Cousins Properties (CUZ) Q1 FFO In Line With Estimates

Cousins Properties Incorporated CUZ reported first-quarter 2017 funds from operations (FFO) per share of 15 cents, in line with the Zacks Consensus Estimate. However, the figure came in lower than the prior-year quarter tally of 16 cents.

Results reflected better-than-expected revenues in the quarter. Further, rise in second-generation net rent per square foot on a cash basis was experienced.

Rental property revenues for the quarter came in at $113.3 million compared with $112.5 million in the year-ago quarter. Further, the figure beat the Zacks Consensus Estimate of $110.2 million. However, total revenues came in at $117.2 million, lower than $119.9 million reported in the prior-year period.

Quarter in Detail

Cousins Properties leased or renewed 329,583 square feet of office space in the reported quarter. Same-property net operating income (NOI), on a cash basis, rose 9.4% from the year-ago quarter. Moreover, second-generation net rent per square foot (cash basis) increased 19.3%.

Total costs and expenses came in at $103.2 million, down 10.7% from the prior-year quarter.

Cousins Properties exited the first quarter with cash and cash equivalents of $108.2 million, against $148.9 million recorded as of Dec 31, 2017.

2018 Outlook

Cousins Properties reiterated its 2018 FFO per share guidance issued in the fourth quarter of 2017. The company expects FFO for the year to be in the band of 59-63 cents. The Zacks Consensus Estimate for 2018 is currently pegged at 62 cents.

Cousins Properties updated its guidance for fee and other income. Management now expects it to be in the $11-$13 million range, up from the previous range of $10-$12 million. The change was due to $1 million in forecasted termination fees.

In Conclusion

Cousins Properties’ diversified portfolio, presence of high-end tenants in its roster and opportunistic investments in the best sub-markets will likely help the company keep the impressive growth momentum alive. Further, the company’s investments in high-growth markets are anticipated to boost its leasing metrics.

Nonetheless, the company faces stiff competition from other market players. This impacts its ability to retain and attract tenants at higher rents. Moreover, despite the improvement in the job market, fundamentals of the office real estate market are anticipated to be affected in the future because of the rise in new deliveries of office space.

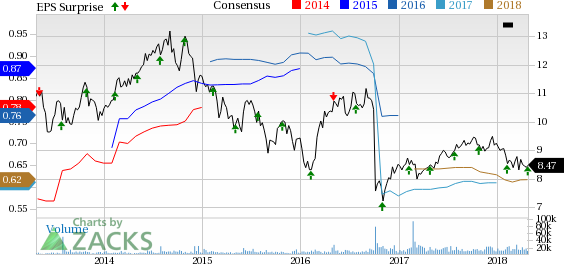

Cousins Properties Incorporated Price, Consensus and EPS Surprise

Cousins Properties Incorporated Price, Consensus and EPS Surprise | Cousins Properties Incorporated Quote

Currently, Cousins Properties has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of other REITs like Alexandria Real Estate Equities, Inc. ARE, Regency Centers Corporation REG and Essex Property Trust Inc. ESS. Alexandria and Regency Centers are scheduled to release results on Apr 30, while Essex is slated to report its numbers on May 2.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.