Crown Holdings (CCK) Q4 Earnings & Sales Top Estimates, Up Y/Y

Crown Holdings, Inc. CCK reported fourth-quarter 2020 adjusted earnings per share of $1.50, handily outpacing the Zacks Consensus Estimate of $1.28. The bottom-line figure jumped 44.2% year over year.

Including one-time items, earnings per share surged 75% year on year to $1.12 in the reported quarter.

Net sales in the quarter came in at $2,962 million, up from the year-ago quarter’s $2,791 million. The top line increased on solid beverage-can, food-can volumes and favorable currency translation. The reported figure also beat the Zacks Consensus Estimate of $2,873 million.

Cost and Margins

Cost of products sold was up 2.7% year over year to $2,329 million. On a year-over-year basis, gross profit climbed 20.8% to $633 million. Gross margin expanded to 21.1% from the year-ago quarter’s 18.7%.

Selling and administrative expenses came in at $161 million, flat year over year. Segment operating income increased 39.2% year over year to $397 million during the December-end quarter. Operating margin came in at 13.4% compared with the 10.2% recorded in the prior-year quarter.

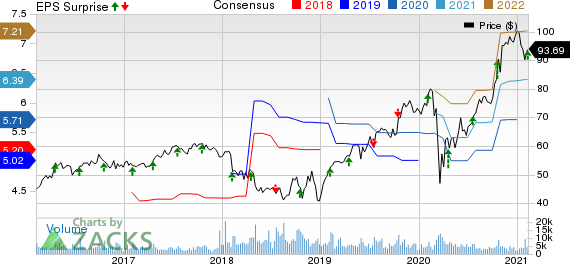

Crown Holdings, Inc. Price, Consensus and EPS Surprise

Crown Holdings, Inc. price-consensus-eps-surprise-chart | Crown Holdings, Inc. Quote

Segment Performance

Net sales in the Americas Beverage segment came in at $957 million, up 11.8% year over year. Segment operating profit jumped 32.4% year over year to $196 million.

The European Beverage segment’s sales were up 14.2% year over year to $379 million. Operating income came in at $63 million, significantly up 133.3% year on year.

Revenues in the European Food segment climbed 12.8% year over year to $451 million. Segment operating profit soared 131.2% year over year to $37 million.

The Asia-Pacific segment’s revenues declined 4.5% year over year to $316 million. Operating profit edged down 1.9% year over year to $50 million.

Revenues in the Transit Packaging segment totaled $523 million compared with the year-ago quarter’s $549 million. Operating profit was up 3.2% year over year to $65 million.

Financial Update

Crown Holdings had cash and cash equivalents of $1,173 million at the end of 2020 compared with the $607 million held at the end of 2019. The company generated $1,315 million cash in operating activities in 2020 compared with the $1,163 million witnessed in 2019.

Crown Holdings’ long-term debt increased to $8,023 million at the end of 2020 from $7,818 million at the end of 2019.

The company plans to initiate a quarterly dividend of at least 20 cents per share. It will make the first payment in the current quarter.

2020 Performance

Crown Holdings reported adjusted earnings per share of $5.92 for 2020 compared with the $5.11 reported in prior year. Earnings also beat the Zacks Consensus Estimate of $5.71. Including one-time items, the bottom line came in at $4.30, up 13.8% from the $3.78 reported in 2019.

Sales were down 0.7% year over year to $11.6 billion from the prior-year figure of $11.7 billion. The top line, however, surpassed the Zacks Consensus Estimate of $11.4 billion.

Outlook

Crown Holdings expects first-quarter 2021 adjusted earnings per share between $1.35 and $1.40. For the ongoing year, the company anticipates adjusted earnings per share in the range of $6.60 to $6.80. Management projects adjusted free cash flow of approximately $500 million and capital expenditures of $850 million for 2021.

The company’s products are significant part of the food and beverage supply chains, and also provide critical support to the transportation industry. It is focused on ensuring that its manufacturing facilities across the globe remain operational while continuing to meet the evolving customer demand by delivering high quality products.

Crown Holdings continues to implement several numbers of beverage-can capacity-expansion projects in a bid to meet the surging beverage-can demand. Also, it is committed to implement the previously-announced capacity-expansion projects with its solid liquidity position and sound capital structure.

Price Performance

Crown Holdings’ shares have gained 16.9% over the past year compared with the industry’s growth of 16.7%.

Zacks Rank and Other Stocks to Consider

Crown Holdings currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks in the Industrial Products sector include AGCO Corporation AGCO, Avery Dennison Corporation AVY and AptarGroup, Inc. ATR. While AGCO Corporation currently sports a Zacks Rank #1, Avery Dennison and AptarGroup carry a Zacks Rank of 2.

AGCO Corporation has a projected earnings growth rate of 11.4% for the current year. Shares of the company have soared 83% over the past year.

Avery Dennison has an estimated earnings growth rate of 8.8% for 2021. The company’s shares have rallied 28% in a year’s time.

AptarGroup has an expected earnings growth rate of 14.4% for the ongoing year. Over the past year, the stock has gained 23%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research