The Cushman & Wakefield (NYSE:CWK) Share Price Has Gained 34% And Shareholders Are Hoping For More

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Cushman & Wakefield plc (NYSE:CWK) share price is up 34% in the last year, that falls short of the market return. Cushman & Wakefield hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Cushman & Wakefield

Cushman & Wakefield wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Cushman & Wakefield saw its revenue shrink by 10%. The lacklustre gain of 34% over twelve months, is not a bad result given the falling revenue. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

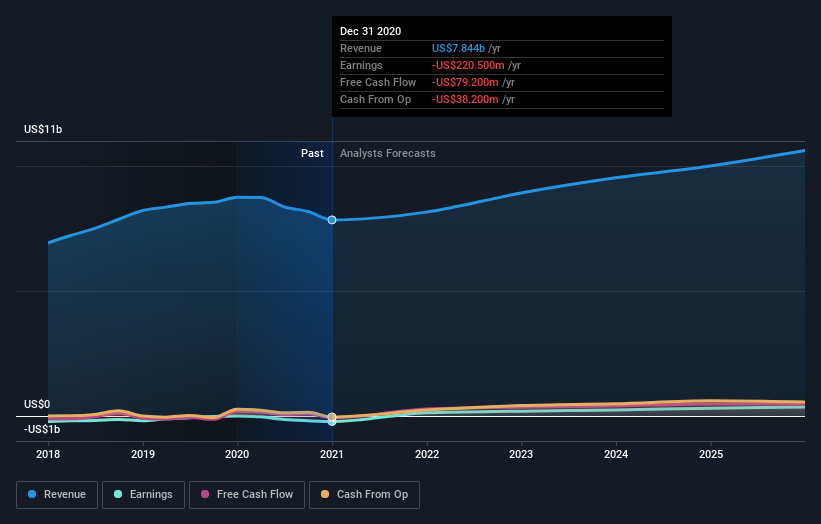

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Cushman & Wakefield's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're happy to report that Cushman & Wakefield are up 34% over the year. The bad news is that's no better than the average market return, which was roughly 52%. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Cushman & Wakefield may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.