Earnings would've been up in Q3 if it weren't for three industries: Morning Brief

Tuesday, November 24, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Aggregate earnings don’t tell the whole story.

Third quarter earnings season is wrapping up.

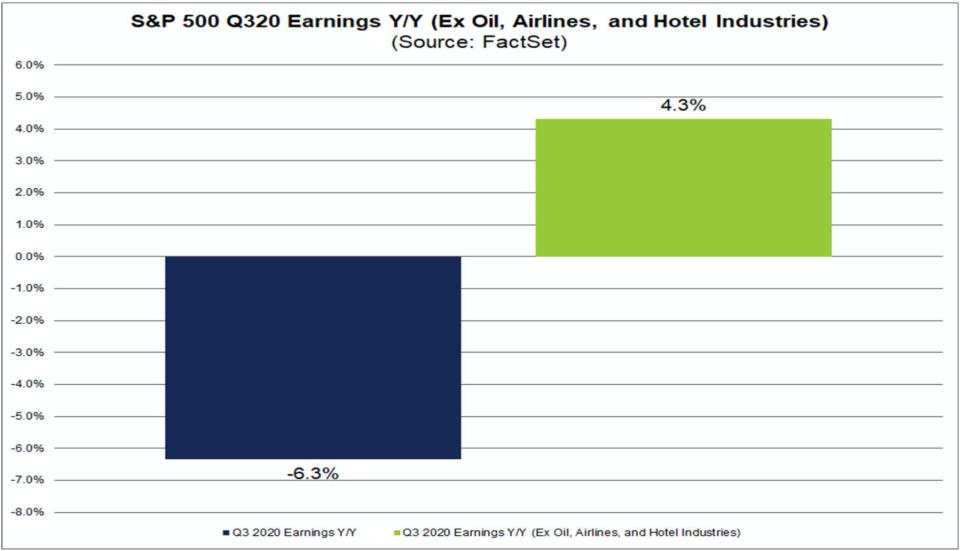

Through Friday, earnings per share for S&P 500 companies was down 6.3% over last year, the fourth-biggest quarterly drop since 2009, according to data from FactSet.

This will also mark the sixth time in the last seven quarters that year-over-year earnings fell, with tax cuts in 2018 and the onset of the pandemic early this year tough year-over-year comps that companies couldn’t beat.

The aggregate decline in corporate profitability among S&P 500 members, however, makes the earnings situation for America’s biggest companies appear dicier than it really is.

Nicholas Colas, co-founder of DataTrek Research, flagged in a note Monday that more than all of the decline in profits for the S&P 500 in the third quarter came from just three industries: oil & gas; hotels, restaurants & leisure; and airlines.

Which comes as little surprise.

The hospitality industry has been hit hard this year for obvious reasons with business travel more or less disappearing, taking away major profit drivers for hotels and airlines. Restrictions aimed at stopping the spread of the virus have hamstrung the restaurant business. And the price of oil has been stuck in the low-$40s per barrel for months while alternative energy has been one of the buzziest sectors for investors this year.

Combine the losses from these three sectors and you get a decline in profits of $37.1 billion. The S&P 500’s earnings decline comes out to a $22.7 billion loss for the whole index.

And if we back out these struggling industries from S&P 500 earnings in the third quarter, profits actually rose 4.3%.

“This is a great example of how aggregate numbers can hide important facts,” Colas writes. “Seeing that 3 beaten up industries are the delta between Q3 S&P operating income gains versus losses shows that underlying US corporate earnings power is on solid footing.”

Colas adds that, “Wall Street earnings estimates for Q4 2020 and 2021 continue to creep higher every single week. Since many companies are not giving guidance, this slow grind of increasing earnings expectations is coming from analysts seeing improvements in real-world conditions.”

Earnings and the role they play in stock prices, however, can be a funny thing.

Writing in a note to clients over the weekend, Goldman Sachs’ David Kostin said that some of the firm’s clients are concerned a strong rebound in the economy could create an inflationary environment that would result in higher rates and lower stock prices as valuations compress.

