Crude Oil Price Update – Trader Reaction to Gann Angle at $55.84 Will Determine Direction Today

January West Texas Intermediate crude oil futures are called lower shortly ahead of the regular session opening. The market is posting an inside move for a second day which typically indicates investor indecision and impending volatility.

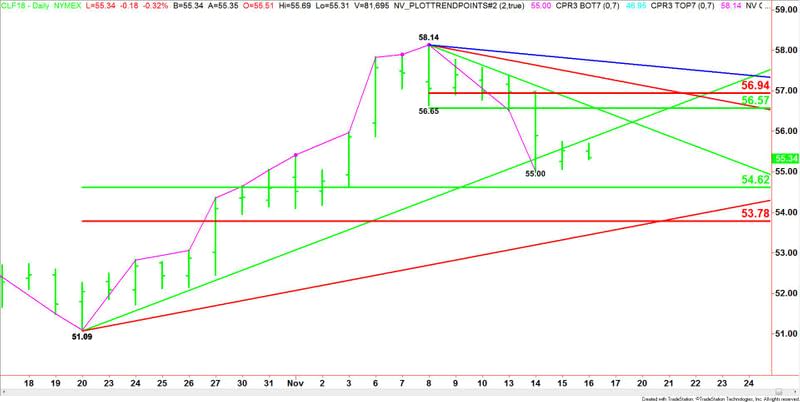

Daily Technical Analysis

The main trend is up according to the daily swing chart, however, momentum shifted to the downside with the formation of the closing price reversal top on November 8.

The main range is $51.09 to $58.14. Its retracement zone at $54.62 to $53.78 is the primary downside target. Since the main trend is up, buyers are likely to come in on a test of the retracement zone.

The new short-term range is $58.14 to $55.00. If the low was hit on Wednesday then we could see a short-term rally into its retracement zone at $56.57 to $56.94.

Daily Technical Forecast

Based on the current price at $55.31 and the earlier price action, the direction of the market the rest of the session is likely to be determined by trader reaction to the uptrending Gann angle at $55.84.

A sustained move under $55.84 will signal the presence of sellers. This could trigger a retest of this week’s low at $55.00. This is followed closely by the 50% level at $54.62.

If this price fails to hold as support then look for a possible acceleration to the downside with the Fibonacci level at $53.78 the next target, followed closely by an uptrending angle at $53.47.

Overtaking the uptrending angle at $55.84 will indicate the return of buyers. This could trigger an acceleration to the upside with the next target a resistance cluster at $56.57 to $56.64. Aggressive counter-trend sellers may come in on a test of this area in an effort to form a potentially bearish secondary lower top.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – November 16, 2017 Forecast

Gold Price Futures (GC) Technical Analysis – November 16, 2017 Forecast

Crude Oil Price Update – Trader Reaction to Gann Angle at $55.84 Will Determine Direction Today

U.S Investors Under Microscope, Wall Street Expected to Open Higher

E-mini Dow Jones Industrial Average (YM) Futures Analysis – November 16, 2017 Forecast