Is CUBE Stock A Buy or Sell?

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 887 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds' and investors' portfolio positions as of December 31st. In this article we look at what those investors think of CubeSmart (NYSE:CUBE).

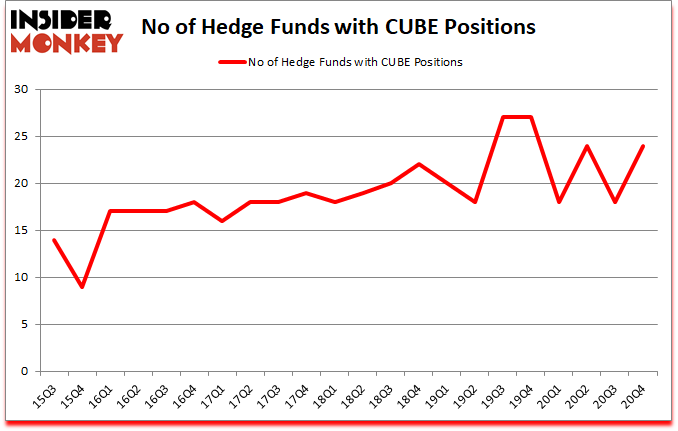

Is CUBE stock a buy? CubeSmart (NYSE:CUBE) has seen an increase in hedge fund interest in recent months. CubeSmart (NYSE:CUBE) was in 24 hedge funds' portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 27. Our calculations also showed that CUBE isn't among the 30 most popular stocks among hedge funds (click for Q4 rankings).

According to most market participants, hedge funds are assumed to be slow, outdated investment vehicles of the past. While there are more than 8000 funds trading at present, We choose to focus on the masters of this group, around 850 funds. These money managers command the lion's share of all hedge funds' total capital, and by tailing their first-class picks, Insider Monkey has determined a few investment strategies that have historically outstripped Mr. Market. Insider Monkey's flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter's portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Ric Dillon of Diamond Hill Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind let's view the key hedge fund action surrounding CubeSmart (NYSE:CUBE).

Do Hedge Funds Think CUBE Is A Good Stock To Buy Now?

At fourth quarter's end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in CUBE a year ago. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ric Dillon's Diamond Hill Capital has the number one position in CubeSmart (NYSE:CUBE), worth close to $128.6 million, amounting to 0.6% of its total 13F portfolio. The second most bullish fund manager is Zimmer Partners, led by Stuart J. Zimmer, holding a $69.7 million position; the fund has 1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism contain Israel Englander's Millennium Management, Ken Griffin's Citadel Investment Group and D. E. Shaw's D E Shaw. In terms of the portfolio weights assigned to each position Hill Winds Capital allocated the biggest weight to CubeSmart (NYSE:CUBE), around 4.97% of its 13F portfolio. Zimmer Partners is also relatively very bullish on the stock, dishing out 1.02 percent of its 13F equity portfolio to CUBE.

As industrywide interest jumped, key money managers have been driving this bullishness. Zimmer Partners, managed by Stuart J. Zimmer, initiated the most valuable position in CubeSmart (NYSE:CUBE). Zimmer Partners had $69.7 million invested in the company at the end of the quarter. D. E. Shaw's D E Shaw also made a $13.7 million investment in the stock during the quarter. The following funds were also among the new CUBE investors: Renaissance Technologies, Ken Heebner's Capital Growth Management, and John Overdeck and David Siegel's Two Sigma Advisors.

Let's now review hedge fund activity in other stocks similar to CubeSmart (NYSE:CUBE). These stocks are DXC Technology Company (NYSE:DXC), Hill-Rom Holdings, Inc. (NYSE:HRC), Kimco Realty Corp (NYSE:KIM), Cabot Oil & Gas Corporation (NYSE:COG), ADT Inc. (NYSE:ADT), JOYY Inc. (NASDAQ:YY), and OneMain Holdings Inc (NYSE:OMF). All of these stocks' market caps resemble CUBE's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position DXC,39,787039,2 HRC,28,414534,-6 KIM,22,216436,0 COG,19,94339,-6 ADT,24,281328,-6 YY,20,205802,-11 OMF,30,654934,-3 Average,26,379202,-4.3 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $379 million. That figure was $317 million in CUBE's case. DXC Technology Company (NYSE:DXC) is the most popular stock in this table. On the other hand Cabot Oil & Gas Corporation (NYSE:COG) is the least popular one with only 19 bullish hedge fund positions. CubeSmart (NYSE:CUBE) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for CUBE is 49.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. A small number of hedge funds were also right about betting on CUBE as the stock returned 23.2% since the end of the fourth quarter (through 4/19) and outperformed the market by an even larger margin.

Get real-time email alerts: Follow Cubesmart (NYSE:CUBE)

Disclosure: None. This article was originally published at Insider Monkey.

Follow Insider Monkey on Twitter

Related Content