The CorVel (NASDAQ:CRVL) Share Price Has Gained 43% And Shareholders Are Hoping For More

CorVel Corporation (NASDAQ:CRVL) shareholders might understandably be very concerned that the share price has dropped 41% in the last quarter. On the bright side the share price is up over the last half decade. In that time, it is up 43%, which isn't bad, but is below the market return of 45%.

See our latest analysis for CorVel

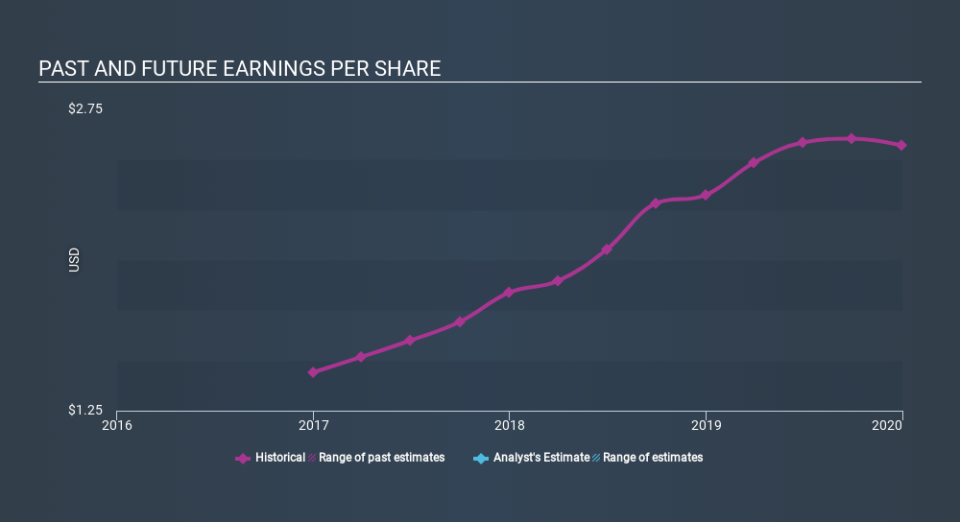

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, CorVel achieved compound earnings per share (EPS) growth of 11% per year. The EPS growth is more impressive than the yearly share price gain of 7.4% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market lost about 0.2% in the twelve months, CorVel shareholders did even worse, losing 32%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 7.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand CorVel better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for CorVel you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.