Crypto bulls send Bitcoin and Ether soaring—but not up to pre-Omicron levels

Major stock indexes from New York to Hong Kong plunged Friday as investors abandoned riskier stocks in the wake of the discovery of the new Omicron variant. And despite upward moves on Monday, most are still significantly below their pre-Omicron levels. Amid all the movement, one asset stands out for its perilous plunge—and later steep rise: crypto.

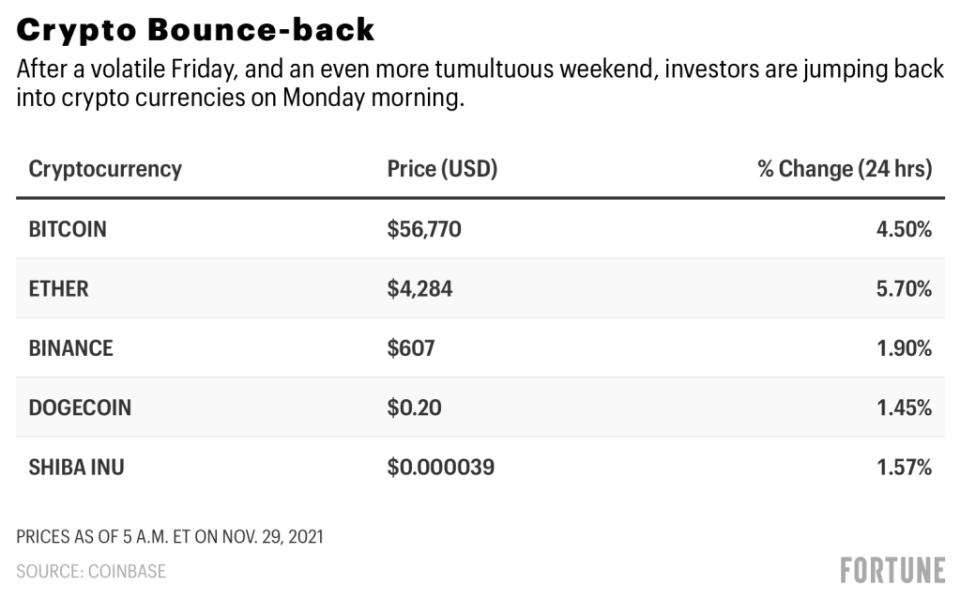

Cryptocurrencies took a gigantic hit Friday—crypto king Bitcoin fell by over 9% at one point, to just over $53,000—and then wallowed in the depths until early Monday when they popped. Bitcoin rose to almost $58,000 early Monday in Europe, leaving it less than 2% below its Thursday, pre-Omicron levels of around $59,000. Similarly, Ether, the second-largest digital currency, dropped from its Thursday high around $4,500 by more than 11% but is now back up to $4,350—about 3% down from Thursday.

Stock markets have not endured the same ride—nor the same bounce-back. In Asia, the Nikkei 225 fell by 2.53% on Friday—its worst loss in five months—and finished Monday trading 4.17% below its Thursday close price. Over in Hong Kong, the Hang Seng Index fell by 2.67% on Friday and closed Monday 3.73% down from its Thursday close.

Europe—which has been quick to shutter its doors and stop travel from the Global South—saw its markets drop harder on the first day, with the Stoxx 600 falling by 3.5% and the U.K’s FTSE 100 falling by 2.7% on Friday. While the Europe Stoxx 600 had recovered by 1.12% on Monday, and the FTSE by 1.32%, neither has fully made back its losses from Friday. The situation was similar in the U.S., where S&P 500 futures were up only 0.8% just before markets opened on Monday after the index tumbled by 2.3% on Friday.

Divergence from tech

The remarkable plunge and recovery of cryptocurrency prices provides more evidence that their price movement is coming uncoupled from tech stocks, with which they have historically moved in tandem. This decoupling has been going on for some time, with the 30-day correlation between cryptocurrencies and the Nasdaq 100 index recently falling to almost zero in mid-November from its 2021 peak of 0.56 at the end of September.

Crypto’s huge Friday plunge in value might be attributable to investors’ increasing use of debt through margin borrowing to bet on stocks, which makes them more sensitive to volatility in the markets.

The plunge could also show that trade in the digital coin is “overcrowded,” Scott Thiel, chief fixed-income strategist for BlackRock, told Bloomberg TV on Monday. Trade in a risk asset becomes overcrowded when an excessive number of investors pile in, a condition that, in the worst cases, can lead to a speculative bubble. Market observers say such trades are particularly vulnerable to sudden plunges on the arrival of a news shock—like the appearance of Omicron.

Die-hard crypto traders didn’t seem to mind the plunge at all, however. On crypto discussion forums, some posters likened the price cut to a Black Friday sale.

https://twitter.com/BTC_Archive/status/1464189767017545739

This story was originally featured on Fortune.com