Corning (GLW) Q4 Earnings & Revenues Top Estimates, Fall Y/Y

Corning Incorporated GLW reported decent fourth-quarter 2019 results, wherein the top line and the bottom line surpassed the respective Zacks Consensus Estimate. However, revenues and earnings decreased on a year-over-year basis.

In 2019, Corning successfully delivered on its 2016-2019 Strategy and Capital Allocation Framework goals. It returned more than $12.5 billion to shareholders over four years, including a 67% increase in dividends per share, while investing to advance longer-term growth initiatives.

Net Income

On a GAAP basis, net income for the December quarter declined to $32 million or 1 cent per share from $292 million or 32 cents per share in the year-ago quarter, primarily due to lower operating income and equity in losses of affiliated companies. For 2019, net income was $960 million or $1.07 per share compared with $1,066 million or $1.13 per share in 2018.

Quarterly core net income came in at $406 million or 46 cents per share compared with $539 million or 59 cents per share in the prior-year quarter. The bottom line, however, beat the Zacks Consensus Estimate by 2 cents.

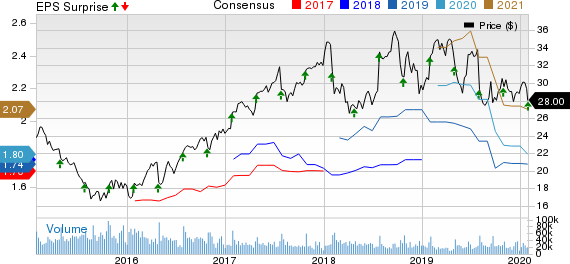

Corning Incorporated Price, Consensus and EPS Surprise

Corning Incorporated price-consensus-eps-surprise-chart | Corning Incorporated Quote

Revenues

Fourth-quarter GAAP net sales were down 7.2% year over year to $2,817 million. This reflects the material impact of changing market and customer dynamics in Optical Communications and Display Technologies business segments. For 2019, GAAP net sales were up 1.9% year over year to $11,503 million.

Quarterly core sales decreased to $2,851 million from $3,081 million recorded in the year-ago quarter. The top line, however, surpassed the consensus estimate of $2,680 million.

Quarterly Segment Results

Net sales from the Optical Communications segment, which accounts for the lion’s share of total revenues, declined 22.6% year over year to $903 million reflecting overall market weakness due to customers’ project spending decisions, primarily in carrier networks. The segment’s net income was $62 million compared with $165 million in the prior-year quarter, impacted by lower volume and reduced production to decrease inventory.

The company expects full-year 2020 sales to decline by 5-10% as the lower level of sales experienced in the second half of 2019 continues throughout the first half of 2020. It expects first-quarter 2020 sales to be down nearly 25% year over year, implying strong project spending in first-quarter 2019. It anticipates year-over-year growth in sales and profit to resume in the second half of 2020 driven by projects for 5G, fiber-to-the home and hyperscale data center deployments.

Net sales from Display Technologies were $795 million compared with $899 million in the year-earlier quarter due to lower glass volume and prices. For 2020, the company anticipates its display glass volume to grow by a mid-single digit percentage, similar to the mid-single digit growth expected in the display glass market. It expects glass price declines to remain moderate, down mid-single digits for the full year. The segment’s net income was $180 million compared with $240 million in the prior-year quarter.

Specialty Materials’ net sales were up 13.5% to $453 million, supported by innovations and strong demand for premium glasses. The company expects high-single digit year-over-year sales growth in 2020. The segment’s net income was $94 million compared with $87 million in the prior-year quarter.

Environmental Technologies’ net sales increased 17.2% to $374 million, primarily driven by gasoline particulate filter (GPF) adoption. The segment’s net income was $64 million compared with $42 million in the prior-year quarter. On a year-over-year basis, management expects sales to increase by a mid-single digit percentage in both first-quarter and full-year 2020.

Net sales from Life Sciences were up 7.6% to $256 million, as the business continued to outpace market growth. The segment’s net income was $38 million compared with $29 million in the prior-year quarter. On a year-over-year basis, sales are expected to increase by a mid-single digit percentage in both first-quarter and full-year 2020.

Other Details

Quarterly cost of sales increased 7.1% year over year to $1,963 million. Gross profit declined to $854 million from $1,202 million due to lower revenues and higher cost of sales. Core gross profit was $1,054 million compared with $1,297 million recorded in the prior-year quarter, with respective margin of 37% and 42%.

Cash Flow & Liquidity

In 2019, Corning generated $2,031 million of net cash from operating activities compared with $2,919 million in 2018. As of Dec 31, 2019, the specialty glass maker had $2,434 million in cash and equivalents with $7,729 million of long-term debt compared with the respective tallies of $2,355 million and $5,994 million a year ago.

Going Forward

While sales growth in 2019 did not meet long-term targets, the company outperformed the underlying markets and expects to build momentum throughout 2020. It remains confident in its 2020-2023 Strategy & Growth Framework goals.

Through 2023, Corning expects to deliver 6-8% compound annual sales growth and 12-15% compound annual earnings per share growth while investing $10 billion to $12 billion in RD&E, capital, and mergers and acquisitions. It also plans to expand operating margin and ROIC, and deliver $8 billion to $10 billion to shareholders, including annual dividend per share increase of at least 10%. To deliver its goals, the company expects to add an incremental $3 billion to $4 billion in annual sales and improve profitability by the end of 2023.

Zacks Rank & Stocks to Consider

Corning currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader industry are Splunk Inc. SPLK, Cloudera, Inc. CLDR and Chegg, Inc. CHGG. While Splunk sports a Zacks Rank #1 (Strong Buy), Cloudera and Chegg carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Splunk topped earnings estimates in the trailing four quarters, the surprise being 74.3%, on average.

Cloudera surpassed earnings estimates thrice in the trailing four quarters, the positive surprise being 36.1%, on average.

Chegg topped earnings estimates in the trailing four quarters, the beat being 49.4%, on average.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Chegg, Inc. (CHGG) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

Cloudera, Inc. (CLDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research