CVS/Aetna to waive cost sharing for coronavirus-related inpatient care

Aetna announced on Wednesday that it would waive cost-sharing and co-payments for in-network patient admissions related to the coronavirus outbreak.

With its move, CVS Health’s (CVS) Aetna became the first major insurer to voluntarily forego costs connected to the COVID-19 pandemic, which has become the most far-reaching infection in decades.

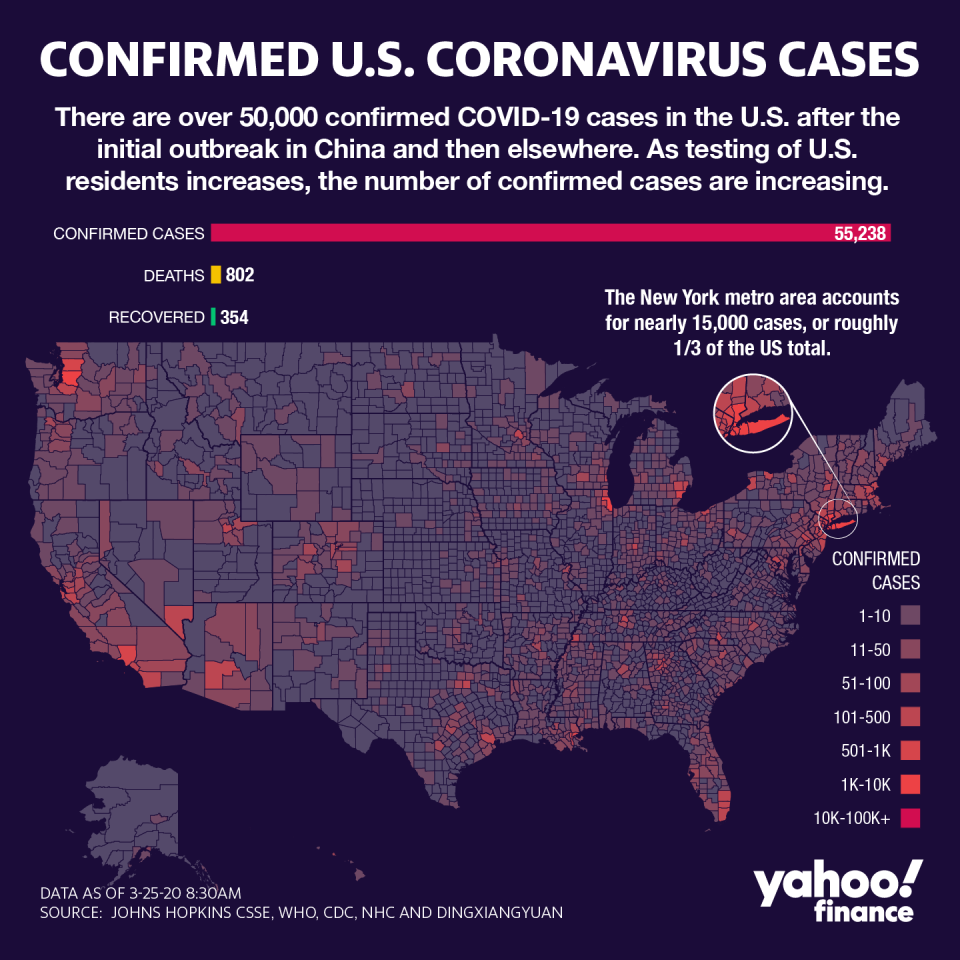

Over 435,000 people worldwide have been diagnosed, and the death toll is surging toward 20,000 — with New York, Italy and Spain now considered three of the hottest coronavirus zones in the world.

The company agreed to waive costs for “inpatient hospital admissions related to COVID-19 for Aetna’s commercially insured members,” Aetna said in a statement.

As more symptomatic patients show up in emergency rooms and require care, questions have surfaced over who will pay the bills — and how much it will cost.

“The additional steps we’re announcing today are consistent with our commitment to delivering timely and seamless access to care as we navigate the spread of COVID-19,” said Aetna business unite president and CVS Health vice president Karen Lynch.

“We are doing everything we can to make sure our members have simple and affordable access to the treatment they need as we face the pandemic together,” Lynch added.

The Empire State now has over 55,000 cases reported so far, with nearly half in New York City, something CVS/Aetna moved to address in its announcement.

“In states like New York and Washington with the strongest prevalence of COVID-19 cases, hospitals no longer need advance approval from Aetna for members requiring hospitalization for COVID-19. This change allows for expedited access to the necessary treatment,” CVS said in the statement.

Insurers across the country have, in the past few weeks, agreed to waive co-pays and costs for their members related to tests and visits for those tests, as well as, in some cases, tele-health visits.

Some have differentiated between seeking an in-network facility rather than an out-of-network institution. The Centers for Medicare and Medicaid Services has also announced an expansion of coverage. Self-insured plans managed by major insurers have had the option of opting in or out of the coverage offered.

America’s Health Insurance Plans (AHIP), the national insurance trade group, has already stated its members are covering visits and treatment needed to recover, but the more expensive inpatient stay has not yet been addressed.

Some AHIP members have also agreed to waive pre-authorization requirements in order to streamline the process for when patients need to be moved between critical and non-critical care settings.

The average inpatient cost per day in the U.S. is about $2,000, and some estimates place a total inpatient visit cost average at $22,000.

Of that total, depending on the insurance plan, the patient could be on the hook for the entire portion of their deductible plus the additional costs of interacting with an out-of-network individual— which plays a role in the surprise billing debates.

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.