Danaher (DHR) Q4 Sales to Exceed Guidance on Healthy Demand

Danaher Corporation DHR yesterday pleased investors with its expectation of delivering better-than-expected top-line results for the fourth quarter of 2021. The announcement was made by Rainer M. Blair, the company’s president and chief executive officer, at the J.P. Morgan Healthcare Conference.

Notably, shares of Danaher gained 0.76% yesterday, ending the trading session at $305.33.

Inside the Headlines

As communicated, strength across the Life Sciences and Diagnostics segments as well as healthy growth in the Environmental & Applied Solutions segment helped Danaher perform impressively in fourth-quarter 2021. The demand for testing products (respiratory and non-respiratory) was solid and added vigor to the company’s molecular diagnostics business.

On a year-over-year basis, revenue expectations in the fourth quarter have grown in the high-teens to low-twenties percentage range. Core sales are expected to increase in high-teens, higher than the previously mentioned low to mid-teens percentage range. Also, base revenues in the quarter are anticipated to increase 10% compared with the high-single digits stated earlier.

For 2021, the company’s revenues are expected to increase in the low-30% range, with core sales increasing in the low-twenties range. Acquisitions/divestitures are anticipated to boost sales by high-single digits, while currency exchange rates are likely to expand it by low-single digits.

Danaher will release its fourth-quarter 2021 results on Jan 27, before market open. The Zacks Consensus Estimate for the company’s fourth-quarter revenues is pegged at $7,806 million. The estimate suggests an increase of 15.5% from the year-ago reported figure and growth of 8% from the previous quarter. The consensus estimate for 2021 revenues is pegged at $29.1 billion, indicating a year-over-year increase of 30.5%.

Zacks Rank, Price Performance and Earnings Estimates

With a market capitalization of $216.5 billion, Danaher currently carries a Zacks Rank #2 (Buy). Benefits from Danaher Business System, acquired assets, healthy demand, and shareholder-friendly policies are raising the company’s attractiveness.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

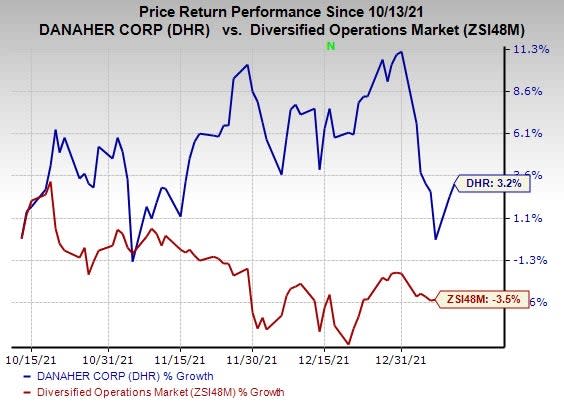

In the past three months, Danaher’s shares have gained 3.2% against the industry’s decline of 3.5%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for the company’s earnings per share is pegged at $9.86 for 2021 and $10.27 for 2022, reflecting increases of 0.6% and 1.9% from the respective 60-day-ago figures. The consensus estimate of $2.50 for fourth-quarter 2021 has been unchanged over the past 60 days.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Other Players From the Industry

Below we discussed three companies from the same industry that are slated/anticipated to release earnings results this month.

3M Company MMM is likely to report its fourth-quarter 2021 results on Jan 25. The company presently carries a Zacks Rank #3 (Hold).

The Zacks Consensus Estimate for 3M’s earnings is pegged at $2.05 per share for the fourth quarter of 2021, reflecting a 1% decrease from the 60-day-ago figure. Meanwhile, the consensus estimate is pegged at $9.86 for 2021 and $10.58 for 2022. Estimates suggest a 0.1% decrease for 2021 and growth of 0.7% for 2022 from the respective 60-day-ago figures.

General Electric Company GE will release the results for fourth-quarter 2021 on Jan 25, before market opens. The company presently carries a Zacks Rank #4 (Sell).

The Zacks Consensus Estimate for fourth-quarter earnings of General Electric is pegged at 83 cents per share, reflecting a 1.2% increase from the 60-day-ago figure. Also, estimates are pegged at $2.01 for 2021 and $4.01 for 2022, reflecting no movement and a decrease of 1.2% from the respective 60-day-ago figures.

Crane Co. CR will report its fourth-quarter 2021 results on Jan 24, after market close. The company presently carries a Zacks Rank #4.

The Zacks Consensus Estimate for Crane’s earnings is pegged at $1.12 per share for the fourth quarter of 2021, reflecting a 2.6% decrease from the 60-day-ago figure. Meanwhile, estimates are pegged at $6.42 for 2021 and $7.24 for 2022. These estimates suggest a 0.2% decline for 2021 and a 1% fall for 2022 from the respective 60-day-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Crane Co. (CR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research