Daily ETF Roundup: GLTR Jumps On Gold Demand, IYZ Soars After CCI Earnings

A slew of upbeat earnings reports and encouraging labor data helped boost U.S. equity markets, with the S&P 500 logging in its fifth advance in a row. According to the Labor Department, jobless benefits applications fell below expectations to 339,000 last week, marking the second lowest level since January of 2008. In earnings news, oil giant ExxonMobil (XOM) reported earnings and revenue that topped analysts’ expectations, United Parcel Service (UPS) and Dow Chemical (DOW) also beat analyst estimates, while 3M (MMM) declined after the conglomerate reported profit and revenue that missed the mark and slashed its 2013 earnings forecast [see What Can You Buy With Apple's Cash?].

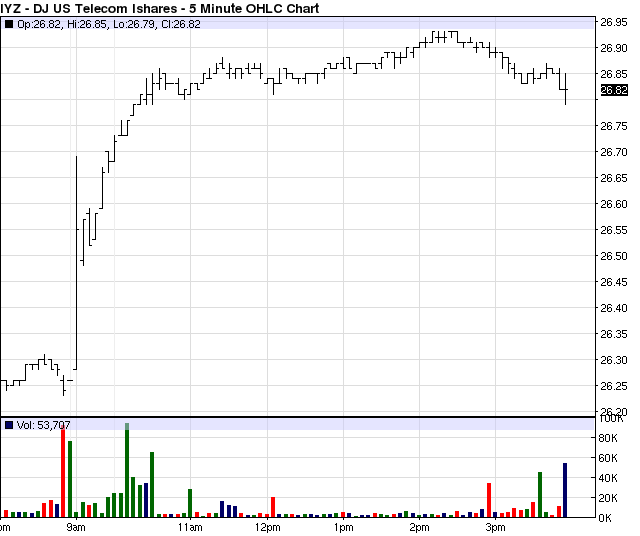

Global Market Overview: Daily ETF Roundup: GLTR Jumps On Gold Demand, IYZ Soars After CCI Earnings

Following today’s better-than-expected earnings and labor reports, all three major U.S. equity indexes managed to close in positive territory. The S&P 500 ETF (SPY, A) rose 0.41% and the tech-heavy Nasdaq ETF (QQQ, A-) gained 0.53%, as both underlying indexes logged a five-day rally, their best win streaks since last November. The Dow Jones Industrial Average ETF (DIA, B) ended 0.21% higher.

In Europe, markets were higher after U.K. economic growth came in better-than-expected at 0.3%; the Stoxx Europe 600 rose 0.8%. Meanwhile, Asian markets were mixed; Japan’s Nikkei Stock Average rose 0.6%, while China’s Shanghai Composite Index slipped 0.9%.

Bond ETF Roundup

U.S. Treasury prices were slightly lower after today’s better-than-expected labor report. Yields on 10-year notes rose nearly 1 basis point, while yields on 30-year bonds rose over 1.5 basis points [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures rose to settle above $93 a barrel after the U.K. reported economic growth that topped analysts expectations. Gasoline futures were also higher, while natural gas remained essentially unchanged. Meanwhile, gold futures jumped by nearly $40 an ounce, logging in its biggest one-day gain of the year. Silver also rallied, rising 5.7%.

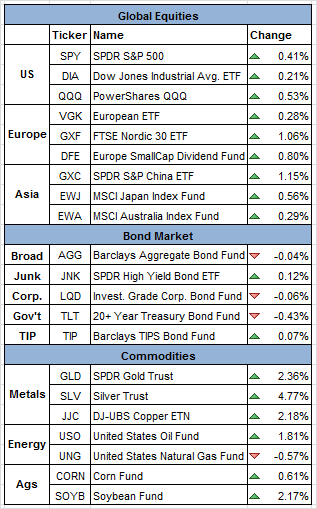

ETF Chart Of The Day #1: (GLTR)

The Physical Precious Metal Basket Shares (GLTR, B+) was one of the best performers today, gaining 2.44% during the session. As investor demand for physical precious metals rose once again today, this ETF gapped significantly higher at the open. GLTR inched higher throughout the day, eventually settling at $79.40 a share [see GLD-Free Gold Bug ETFdb Portfolio].

Click To Enlarge

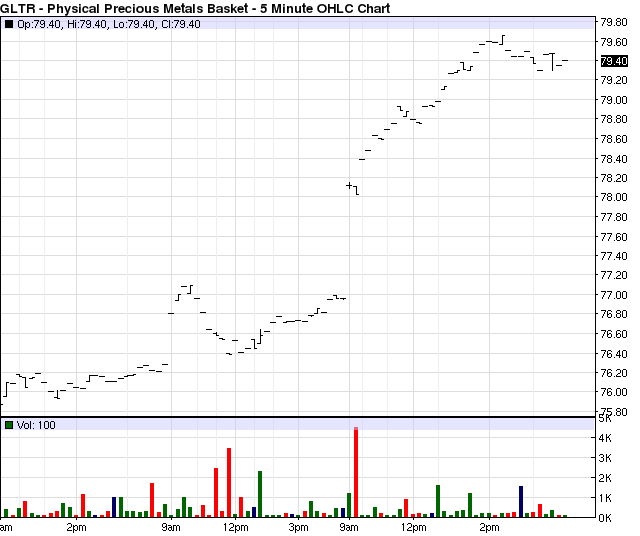

ETF Chart Of The Day #1: (IYZ)

The Dow Jones U.S. Telecommunications Index Fund (IYZ, A-) also posted a strong performance today, gaining 2.09% during the session. After Crown Castle International Corp (CCI) announced that profit slumped but it raised its 2013 earnings outlook, this ETF jumped significantly higher at the open. IYZ slid sideways during the afternoon hours, eventually settling at $26.81 a share [see High Tech ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing themed strategy over the trailing 3-year period has been the High Yield ETFdb Portfolio, which has gained 37.81%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: PPA Pops On Boeing Earnings, IBB Slumps On Declining Amgen Sales

Daily ETF Roundup: OIH Jumps On Strong Earnings, TAN Soars After Acquisition Deal

Daily ETF Roundup: Stocks Rebound From Worst One-Day Drop In 2013