Costco (COST) Continues With Stellar Comparable Sales Run

Costco Wholesale Corporation COST continued with stellar comparable sales (comps) performance, as evident from its April sales results. Comps for four-week ended May 6, 2018 increased 10.9%, following an advance of 8.6% in March, 10.5% in February and 6% in January. Certainly, improving labor market, rising disposable income and elevated consumer sentiment are working in tandem for the company.

The company generated net sales of $10.81 billion in the month of April, up 13.1% year over year. Notably, net sales have jumped 10.9%, 12.8% and 8.4% in the months of March, February and January, respectively.

Management highlighted that due to the calendar shift of Easter, April had one extra shopping day that favourably impacted sales as well as comps by an estimated one and one half to two percentage points.

Comps for April reflect an increase of 10.2%, 14% and 11.2% at the United States, Canada and Other International locations, respectively. Excluding the impact of foreign currency fluctuations and gasoline prices, Costco’s comps for the month under review rose 7.3%. The company recorded comps increase of 7.9%, 6% and 6.3% at the United States, Canada and Other International locations, respectively.

For the 35-week period, Costco reported 9.6% jump in comps, displaying an increase of 8.9%, 10.1% and 13.3% at the United States, Canada and Other International locations, respectively. Net sales for the period came in at $92.24 billion, an increase of 12.2% from the year-ago period.

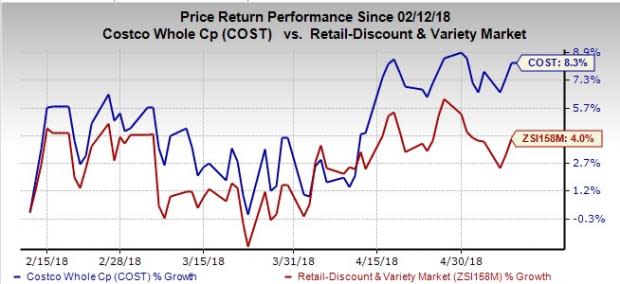

While major chains are grappling with sluggish store and mall traffic as consumers switch to online shopping, Costco seems somewhat resilient to the challenging retail backdrop. We note that in the past three months shares of this Zacks Rank #3 (Hold) have risen 8.3%, compared with the industry’s growth of 4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We noted that the company’s e-commerce comparable sales surged 43.1% in the month under review. This signals that its efforts to drive online sales bode well. With the wave of digital transformation hitting the sector, retailers are fast adopting the omni-channel mantra to provide a seamless shopping experience, whether online or in-stores. Costco, which shares space with Walmart WMT, Amazon AMZN and Target TGT, is no exception to this trend.

Costco operates 749 warehouses, comprising 519 warehouses in the United States and Puerto Rico, 98 in Canada, 38 in Mexico, 28 in UK, 26 in Japan, 14 in Korea, 13 in Taiwan, nine in Australia, two in Spain, one in Iceland and one in France. It is also gradually expanding e-commerce capabilities in the United States, Canada, the U.K., Mexico, Korea and Taiwan.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research