Cosan's (CZZ) Q2 Net Income Surges 104%, Revenues Up Y/Y

Cosan Limited’s CZZ adjusted net income totaled R$114 million ($31.5 million) in second-quarter 2018, surging 104% from the year-ago tally of R$55.8 million ($17.8 million). However, the net income plunged 26% from R$154 million ($47.4 million) recorded in the previous quarter.

Revenues Increase Y/Y

In the reported quarter, Cosan’s net revenues came in at R$4,074.5 million ($1,125.6 million), reflecting year-over-year growth of 21%. On a sequential basis, the top line increased 15%.

The company operates under two business segments — Cosan S.A. and Cosan Logistica S.A. While Cosan S.A includes Raizen Energia, Raizen Combustiveis, Comgas, Moove and Cosan Corporate, Cosan Logistica comprises the Rumo Logistica business.

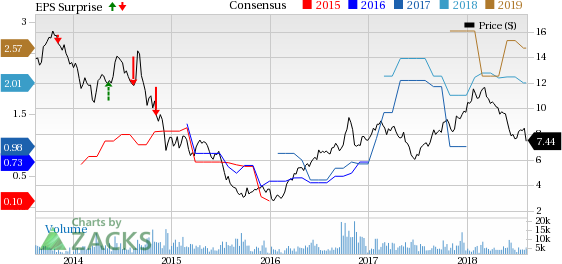

Cosan Limited Price, Consensus and EPS Surprise

Cosan Limited Price, Consensus and EPS Surprise | Cosan Limited Quote

Fuel volume sold edged down 1.5% year over year due to an 18% decline in gasoline volumes. However, ethanol volumes rose around 36.6%, diesel volume grew 2.6% and aviation-fuel volume improved 10.3%.

Sugar volume sold slumped 43% year over year to 0.7 million tons. Of the total, roughly 68.5% was exported, while the rest was sold domestically. Ethanol volume sold decreased 4% to 1 million cbm, including 25% of export volume and the rest of domestic volume.

Rise in Cost of Sales Impedes Gross Margin

Cosan’s cost of sales and services sold in the reported quarter marked a 32% year-over-year rise to R$2,913.3 million ($804.8 million). It represents 71.5% of net revenues versus 65.4% witnessed in the year-ago quarter. Gross profit dipped 0.4% year over year to R$1,161.2 million ($320.8 million), while gross margin shrunk 610 basis points (bps) year over year to 28.5%.

Selling, general and administrative expenses were down 1.4% year over year to R$483.9 million ($133.7 million), representing 12.4% of net revenues. Financial expenses came in at R$743.8 million ($205.5 million), up 8.7% year over year.

Balance Sheet

Exiting the June-end quarter, Cosan’s cash and cash equivalents were R$4,073 million ($1,050 million), up from R$6,103 million ($1,573 million) reported at the end of the previous quarter. Loans and borrowings inched up 1.7% sequentially to R$22,343 million ($5,759 million).

Outlook

For 2018, Cosan affirmed its pro-forma net revenues to be R$50-R$53 billion for Cosan S.A. Earnings before interest, tax, depreciation and amortization (EBITDA) outlook was also confirmed at R$4.9-R$5.4 billion.

The guidance for Cosan S.A.’s and Rumo’s businesses is discussed below:

Raizen Energia (guidance for crop-year April 2018-March 2019): Management expects crushed sugarcane volumes of 60-63 million tons (down from 62-66 million tons expected earlier). Sugar volume produced is projected at 4.2-4.6 million tons. The company has trimmed estimates for sugarcane crushing at Raízen Energia due to drier weather which affected productivity at some regions.

Ethanol volume production is expected to be 2.3-2.6 billion liters, while the volume of energy sold is expected to be 2.5-2.7 million MWh. EBITDA is likely to be R$3.4-R$3.8 billion, while capital spending is anticipated to be R$2.4-R$2.7 billion.

Raizen Combustiveis: EBITDA is projected at R$2.85-R$3.15 billion and capital expenditure is likely to be R$800-R$1,000 million.

Moove: EBITDA is expected to be R$200-R$230 million.

Comgas: Volume of gas sold is likely to be 4.4-4.6 million cbm, while EBITDA is projected at R$1.77-R$1.87 billion. Capital expenditure will likely be R$450-R$500 million.

Share Price Performance

In the past year, Cosan has outperformed its industry with respect to price performance. The stock has gained around 4%, while the industry has registered a 55% decline during the same time frame.

Zacks Rank & Key Picks

Cosan currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the same sector include Celanese Corporation CE, Huntsman Corporation HUN and KMG Chemicals, Inc. KMG. All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Celanese has a long-term earnings growth rate of 10%. The stock has gained around 19% in a year’s time.

Huntsman Corporation has a long-term earnings growth rate of 8.5%. The company’s shares have been up 24% during the past year.

KMG Chemicals has a long-term earnings growth rate of 28.5%. Its shares have appreciated 37% in the past year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

Cosan Limited (CZZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.