CoStar (CSGP) Announces Acquisition of Homesnap for $250M

CoStar Group, Inc. CSGP announced the acquisition of Homesnap Inc in an all cash deal worth $250 million. The acquisition, subject to regulatory and customary conditions, is expected to conclude by the end of 2020.

Headquartered in Bethesda, Homesnap provides applications and technology services to real estate agents. CoStar stated that more than 300,000 agents utilize Homesnap’s apps at an average rate of 30 times per month.

Homesnap’s well-known app — Homesnap Pro — is backed by majority of multiple listing services (MLSs) across United States. Consequently, real estate agents who have access to the app number more than 1.1 million.

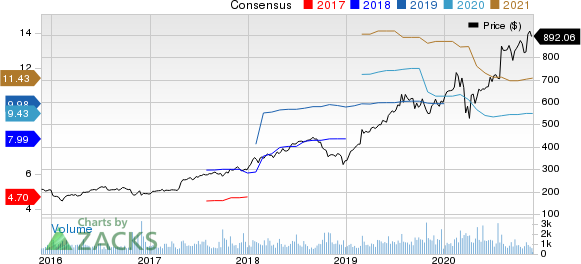

CoStar Group, Inc. Price and Consensus

CoStar Group, Inc. price-consensus-chart | CoStar Group, Inc. Quote

Since 2016, Homesnap’s monthly active user base witnessed a CAGR of 40%, added CoStar.

Synergies From the Homesnap Acquisition

CoStar is one of the leading online platforms that provides wide ranging data pertaining to commercial real estate and online marketplaces.

With the Homesnap buyout, CoStar is looking to expand its addressable market in the U.S. residential real estate vertical. Per the company, the residential market in the United States is worth $27 trillion, while the commercial real estate market is valued at $16 trillion.

The total number of professional brokers and active agents on the CoStar platform will increase to more than 400,000 from 100,000 earlier with the addition of agents enlisted on Homesnap’s platform. Also, the number of property listings across the United States on CoStar’s platform will increase to 2.6 million compared with 1.35 million listings earlier.

Homesnap is expected to generate $40 million in revenues for 2020, which indicates year-over-year surge of 45%.

CoStar on Acquisition Spree to Expand Footprint

CoStar has been on an acquisition spree to boost its footprint in the real estate vertical. In June 2020, management acquired Ten-X for $190 million. While the company announced the purchase of RentPath for $588 million in cash in February 2020, the transaction is yet to be concluded as regulatory approval remains pending.

In May 2020, CoStar announced its intent to acquire Ten-X, which is an online auction platform for commercial real estate. The company is working on combining Ten-X operations with LoopNet and CoStar platform to enhance the visibility for auctions on Ten-X platform.

At the third-quarter 2020 earnings conference call, management highlighted that the number of qualified bidders rose 47% on Ten-X platform. The company expects revenue contribution from Ten-X in the range of $25-$30 million for 2020.

Apart from that, CoStar’s acquisitions include STR, Inc, Off Campus Partners, LLC, ForRent.com, Apartment Finder, LoopNet, and Apartments.com. LoopNet and Apartments.com are two of the biggest buyouts for CoStar. The company acquired LoopNet in 2012 at a price of $860 million, while it paid $585 million for Apartments.com in 2014.

CoStar is also focused on expanding its presence in the international markets. In the third quarter 2020 conference call, management announced the conclusion of buyout of Germany-based Emporis for an undisclosed amount. Emporis is a commercial real estate data provider, which boasts 600,000 images in 100 countries along with 700,000 building records in its data base, added CoStar. The company will be leveraging the data on Emporis’ platform to accelerate its international data collection initiative.

CoStar is also eyeing to launch data collection services in 50 international cities over the next two years. Management considers revenue growth opportunity in international territories to be more than double compared with the revenue growth opportunity in North America.

CoStar’s cash and cash equivalents and restricted cash were $3.87 billion, while net long-term debt stood at $986.4 million as of Sep 30, 2020. The company reported revenue growth of 20.6% to $425.6 million in third-quarter 2020.

Zacks Rank and Key Picks

At present, CoStar carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Cirrus Logic CRUS, Qorvo QRVO, and Avnet AVT. All sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Cirrus Logic, Qorvo and Avnet is pegged at 7.1%, 15.8% and 19%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

CoStar Group, Inc. (CSGP) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research