Daily ETF Roundup: Stocks End Mixed

Strong pullbacks in several bellwether stocks had markets struggling for a definitive direction today, with the bulls and bears seemingly reaching a stalemate amidst a lack of significant market catalysts. Meanwhile, investors attempted to digest last’s night State of the Union address, where President Obama expressed his desire for Washington to come to a bipartisan agreement on spending. Despite receiving strong support from Democratic leaders, many believe the speech will do little to rally together the deeply divided Congress. On the economic front, U.S. retail sales came in slightly higher in January, inline with expectations [Be sure to check out the real estate news, trends, tips and tricks over at Dividend.com].

Global Market Overview: Stocks End Mixed

Though most equities came off their session lows, major U.S. equity index closed mixed on the day. The Dow Jones Industrial Average ETF (DIA, ) slipped 0.13%, dragged down by McDonald’s (MCD) and other fast-food stocks which were pressured by the President’s comments concerning minimum wage. Bolstered by new of General Electric (GE) agreeing to sell Comcast (CMCSA) the remaining 49% of NBCUniversal, the S&P 500 ETF (SPY, ) managed to log in a mere 0.09% gain. The tech-heavy Nasdaq ETF (QQQ, ) inched 0.35% higher. In Europe, were mostly higher after euro zone industrial production came in better-than-expected. Japanese equities were mostly lower on a stronger yen, while markets in Hong Kong and Shanghai remained closed for holiday.

Bond ETF Roundup

U.S. Treasuries fell today after the Treasury Department sold $24 billion in 10-year notes at the highest auctioned yield since March. Yields on 5 and 10-year notes rose 4 basis points, while 30-year bond yields rose 3 basis points [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Commodities were mixed across the board today, with U.S. crude futures settling lower on data showing rising crude oil inventories and a revised report indicating lower than expected global oil demand growth for the year. Meanwhile, gold prices fell after U.S. retail sales in January showed only small growth.

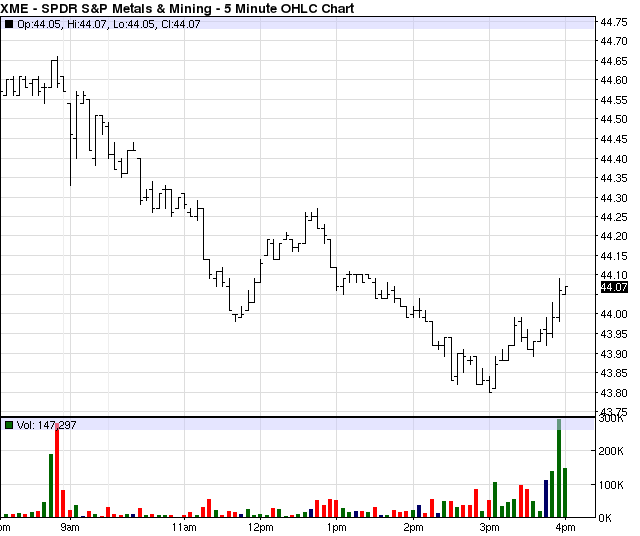

ETF Chart Of The Day #1: (XME)

The SPDR S&P Metals & Mining ETF (XME, ) was one of the worst performers today, shedding 1.12% during the session. After Cliffs Natural Resources (CLF) reported its plans to sell shares and cut its quarterly dividend, this ETF took a steep tumble. XME fell lower throughout the day, eventually settling at $44.07 a share [see Mining Boom ETFdb Portfolio].

Click To Enlarge

ETF Chart Of The Day #2: (VIS)

The Industrials ETF (VIS, ) was one of the best performers today, gaining 0.66% during the session. After General Electric (GE) reported that it has agreed to sell Comcast (CMCSA) the remaining 49% of NBCUniversal, this ETF gapped significantly higher at the open. VIS slid sideways for the remainder of the day, eventually settling at $77.49 a share [see Futures Free Commodity ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing themed strategy over the trailing one-year period has been the Alpha Seeker Portfolio 2.0, which has gained 9.78%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: Stocks End Mixed, S&P Posts Seventh Weekly Gain

Daily ETF Roundup: Stocks Little Changed Despite M&A Activity

Daily ETF Roundup: Stocks Rally Ahead of Obama’s State of the Union

Daily ETF Roundup: Stocks Dragged By Energy In Lackluster Session