Danaher Shares Gain 26% in 3 Months: What's Driving the Rally?

Shares of Danaher Corporation DHR have gained impressively in the past three months. We believe that the share price increase primarily reflects a healthy demand for the company’s products and the expectation for the second quarter.

The Washington, DC-based company belongs to the Zacks Diversified Operations industry. The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past three months, Danaher’s shares have gained 26.1% compared with the industry’s growth of 9.6%. Notably, the S&P 500 has risen 16% during the same period.

Factors Influencing the Stock

In the past three months, Danaher has reported results for first-quarter 2020, with an earnings beat of 5%. It is worth mentioning here that earnings in the first quarter increased 6.1% from the year-ago quarter, while sales expanded 2.9%. Organic sales grew by 4.5%, driven by the expansion of Pall, Radiometer, ChemTreat and Cepheid businesses.

In addition to better-than-expected results, sound expectations for the second quarter and the overall revival in the broader market might have supported the price improvement. The company believes that solid demand for products — mainly those related to molecular diagnostics and acute care diagnostics — will aid its Diagnostics segment’s performance in the second quarter.

Also, it believes that the Environmental & Applied Solutions segment will gain from sales growth for consumer goods, water testing products, treatment consumable products, and products related to coding and marking of medicines. Further, growth in core sales for genomic, bioprocessing and automation products will boost performances of the Life Sciences segment.

In addition, acquired assets, shareholder-friendly policies, innovation of products and efficient workforce are other tailwinds for Danaher. In March 2020, the company acquired General Electric Company’s GE BioPharma business — now called Cytiva. The buyout is expected to aid the company’s biologics workflow solutions of the Life Sciences segment. Notably, Cytiva is anticipated to boost Danaher’s core sales by 2% in the second quarter.

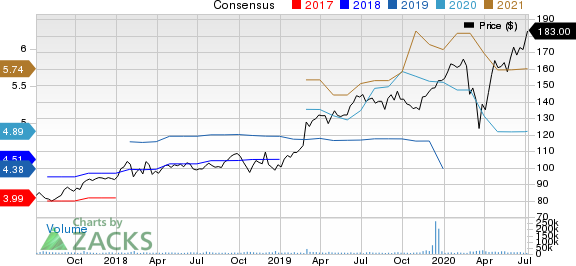

Currently, the Zacks Consensus Estimate for the company’s earnings is pegged at $4.89 for 2020 and $5.74 for 2021, marking increases of 0.2% and 0.3% from the respective 30-day-ago figures. Notably, there was one upward revision for both 2020 and 2021 in the past 30 days.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Also, earnings estimates for the second quarter have improved from earnings of $1.02 to $1.03 per share in the past month. Such an upward revision in earnings estimates is reflective of improving operating conditions for the company.

It is worth mentioning here that Danaher still has concerns related to the pandemic and has withdrawn projection for 2020.

Danaher’s Performance Versus Two Peers

The company outperformed two peers — including Thermo Fisher Scientific Inc. TMO and Abbott Laboratories ABT — in the past three months. During the period, Thermo Fisher and Abbott’s shares gained 24.4% and 9.4%, respectively.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research