Daily ETF Roundup: Healthcare Shares Boost IHI And XLV

Wall Street regained some of its momentum today as investors digested the latest commentary from two Fed officials. Helping boost equities were a pair of speeches from St. Louis Fed President James Bullard and New York Fed President William Dudley; Bullard commented that the central bank’s stimulus measures have been “effective” and expressed his continuing support of the program, while Dudley indicated that the Fed could change asset purchases in either direction. Meanwhile, investors remain somewhat cautious ahead of Ben Bernanke’s testimony before the Senate tomorrow and the release of the latest FOMC minutes [see The Cheapest ETF for Every Investment Objective].

Global Market Overview: Healthcare Shares Boost IHI And XLV

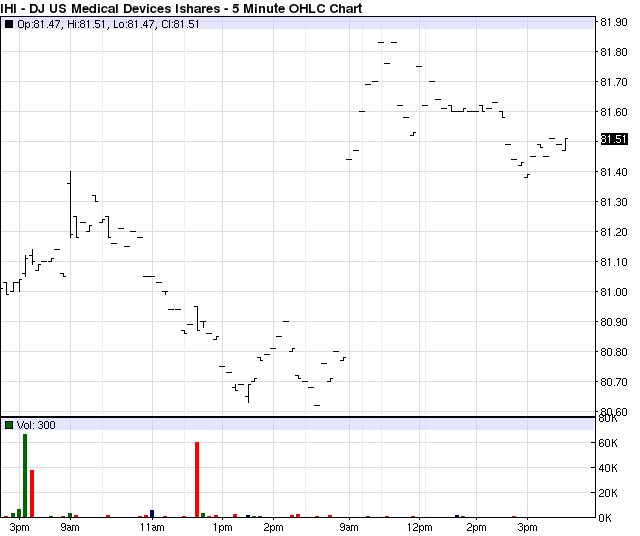

Ahead of Bernanke’s testimony, all three major U.S. equity indexes rose to close in positive territory. The S&P 500 ETF (SPY, A) settled 0.13% higher, with its underlying index on track for its biggest one-month point gain since October 2011. The Dow Jones Industrial Average ETF (DIA, B) rose 0.30%, while the tech-heavy Nasdaq ETF (QQQ, A-) posted a 0.11% uptick.

In Europe, markets reversed earlier losses to finish higher after Germany’s Bundesbank said the country’s economy is expected to recover at a faster pace: the Stoxx Europe 600 rose 0.1%. Meanwhile, Asian markets were mixed, Japan’s Nikkei Stock Average rose 0.13% on a weaker yen, and China’s Shanghai Composite Index edged 0.22% higher.

Bond ETF Roundup

U.S. Treasury prices rose following commentary from Fed officials Dudley and Bullard. Yields on 10-year notes fell 3.5 basis points, while 30-year bond and 5-year note yields fell 4 and 2.5 basis points, respectively [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures fell today, marking their first decline in five sessions, as a stronger dollar put pressure on the commodity. In other energy trading, gasoline futures inched lower, while natural gas ended higher. Meanwhile, gold traded lower on speculations of the Fed scaling back its massive bond buying program.

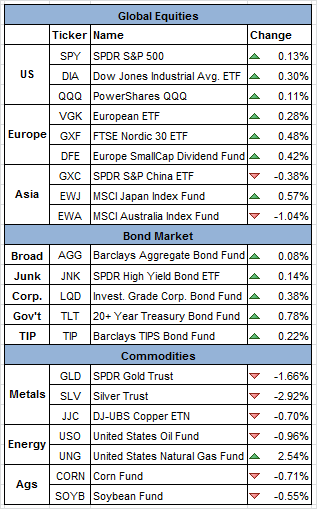

ETF Chart Of The Day #1: (XLV)

The Health Care Select Sector SPDR ETF (XLV, A+) was one of the best performers today, gaining 1.09% during the session. Health care shares were among today’s top performers, allowing this ETF to gap higher at the open. XLV rallied throughout the day, eventually settling at $49.29 a share [see Baby Boomers ETFdb Portfolio].

Click To Enlarge

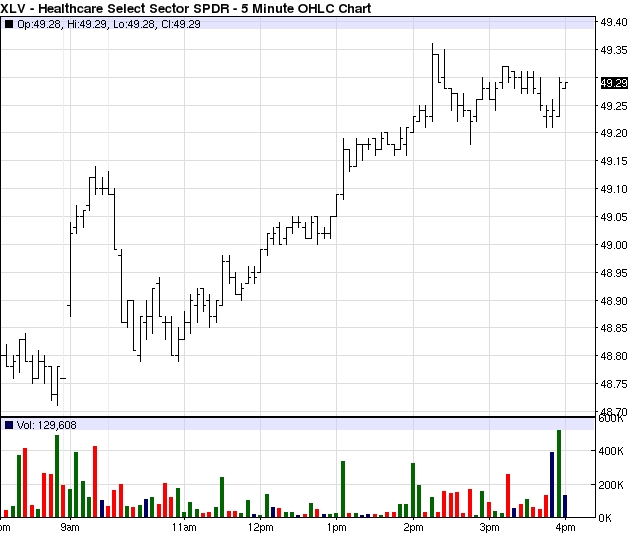

ETF Chart Of The Day #2: (IHI)

The Dow Jones U.S. Medical Devices Index Fund (IHI, B-) also posted a strong performance today, gaining 0.91% during the session. After Medtronic (MDT) reported its adjusted earnings, shares of the company rallied more than 5%, allowing this ETF to gap significantly higher at the open. IHI slid sideways for the remainder of the day, eventually settling at $80.46 a share [see High Tech ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing retirement strategy over the trailing 13-week period has been the 30 Years Til Retirement Portfolio, which has gained 7.23%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: IGN Pops After Cisco Earnings, XLV Slumps

Daily ETF Roundup: XLV Slips On Pfizer Earnings, VGT Jumps On Apple Bond Deal

Daily ETF Roundup: Stocks Rebound From Worst One-Day Drop In 2013