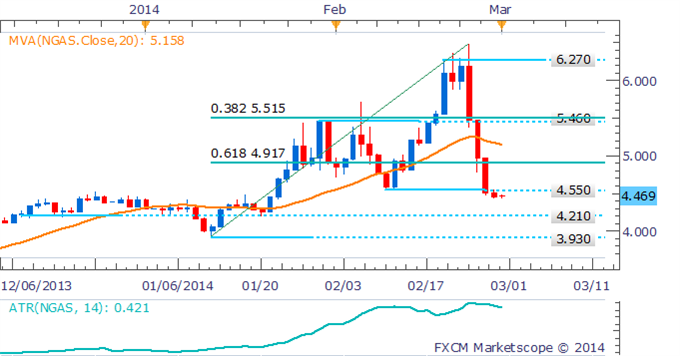

NATURAL GAS TECHNICAL ANALYSIS – The plunge in natural gas prices has led to a spike in volatility for the commodity. With sellers having pushed prices below support at 4.550 further declines would likely prompt buyers to emerge at the 4.210 level.

Daily Chart - Created Using FXCM Marketscope 2.0

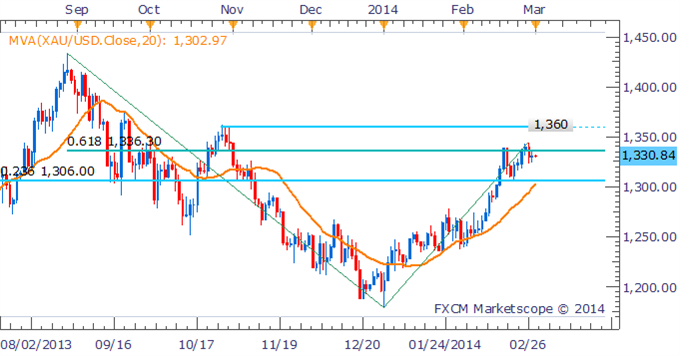

GOLD TECHNICAL ANALYSIS – After teasing at an upside break gold has failed to hold above $1,336 (61.8% Fib Retracement Level). An uptrend on the daily supports further gains for the commodity and declines are likely to be met by support at the $1,306 mark.

Daily Chart - Created Using FXCM Marketscope 2.0

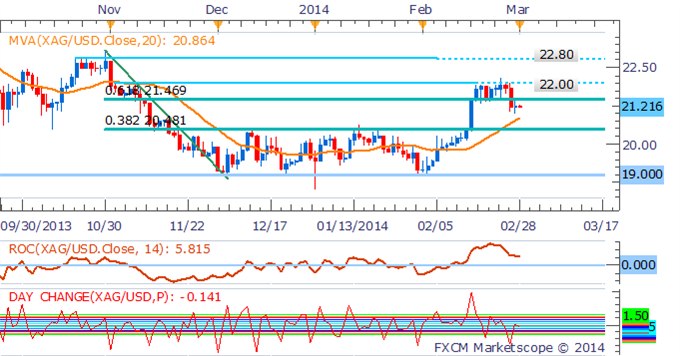

SILVER TECHNICAL ANALYSIS – The silver bulls appear to have lost the battle to hold onto gains for the precious metal around the 22.00 level. This follows a signal from the rate of change indicator indicating a fading of upside momentum. While we’ve broken below support around 21.50, a shift towards a downtrend is required before offering a bearish bias for the commodity.

Daily Chart - Created Using FXCM Marketscope 2.0

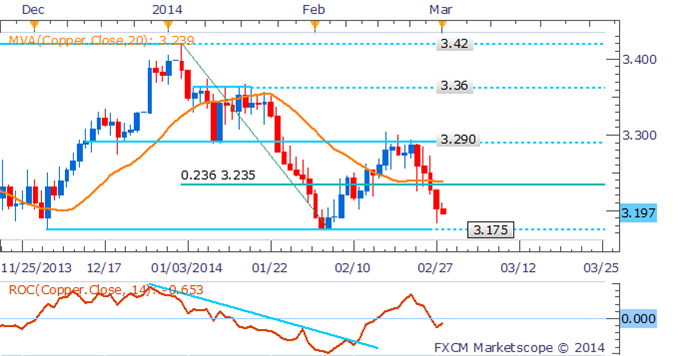

COPPER TECHNICAL ANALYSIS– Copper is heading towards support at $3.175 following a break through the 23.6% Fib Level at 3.235. With a shift in the trend indicated by prices moving below their 20 SMA a bearish technical bias is offered.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by David de Ferranti, Market Analyst, FXCM Australia

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.