CP Rail: A 5-Star Stock at a Bargain Price

U.S. investors looking for more international exposure might want to check out Canadian Pacific Railroad Ltd. (NYSE:CP), which is traded on both American and Canadian exchanges.

The stock is currently listed on the Undervalued Predictable screener list at GuruFocus. The top 25 stocks from this list have, on average, outperformed the S&P 500 by 5.8%.

Canadian Pacific, more commonly known as CP, CP Rail or CPR, is one of the seven largest (Class 1) North American railways, with extensive trackage in Canada as well as feeder lines and subsidiaries in the U.S. While there are many smaller lines, mostly operating within provincial boundaries, CP and Canadian National Railway are the major lines and each has a large geographic monopoly or near-monopoly.

CP divides its business into three categories, according to the the 2020 first quarter earnings review:

Bulk commodities such as grain and fertilizer, which make up 40% of its freight revenue.

Merchandise, the major component of which is oil and oil products, makes up 39%.

Intermodal (containers that move on trains, trucks and ships) contributes 21% of revenue.

The company made a consequential and controversial transition in 2012 when activist investor Bill Ackman (Trades, Portfolio) of Pershing Square Capital Management convinced the board of directors to replace the CEO with Hunter Harrison. Ackman pushed to hire Harrison because the latter's Precision Scheduled Railroading (PSR) had drastically improved results at Canadian National.

PSR is a strategy that increases the efficiency of the whole railroad and generally brings down operating costs, leading to improvement in a key railroading metric, the Operating Ratio. It is calculated by dividing operating expenses by operating revenues and is generally considered the most important measure in comparing efficiency across railroads. In the past decade, six of the seven Class 1 operators have adopted this strategy.

The transition to PSR made a significant difference at CP, where the operating ratio was 81.3% in 2011. After Harrison's arrival, the ratio began declining steadily and continued after Harrison was wooed away by another railroad a few years later. For 2019, the CP ratio was down to 59.9%, indicating the railroad had become much more efficient. Not surprisingly, PSR led to extensive layoffs and poorer customer service in some cases, leading to complaints and controversy.

For a quantitative analysis of the company, I turn once again to the Macpherson model, which is a conservative value model of corporate quality that measures moat, financial strength, profitability and valuation.

Moat

The Macpherson model uses two criteria for testing a company's competitive advantage, return on captial (ROC) and return on tangible equity (ROTE):

ROC, or return on capital, calls for a median return of at least 15% over the past 10 years. CP passes this test; based on data from 2014 through 2019, its median ROC was 13.45%, and it wound up the decade with ROC of 16.26% (I have not used 10-year data because of PSR-driven changes, which started in 2012).

ROTE, or return on tangible equity, calls for a median of at least 15% over the past 10 years as well. CP scored well on this metric; since the precision railroading began taking effect, the lowest its ROTE has been was 22.79%, and for 2019 it was 37.06%.

As I've noted, CP has a large geographic monopoly, and in the rest of Canada, it is in a duopoly situation. Thus, the data confirms qualitative assessments.

Financial strength

Here, the model looks for a cash-to-debt ratio of at least 100 and a GuruFocus financial rating of at least 9 out of 10. With its debt, CP misses on both counts:

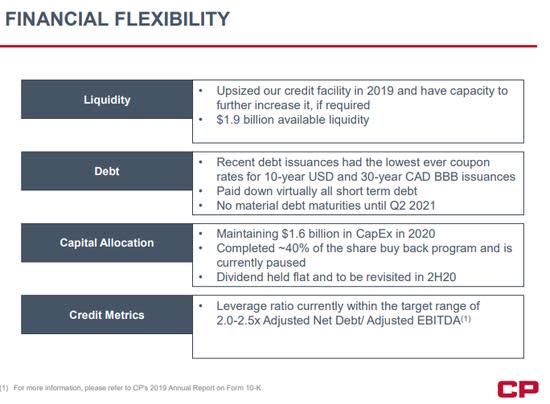

While there is considerable debt, CP appears to be safe from bankruptcy at this level. The table above shows good coverage of the interest, and its return on capital is more than triple its weighted average cost of capital. Plus, in its Q1 2020 investor presentation, the company provided a slide showing debt is within its target range:

I would be comfortable giving the company a passing score on financial strength, given the circumstances, though the Macpehrson model gives it a hard fail.

Profitability

In terms of profitability, CP really shines, with a full 10 out of 10 for its GuruFocus profitability rank. Note the margins that this company boasts.

Valuation

A market price below the intrinsic value is also a must, since without it there would be no margin of safety.

CP meets that requirement, according to the earnings-based discounted cash flow (DCF) analysis. It gives the railway a fair value of $371.51 per share, which is well above the market price of $227.98 as of the writing of this article. That works out to a 38.63% margin of safety.

The railway passes three of the four Macpherson model tests, falling short on financial strength. Still, there are several caveats on the financial side that I believe would justify some confidence.

The company has a five-star business predictability rating, the highest score available. According to GuruFocus, a five-star company has earned an average share price gain of 12.1% per year if the stock was held for 10 years, while the odds of an investor losing money after holding the position for 10 years were just 3%.

Ownership

Four gurus own CP stock: Steve Mandel (Trades, Portfolio) of Lone Pine Capital, Pioneer Investments (Trades, Portfolio), Ray Dalio (Trades, Portfolio) of Bridgewater Associates and Steven Cohen (Trades, Portfolio) of Point72 Investments.

The chart below shows the gurus have been selling more CP stock than they have been buying:

Institutional investors own 39.77% of the company, while insiders hold just 0.02%.

Covid-19 response

In the guidance, President and CEO Keith Creel wrote, "The company is in a strong position from both a balance sheet and liquidity perspective, and as we navigate through this extraordinary period, we remain well-positioned not only to weather this storm, but to recover stronger on the other side."

Conclusion

In my opinion, CP Rail has good credentials, as might be expected for a company on GuruFocus' Undervalued Predictable list. The discounted cash flow analysis indicates there is a nearly 40% margin of safety, and the company offers a decent moat, reasonable financial strength, 10 out of 10 profitability rating and a five-star business predicability rating.

Whether it can continue to wring new efficiencies and bottom-line results out of PSR is a continuing question for long-term investors. Regarding the current twin crises of health and economics, I believe the company should have no trouble weathering them unless the problems are deeper and longer than currently expected.

Strict, non-contrarian value investors may want to skip the stock because of its debt load, but otherwise, I think CP is worth considering.

Disclosure: This article is only an introduction to the company and investors must do their own due diligence. I do not own shares mentioned and do not expect to buy any in the next 72 hours.

Read more here:

Lennox International: Undervalued, but Will It Still Be Predictable?

Ross Stores: Paused for the Pandemic, but the Future Is Promising

Transdigm: Management Knows How to Make Money, but What About the Debt?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.