CPK or MDU: Which is a Better Utility Gas Distribution Stock?

The shale revolution has substantially increased the production of natural gas, which has become the preferred choice of fuel in the United States. Wide availability and a clean-burning nature are steadily boosting the demand for natural gas in the electric power, industrial, commercial and residential markets. However, natural gas is facing competition from other clean energy sources like renewable energy.

Gas distribution pipelines play a vital role in delivering natural gas from intrastate and interstate transmission pipelines to consumers through small-diameter pipelines. Currently, the United States has nearly three million miles of natural gas pipelines that ensure a steady supply of natural gas to millions of customers.

Per the latest short-term energy outlook released by the U.S. Energy Information Administration (“EIA”), dry natural gas production is projected at 99 billion cubic feet per day (Bcf/d) in the United States in the fourth quarter of 2022. The same is expected to increase to 100.4 Bcf/d by 2023.

The EIA expects U.S. natural gas consumption to rise 4.3% in 2022 to 86.6 Bcf/d, driven by increases across all consuming sectors. Meanwhile, in 2023, consumption is expected to drop 1.9 Bcf/d due to declines in consumption in the industrial and electric power sectors.

Furthermore, the EIA expects U.S. liquefied natural gas (LNG) export volumes to increase to 11.7 billion cubic feet per day Bcf/d in the fourth quarter of 2022, up 1.7 Bcf/d sequentially. Also, the EIA forecasts total U.S. LNG exports to reach 12.3 Bcf/d for 2023. The higher production and export volumes will increase usage and demand for natural gas pipelines in the United States.

In this article, we run a comparative analysis on two Utility - Gas Distribution companies — Chesapeake Utilities Corporation CPK and MDU Resources Group Inc. MDU — to decide which stock is a better pick for your portfolio now.

Both the stocks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projection & Earnings Surprise

The Zacks Consensus Estimate for Chesapeake Utilities’ 2022 earnings is pegged at $5.04. The bottom line suggests an increase of 6.6% from 2021’s reported figure.

The Zacks Consensus Estimate for MDU Resources’ fiscal 2022 earnings is pegged at $1.85. The bottom line suggests a decline of 1.1% from 2021’s reported figure.

Chesapeake Utilities delivered an average earnings surprise of 10.1% in the last four quarters, while MDU Resources delivered a negative average earnings surprise of 18% in the last four quarters.

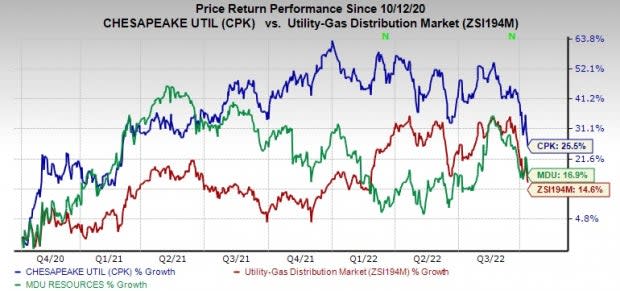

Price Performance

In the past two years, CPK shares have rallied 25.5% compared with the industry's growth of 16.9%. Shares of MDU have rallied 14.6%.

Image Source: Zacks Investment Research

Debt-to-Capital

Debt-to-capital is a good indicator of the financial position of a company. The indicator shows how much debt is used to run the business. Chesapeake Utilities and MDU Resources have a debt-to-capital of 47.7% and 47.2%, respectively, compared with the industry’s 49%.

Return on Equity

Return on Equity (ROE) is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12 months for Chesapeake Utilities and MDU Resources is 11.2% and 9.7%, respectively, compared with the industry’s ROE of 9.7%.

Outcome

Although both the companies are efficiently providing services to customers, Chesapeake Utilities, with its positive earnings surprise, efficient debt management, higher ROE and superior return over the past two years, is a better stock to add to your portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research