Could Transit-Mixed Concrete Ltd’s (SGX:570) Investor Composition Influence The Stock Price?

Every investor in Transit-Mixed Concrete Ltd (SGX:570) should be aware of the most powerful shareholder groups. Institutions often own shares in more established companies, while it’s not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said ‘Show me the incentive and I will show you the outcome.’

With a market capitalization of S$13m, Transit-Mixed Concrete is a small cap stock, so it might not be well known by many institutional investors. In the chart below below, we can see that institutions are not on the share registry. We can zoom in on the different ownership groups, to learn more about 570.

View our latest analysis for Transit-Mixed Concrete

What Does The Lack Of Institutional Ownership Tell Us About Transit-Mixed Concrete?

We don’t tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it’s not particularly common.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Transit-Mixed Concrete might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don’t have many shares in Transit-Mixed Concrete. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Transit-Mixed Concrete

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Transit-Mixed Concrete Ltd. Insiders own S$3.8m worth of shares in the S$13m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public holds a 13% stake in 570. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 59%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

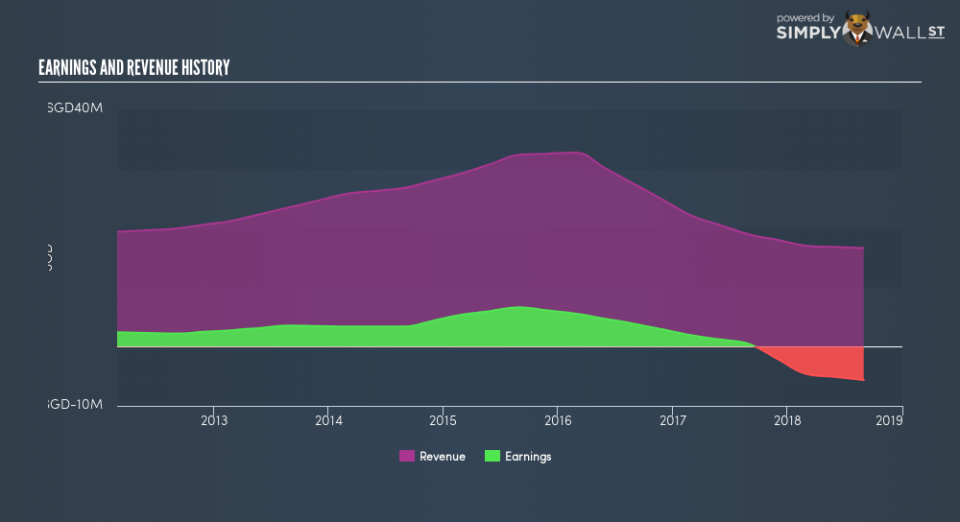

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.