CPK or OKE: Which Utility Stock is Better Placed Right Now?

The Zacks Utility Gas Distribution industry comprises companies that offer services to aid the transportation of natural gas from the source of production to end users. Increasing U.S. shale production and the awareness to lower emissions have increased natural gas production in the United States. As the capacity of the existing pipelines will eventually be inadequate to meet the rising transportation requirements, pipeline operators will have enormous opportunities to add new ones.

In the United States, LNG volumes should increase as new LNG export terminals are coming into operation. Hence, with increase in the transportation of natural gas from production zones to LNG export facilities, the demand for dedicated natural gas pipelines will grow. The ongoing improvement in U.S. natural gas production volumes and increasing LNG export volumes will also call for the addition and expansion of natural gas pipelines.

After registering earnings growth of 2.6% in second-quarter 2019, the utility sector’s bottom line is expected to improve 2.8% in the third quarter on the back of year-over-year revenue improvement of 3.7%. The sector is expected to continue the momentum in the second half of 2019 as well. (For more details, read our weekly Earnings Trends report)

Billions of dollars will be required to construct new natural gas pipelines that are required to transport natural gas to refineries, terminal and export facilities. The capital-intensive industry will definitely benefit from the recent rate cuts announced by the Federal Reserve. The Fed lowered its interest rate by a quarter point to a range of 2-2.25%.

Amid such favorable trends in the utility space, we run a comparative analysis of two prominent utilities gas distribution companies — Chesapeake Utilities Corporation CPK and ONEOK Inc. OKE — to determine which one performed better and is a suitable investment option right now.

Earnings Surprise Trend & Long-Term Growth

Chesapeake Utilities Corporation reported average negative surprise of 10.36% in the last four quarters. Its long-term earnings growth is estimated to be 7%.

ONEOK Inc. delivered average positive surprise of 4.58% in the last four quarters. Its long-term earnings growth is estimated to be 11.51%.

Estimates Movement

In the past 60 days, the Zacks Consensus Estimate for Chesapeake Utilities Corporation’s earnings for 2019 has increased 0.5% to $3.73 per share.

In the same time period, the Zacks Consensus Estimate for ONEOK’s 2019 earnings has moved up 1% to $3.1 per share.

Price Movement

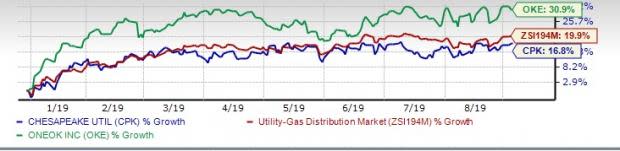

Year to date, shares of Chesapeake Utilities Corporation and ONEOK have gained 16.8% and 30.9%, respectively, compared with the industry’s 19.9% rally.

Price Performance (Year to Date)

Return on Equity (ROE)

ROE is a measure of a company's efficiency in utilizing funds. Chesapeake Utilities Corporation and ONEOK’s ROE stands at 11.3% and 19.3%, respectively. Notably, the industry's ROE currently stands at 9.12%.

Zacks Rank

Chesapeake Utilities Corporation and ONEOK both hold a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Verdict

Both the gas distribution companies continue to efficiently serve their customer base. Notably, increasing hydrocarbon production across the United States is creating more opportunities for these midstream service providers.

At present, ONEOK appears to be a better gas distribution stock than Chesapeake Utilities Corporation, given its strong presence in the Permian Basin and other liquid-rich regions of the United States, as well as price performance in the year-to-date period.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

To read this article on Zacks.com click here.