Crown Castle (CCI) Beats Q2 FFO Estimates, Raises '21 Guidance

Crown Castle International Corp.’s CCI second-quarter 2021 adjusted funds from operations (AFFO) per share of $1.71 surpassed the Zacks Consensus Estimate of $1.66. Moreover, the figure came in 17.9% higher than the year ago quarter’s $1.45.

Net revenues of $1.58 billion improved 9.9% year over year in the reported quarter. Further, the reported figure beat the Zacks Consensus Estimate of $1.56 billion.

Growth in site-rental revenues aided the top-line performance. The company also raised the outlook for 2021, backed by contribution from additional straight-lined revenues and an appreciation in the expected services contribution to be generated from higher towers activity than previously estimated.

Per management, "Capitalizing on the momentum created by a robust 5G leasing environment, we were able to deliver another solid quarter in the second quarter and increase our full year 2021 Outlook for AFFO per share growth to 12%".

Quarter in Detail

Site-rental revenues came in at $1.4 billion, up 8% year over year. The organic contribution of $70 million to site rental revenues reflects 5.3% year-over-year growth. Further, services and other revenues rose 30.6% year over year to $158 million.

Quarterly operating expenses flared up 2% year over year to $1.08 billion. The operating income climbed 31.9% year over year to $505 million. Quarterly adjusted EBITDA of $958 million marked a 15.3% year-over-year rise.

The company reported a capital expenditure of $308 million for the second quarter. This included $289 million of discretionary capital expenditure and $19 million of sustaining capital expenditure.

Balance Sheet

Crown Castle exited second-quarter 2021 with cash and cash equivalents of $339 million, up from the $232 million reported at the end of Dec 31, 2020.

Also, debt and other long-term obligations aggregated $20 billion, up from the $19.1 billion witnessed at the end of 2020.

Guidance

The company has raised its outlook for 2021. The AFFO per share is anticipated to be $6.78-$6.89. The Zacks Consensus Estimate for the same is pegged at $6.81. Management estimates site-rental revenues of $5,677-$5,722 million. Adjusted EBITDA is projected at $3,764-$3,809 million.

Crown Castle currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

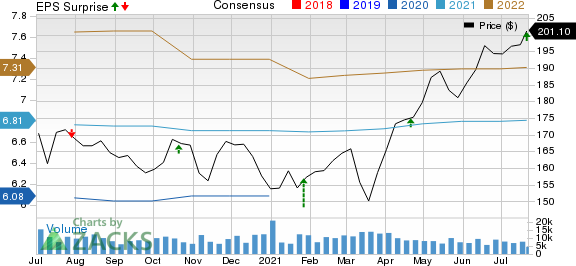

Crown Castle International Corporation Price, Consensus and EPS Surprise

Crown Castle International Corporation price-consensus-eps-surprise-chart | Crown Castle International Corporation Quote

We now look forward to the earnings releases of other REITs like Digital Realty Trust, Inc. DLR, Cousins Properties CUZ and CubeSmart CUBE, all of which are slated to report quarterly numbers on Jul 29.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

CubeSmart (CUBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.