Who could follow Amazon in the Trillion Dollar Wall of Fame?

A flashback of this year’s peaks

Open your Stratton Markets account today

The race continues between Microsoft and Alphabet, as Apple and Amazon have already reached the Trillion Dollar market capitalization. The four magnets have been competing since the beginning of the year in an attempt to overthrow one another at becoming one of world’s Trillion Dollar Company. Could there be a third Trillion Dollar Company in the close future? Let’s look at the facts.

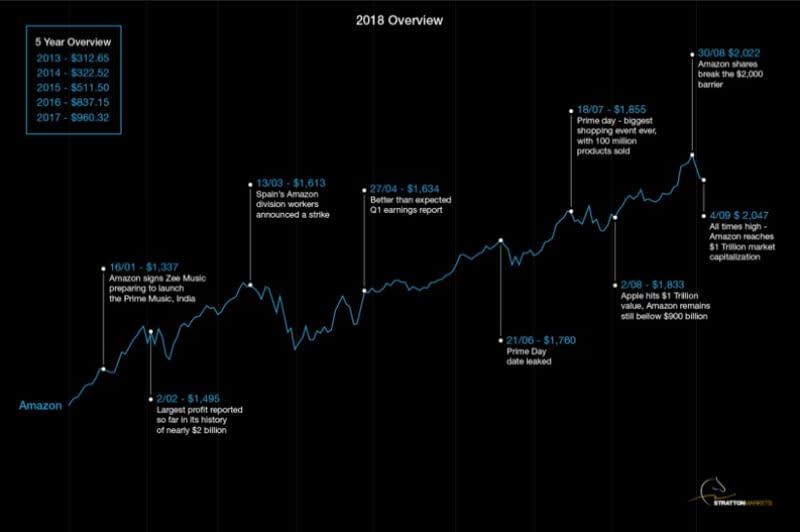

At the half of May, Apple had quite a large advantage of about $140 billion in from of the remaining three companies. The race was tight for the second runner up between Alphabet, Amazon, and Microsoft with only a couple of tens of billions between them. In fact, the 2nd of August, Apple became the first ever company in the world to reach a market value of over $1 Trillion. Shortly after, Amazon managed to get a great head start and just a month later became the world’s second Trillion Dollar Company. Before we can debate which might be the world’s next Trillion Dollar Company, let’s get an overview of Amazon’s financial year so far.

The second Trillion Dollar baby, Amazon was closer to the next runners up – Microsoft and Alphabet – than to Apple, managed to cover $100 billion – more than 10% of its value – in just a month. From heavy drone delivery concept to proprietary package delivery, all the way to the insertion in the food industry, 2018 seems to have been a really good year for Amazon.

The company scored a trifecta this year by having:

doubled in share value by Q3,

surpassed the $2,000 psychological barrier,

reached the Trillion Dollar market capitalization.

The chart below illustrates some of the most important events that influenced its shares this year.

We’d be tempted to say that it couldn’t get any better, but there is more to it than meets the eye, and analysts are already making great forecasts for Amazon’s upcoming months.

The chase for bronze

Microsoft’s current market cap is of $856.61 billion and counting, down from the peak of $861.37 billion. The company has dedicated this year to innovation, foraying the world of blockchain technology, acquiring Artificial Intelligence start-up – Bonsai, all the way to investing in GitHub – a leading software development platform. Following the chart below we can see how it stands so far, compared to its main challenger Alphabet.

On the other hand, Alphabet’s market value reached $815.05 billion, down from $869 billion. Based on the chart from above we might say that it followed Microsoft’s trend. However, Alphabet focused this year on diversity by investing in experimental fields like mobile payments, artificial intelligence, and Waymo – self driving car company.

Upcoming events that might shake giant companies market quotation

Since the end of August, neither of the two tech giants seemed to get any good vibes from the markets. In addition, Senator Bernie Sanders is preparing a new tax bill for giant companies. The so called “Bezos bill” is apparently focused on pushing companies with over 500 employees to either pay them well enough to not qualify for benefits or pay for their benefits if they do qualify.

If Bernie Sanders’s bill will not affect Microsoft and Alphabet in any way, on October 25th we might see a stir in the markets, as on this date both magnets are due to publish Q3 earnings report.

In a speculative market knowledge is king

Which of the future market events might cause more volatility, enough to skyrocket one of the two companies in the 13 digits market cap? Knowing before might make all the difference, or it could make a great event pass unobservable.

A better chance at speculating on future market events, aside from the use of fundamental analysis, could be revolving to the technical one. It has proven to be using multiple times if used with caution. If you’re interested in learning more about this, you can access for free the webinars offered by Stratton Markets.

This article was originally posted on FX Empire