Crypto Market Daily Highlights – ETH on the Move towards $1,500

Key Insights:

On Saturday, the crypto top ten extended the winning streak to four sessions, with Ethereum (ETH) leading the way for a third session.

News updates on the Merge delivered ETH with a breakout session, while market hopes of a 75 basis point Fed rate hike continued to drive investor appetite.

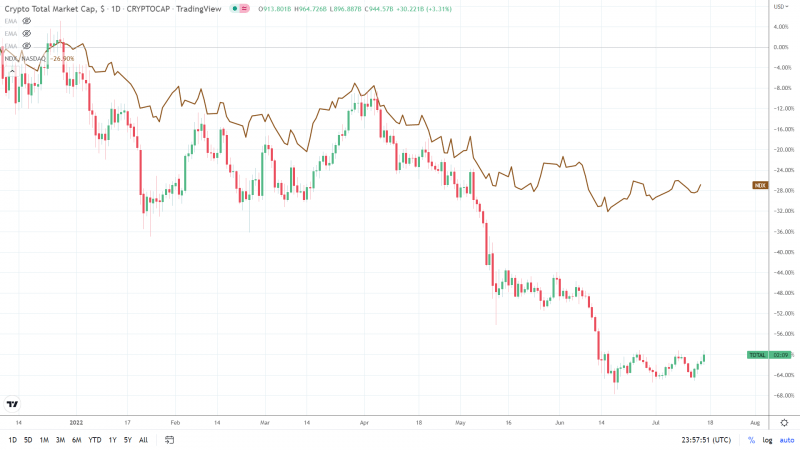

The total crypto market cap rose by $31.5 billion.

It was a bullish Saturday session for the crypto top ten. Bitcoin (BTC) rose for a fourth consecutive day, with ETH touching $1,400 for the first time since June 13.

There were no speeches from FOMC members to provide direction, with members entering the blackout period, which extends from July 16 to July 28.

From Friday, the talk of a 75-basis point continued to resonate, delivering the upside on the day. FOMC members Bostic and Bullard spoke of a 75-basis point hike this month, easing fears of a 100-basis point hike.

With the US equity markets entering the earnings season, the crypto market will be looking to decouple from the NASDAQ 100. However, sentiment toward Fed monetary policy and the economic outlook will likely leave the two interlinked.

The Total Crypto Market Cap Rises for a Fourth Consecutive Session

A bearish start to the Saturday session saw the crypto market cap fall to a day low of $897 billion before finding support. A breakout session, supported by further investor reaction to the US retail sales figures and Fed chatter led to a high of $965 billion before easing back.

Despite a late pullback, investors poured $31.5 billion back into the market to take the crypto market cap up $80 billion for July.

The Crypto Market Movers and Shakers from the Top Ten and Beyond

ETH rallied by 10.12% to lead the way, with BNB (+4.70%), SOL (+5.95%), and XRP (+5.01%) also making solid gains.

ADA (+3.62%), BTC (+ 1.79%), and DOGE (+2.34%) trailed the front runners.

From the CoinMarketCap top 100, Lido DAO (LDO) led the way, surging by 22%, supported by the ETH breakout.

Progress towards the ETH Merge remained the key driver for LDO, with Ether staking on the rise.

Several coins bucked the broader market trend, however. Convex Finance (CVX) and TerraClassicUSD (USTC) fell by 3.90% and by 3.60%, respectively, with Quant (QNT) seeing a 1.55% loss.

Total Crypto Liquidations Spike Despite Bullish Sentiment

On Sunday, 24-hour liquidations jumped at the turn of the day, despite a bullish start to the Sunday session.

This morning, 24-hour liquidations stood at $372.31 million, up from $144 million on Saturday.

Liquidated traders surged over the last 24 hours, suggesting a possible deterioration in market conditions. At the time of writing, liquidated traders stood at 63,031 versus 47,290 on Saturday morning.

Significantly, 12-hour liquidations surged to $344 million, driving four-hour and one-hour liquidations northwards.

According to Coinglass, one-hour liquidations stood at $31.6 million, up from $0.924 million on Saturday.

Daily News Highlights

Rumors of Coinbase having liquidity issues hit the news wires, with Coinbase reportedly ceasing its affiliate program.

Ethereum continued its breakout session, supported by the talk of a September Merge date.

This article was originally posted on FX Empire

More From FXEMPIRE:

Judge blocks Biden admin directives on transgender athletes, bathrooms

Privately issued digital currencies likely better – Australia central bank chief

British prime minister contenders set to clash in second TV debate

Analysis-Pacific bloc, united, demands climate action as China, U.S. woo

Bitcoin (BTC) Fear & Greed Index on the Border of the “Fear” Zone