Crane Holdings (CR) Business Unit Separation Set for April '23

Crane Holdings, Co. CR has filed a Form 10 Registration Statement with the U.S. Securities and Exchange Commission in connection with the company’s previously announced separation of the Payment and Merchandising Technologies unit into an independent public company. The transaction, which received approval from CR’s board of directors on Mar 30, 2022, is expected to be completed on Apr 3, 2023. The spin-off is expected to be tax-free.

The Payment and Merchandising Technologies business will be renamed Crane NXT upon being separated. The independent company, focusing on industrial technology business, will have substantial global scale, healthy margin profile and strong free cash flow generation capacity. The business is expected to generate sales of approximately $1.4 billion in 2022, with a pre-corporate adjusted EBITDA margin approaching 30%.

Crane NXT is expected to make continuous investments in business and carry out strategic acquisitions to boost earnings. The company’s shares will trade on NYSE under the symbol CXT.

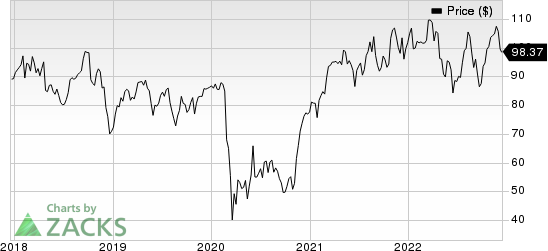

Crane Holdings, Co. Price

Crane Holdings, Co. price | Crane Holdings, Co. Quote

Crane Holdings’ Aerospace & Electronics, Process Flow Technologies and Engineered Materials businesses will operate under Crane Company, which will continue to trade on NYSE under the symbol CR. Crane Company is expected to generate annual sales of approximately $1.9 billion in 2022 with a pre-corporate adjusted EBITDA margin of approximately 18.5%.

Upon separating its Payment and Merchandising Technologies unit, Crane Company is expected to have a strong balance sheet, supporting its organic and inorganic activities and providing a dividend in-line with peers.

Zacks Rank & Key Picks

Crane Holdings currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). AIT delivered a trailing four-quarter earnings surprise of 24.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Applied Industrial has an estimated earnings growth rate of 14.3% for the current fiscal year. The stock has gained 38% in the past six months.

IDEX Corporation IEX presently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 5.7%, on average.

IDEX has an estimated earnings growth rate of 28.3% and 6.1% for the current and next years, respectively. The stock has rallied 33% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Crane Holdings, Co. (CR) : Free Stock Analysis Report