Coronavirus lockdown fatigue helps boost UK house prices

UK house prices saw the greatest jump in 11 years this month — the biggest single-month increase since August 2009 — after the property market saw an “unexpectedly rapid recovery.”

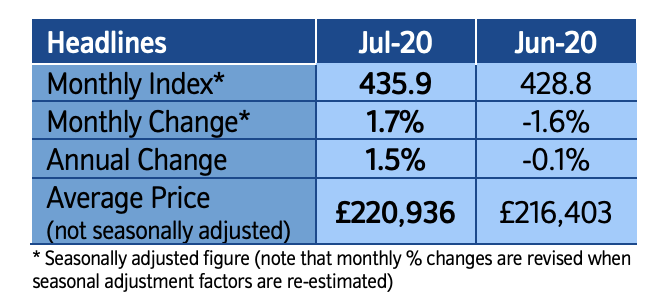

Lender Nationwide said in its monthly House Price Index report that annual house price growth rose in July to 1.5% and also jumped 1.7% month-on-month, reversing last month’s fall, as more people were looking to move homes after the coronavirus induced lockdown made people reassess their living situations.

Robert Gardner, Nationwide's chief economist, said that the rebound in prices “reflects the unexpectedly rapid recovery in housing market activity since the easing of lockdown restrictions. The rebound in activity reflects a number of factors. Pent up demand is coming through, where decisions taken to move before lockdown are progressing.

“Behavioural shifts may be boosting activity, as people reassess their housing needs and preferences as a result of life in lockdown.”

Gardner also pointed to Nationwide’s research that showed that around 15% of people were considering moving as a result of life in lockdown.

“Moreover, social distancing does not appear to be having as much of a chilling effect as we might have feared, at least at this stage,” he added.

Stamp duty holiday effect

Analysts point out that the government’s new stamp duty holiday is having a catalysing effect.

”It's no coincidence that this uptick has come at the same time as the introduction of a stamp duty holiday on purchases up to £500,000 ($627,440),” said Tomer Aboody, director of property lender MT Finance.

“Brexit and COVID-19 aside, stamp duty has been the biggest negative influence on the housing market in recent times since the introduction of higher rates on more expensive properties. This has to be resolved and dealt with, or whatever bounce we have seen in the past few months will only be a temporary one. The government not only has to look to extending the existing holiday but possibly making it permanent, while also looking at benefiting the higher end also.”

At the beginning of July, chancellor Rishi Sunak announced a stamp duty holiday for property buyers, part of a wide-ranging stimulus plan aimed at jumpstarting the UK economy after lockdown.

READ MORE: UK government announces stamp duty holiday to boost property market

The chancellor said that the threshold for stamp duty, a tax on property transactions in England and Northern Ireland, will be temporarily raised from £125,000 to £500,000. The cut, which takes effect immediately, will run until 31 March next year. Sunak said nine out of 10 people buying a main home this year will pay no stamp duty as a result of the change.

“These trends look set to continue in the near term, further boosted by the recently announced stamp duty holiday, which will serve to bring some activity forward,” said Nationwide’s Gardner.

Worsening jobs market could hit house prices

While homeowner sentiment is on the side of moving house, catalysed by government aid, analysts warn that the worsening jobs market will have an impact on property market appetite as personal financial safety diminishes.

“There is a risk this proves to be something of a false dawn. Most forecasters expect labour market conditions to weaken significantly in the quarters ahead as a result of the after effects of the pandemic and as government support schemes wind down. If this comes to pass, it would likely dampen housing activity once again in the quarters ahead,” said Nationwide’s Gardner.

Earlier this month, Office for National Statistics (ONS) figures showed the number of employees on UK payrolls in June continuing to drop as the economy buckles under the weight of the pandemic. UK employers have shed almost 650,000 jobs since March.

READ MORE: Coronavirus: UK employers have shed almost 650,000 jobs since crisis began

Jeremy Leaf, north London estate agent and a former RICS residential chairman said “let's hope lenders look at more imaginative and flexible ways of providing mortgages going forward, assisting buyers who might have been affected by the furlough schemes and a fall in their business.”

“These numbers are not surprising to us as they reflect what we are seeing on the ground as pent-up demand continues to be released and new listings pick up since the housing market re-opened,” he added.

“Activity has been given added impetus by the stamp duty holiday and continued low interest rates. However, concerns remain as to the longer-term prospects for recovery bearing in mind the risk of further Covid spikes and rising unemployment as furlough support falls away.”