Crown Castle (CCI) Beats on Q1 FFO Estimates, Raises View

Crown Castle International Corp.’s CCI first-quarter 2022 adjusted funds from operations (AFFO) per share of $1.87 surpassed the Zacks Consensus Estimate of $1.80.

Net revenues of $1.74 billion exceeded the Zacks Consensus Estimate of $1.70 billion.

Reported AFFO per share compared favorably with the year-ago period’s $1.71. Net revenues climbed 17.3% from the prior-year quarter’s $1.48 billion.

Growth in site-rental revenues due to elevated tower space demand aided the top-line performance. CCI also raised the outlook for site-rental revenues and adjusted EBITDA for 2022.

Jay Brown, chief executive officer of the company, said, “We are seeing the benefit of a robust 5G leasing environment that contributed to the 9% AFFO per share growth we delivered in the first quarter and led to an increase in our operating expectations for the full year 2022."

Quarter in Detail

During the first quarter, CCI’s site-rental revenues came in at $1.6 billion, up 15.1% year over year. The organic contribution of $75 million to the site rental revenues reflected 6.0% growth. Furthermore, services and other revenues climbed 43.1% year over year to $166 million.

CCI’s quarterly operating expenses increased 8.4% year over year to $1.1 billion. The operating income climbed 37.9% to $618 million. The quarterly adjusted EBITDA of $1.1 billion marked a 22.1% year-over-year increase.

In the first quarter, Crown Castle reported capital expenditure of $281 million. This comprised discretionary capital expenditures of $260 million and sustaining capital expenditures of $21 million. Discretionary capital expenditures primarily attributable to Fiber were approximately $209 million, and that to Towers was around $45 million.

Balance Sheet

Crown Castle exited first-quarter 2022 with cash and cash equivalents of $312 million, up from $292 million reported at the end of 2021.

Moreover, debt and other long-term obligations aggregated $21.12 billion, up from $20.62 billion witnessed at the end of 2021.

Guidance

CCI raised the outlook for site-rental revenues and adjusted EBITDA for 2022.

Management now expects site-rental revenues in the band of $6.242-$6.287 billion, suggesting a $40 million increase at the midpoint from the prior outlook. Adjusted EBITDA is forecasted in the range of $4.309-$4.354 billion, indicating a $60 million rise at the midpoint from the previous outlook.

However, for the full year, the AFFO per share guidance is unchanged at $7.31-$7.41. The Zacks Consensus Estimate for the same is pegged at $7.35.

Crown Castle currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

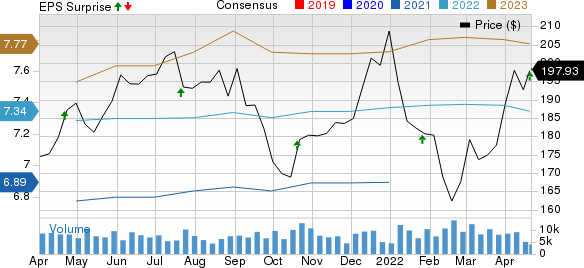

Crown Castle International Corporation Price, Consensus and EPS Surprise

Crown Castle International Corporation price-consensus-eps-surprise-chart | Crown Castle International Corporation Quote

Upcoming Earnings Releases

It’s time to look forward to the earnings releases of REITs like Alexandria Real Estate Equities ARE, Highwoods Properties HIW and Cousins Properties Incorporated CUZ.

Alexandria and Highwoods Properties are slated to release first-quarter 2022 results on Apr 25 and Apr 26, respectively, while Cousins Properties is scheduled to report on Apr 28.

The Zacks Consensus Estimate for Alexandria’s first-quarter 2022 FFO per share is pegged at $2.00, suggesting an increase of 4.7% from the year-ago quarter’s reported figure. ARE currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Highwoods Properties first-quarter 2022 FFO per share stands at 97 cents, indicating an increase of 6.6% from the prior-year period’s reported figure. HIW currently has a Zacks Rank #3.

The Zacks Consensus Estimate for Cousins Properties’ first-quarter 2022 FFO per share is pegged at 67 cents, implying a decrease of 2.9% from the year-earlier quarter’s reported figure. CUZ currently carries a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Highwoods Properties, Inc. (HIW) : Free Stock Analysis Report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research