Daily ETF Roundup: GDX Pops As Gold Surges, IYE Slumps

U.S. equities managed to eke out small gains today as investors digested a mixed bag of earnings reports and underwhelming housing data. On the corporate front, fast-food giant McDonald’s (MCD) reported earnings and revenues that disappointed Wall Street expectations. Toy-maker Hasbro (HAS) also reported lower-than expected earnings, while Haliburton (HAL) missed earnings forecasts but reported higher revenues. In economic news, the National Association of Realtors reported a decline in existing-home sales for June; sales fell 1.2% versus the expected rise of 1.9% [see The Cheapest ETF for Every Investment Objective].

Global Market Overview: GDX Pops As Gold Surges, IYE Slumps

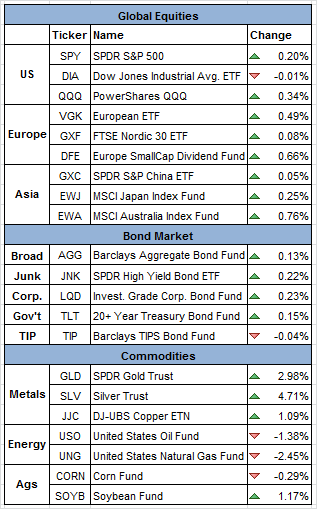

Despite today’s mixed earnings and economic reports, all three major U.S. equity indexes managed to close in positive territory. The S&P 500 ETF (SPY, A) traded 0.20% higher, after its underlying index logged in a four-day rally and yet another record closing high. The Dow Jones Industrial Average ETF (DIA, A) slipped 0.01% (though its underlying index ended up 0.01%), while the tech-heavy Nasdaq ETF (QQQ, B+) rose 0.34%.

In Europe, markets were broadly higher after Portuguese President Anibal Cavaco Silva said he would support the ruling coalition, ending weeks of political uncertainty; the Stoxx Europe 600 gained 0.2%. Meanwhile, China’s Shanghai Composite rose 0.6%, and Japan’s Nikkei Stock Average rose 0.5% after Prime Minister Shinzo Abe’s Liberal Democratic Party regained control of the upper house of parliament in an election over the weekend.

Bond ETF Roundup

U.S. Treasuries were slightly higher today following weaker-than-expected housing data. Yields on 10-year notes fell 0.5 basis points, while 30-year bonds and 5-year note yields fell 1.5 and 0.5 basis points, respectively [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures traded lower today, settling below $107 a barrel, causing the spread between Brent and WTI to widen. In other energy trading, gasoline and natural gas futures also traded lower. Meanwhile, gold futures rallied 3.3%, settling at a one-month high of $1,336.40 an ounce.

ETF Chart Of The Day #1: (GDX)

The Market Vectors TR Gold Miners ETF (GDX, B+) was one of the best performers today, gaining 6.11% during the session. As gold futures and miners rallied today, this ETF gapped significantly higher at the open. GDX inched slightly higher during the morning hours, eventually settling at $27.44 a share [see Mining Boom ETFdb Portfolio].

Click To Enlarge

ETF Chart Of The Day #2: (IYE)

The Energy ETF (IYE, A) was one of the worst performers today, shedding 0.31% during the session. As crude pulled back to settle below $107 a barrel, this ETF traded lower during the afternoon hours. IYE eventually settled at $47.56 a share [see Energy Bull ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing themed strategy over the trailing 4-week period has been the RAFI ETFdb Portfolio, which has gained 6.94%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: SDY Slumps Alongside High-Yield Sectors, GDX Rips Higher

Daily ETF Roundup: XLE Drops As Crude Retreats, IYW Pops On Apple Earnings