Corporación América Airports (NYSE:CAAP) shareholders have endured a 14% loss from investing in the stock three years ago

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Corporación América Airports S.A. (NYSE:CAAP) shareholders, since the share price is down 14% in the last three years, falling well short of the market return of around 43%.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Corporación América Airports

Corporación América Airports wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Corporación América Airports' revenue dropped 37% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 4% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

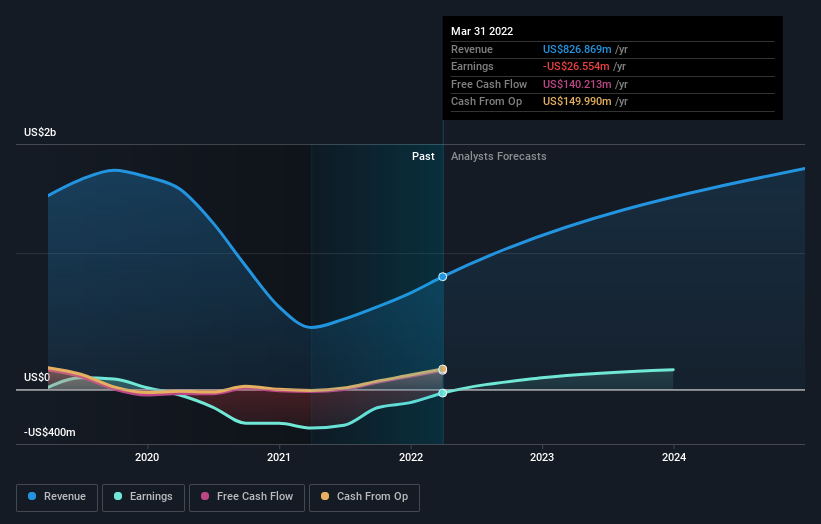

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Pleasingly, Corporación América Airports' total shareholder return last year was 4.7%. That certainly beats the loss of about 4% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Corporación América Airports better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.