Alternatively, Kostin’s clients who believe the firm isn’t bullish enough on 2021 see the success of the S&P 500’s five biggest stocks — Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB) — and expectations that this group will grow earnings nearly 20% a year through 2022 as a reason the index could climb above Kostin’s year-end 2021 price target of 4,300.

Both of these views, however, are challenged by market history.

As Sam Ro outlined in Monday’s Morning Brief, valuations often aren’t a great guidepost for future returns. And some strategists are indeed worried that high valuations set the table for 2021 to be a muted year for stock returns even if profits rebound. But valuations also don’t follow any immutable rule of what is “sensible” and do not mean revert. And over the last 30 years valuations have been above historical averages the vast majority of the time.

Realized earnings are also not the returns driver they might otherwise seem to be. A piece of research we’ve flagged several times in the Morning Brief is work out of Bank of America from 2018 which showed years that in roughly half of the market’s losing years corporate profits were up more than 10%.

Stock prices are driven by what will happen, not what is happening. Positive vaccine developments and a robust rebound in corporate profits next year are outcomes the market has been pricing in this year.

Whether these factors will be enough to drive stocks higher in the new year remains to be seen.

By Myles Udland, reporter and anchor for Yahoo Finance Live. Follow him at @MylesUdland

What to watch today

Economy

9:00 a.m. ET: FHFA House Price Index, month-over-month, September (0.8% expected, 1.5% in August)

9:00 a.m. ET: S&P CoreLogic Case-Shiller US Home Price Index, year-over-year, September (5.71% in August)

9:00 a.m. ET: S&P CoreLogic Case-Shiller 20-City Composite Index, month-over-month, September (0.7% expected, 0.47% in August)

9:00 a.m. ET: S&P CoreLogic Case-Shiller 20-City Composite index, year-over-year, September (5.30% expected, 5.18% in August)

10:00 a.m. ET: Conference Board Consumer Confidence, November (97.2 expected, 100.9 in October)

10:00 a.m. ET: Richmond Fed Manufacturing Activity Index, November (20 expected, 29 in October)

Earnings

Pre-market

6:45 a.m. ET: Burlington Stores (BURL) is expected to report adjusted earnings of 16 cents per share on revenue of $1.53 billion

7:00 a.m. ET: Best Buy (BBY) is expected to report adjusted earnings of $1.72 per share on revenue of $11 billion

7:00 a.m. ET: Dollar Tree (DLTR) is expected to report adjusted earnings of $1.14 per share on revenue of $6.12 billion

7:30 a.m. ET: Dick’s Sporting Goods (DKS) is expected to report adjusted earnings of $1.05 per share on revenue of $2.23 billion

Post-market

4:01 p.m. ET: Autodesk (ADSK) is expected to report adjusted earnings of 96 cents per share on revenue of $942.24 million

4:01 p.m. ET: American Eagle Outfitter (AEO) is expected to report adjusted earnings of 34 cents per share on revenue of $1.03 billion

4:05 p.m. ET: Nordstrom (JWN) is expected to report adjusted earnings of 7 cents per share on revenue of $3.1 billion

4:05 p.m. ET: HP Inc (HPQ) is expected to report adjusted earnings of 52 cents per share on revenue of $14.72 billion

4:15 p.m. ET: The Gap (GPS) is expected to report adjusted earnings of 31 cents per share on revenue of $3.82 billion

4:25 p.m. ET: Dell Technologies (DELL) is expected to report adjusted earnings of $1.42 per share on revenue of $21.85 billion

4:15 p.m. ET: VMWare (VMW) is expected to report adjusted earnings of $1.43 per share on revenue of $2.81 billion

Top News

Former Fed Chair Janet Yellen reportedly Biden pick for Treasury Secretary [Yahoo Finance]

European markets rejoice as Biden transition begins [Yahoo Finance UK]

GM hits reverse on Trump effort to bar California emissions rules [Reuters]

Bitcoin hits $19,000 for first time in three years [Reuters]

YAHOO FINANCE HIGHLIGHTS

4 problems with Biden’s plan to cancel student debt

Trump administration likely to 'bungle' coronavirus vaccine distribution, says former CDC officer

20 jobs most at risk next year because of the coronavirus pandemic: Glassdoor

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay