Daniel Loeb Boosts Global Blue Exposure

- By Sydnee Gatewood

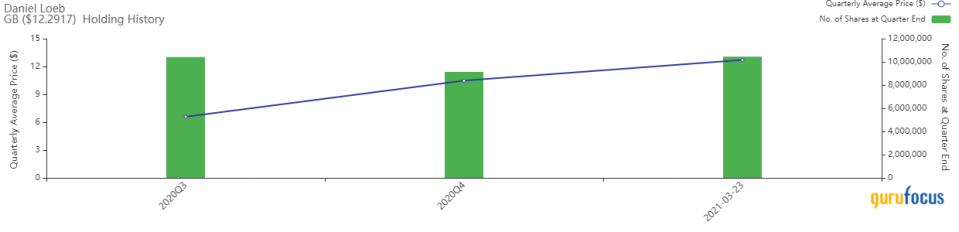

Third Point leader Daniel Loeb (Trades, Portfolio) revealed earlier this week he upped his stake in Global Blue Holding Group Inc. (NYSE:GB) by 14.47%.

Using an event-driven, value-oriented approach to picking stocks, the guru's New York-based firm is known for taking activist positions in underperforming companies that have a catalyst that will help unlock value for shareholders.

According to GuruFocus Real-Time Picks, a Premium feature, Loeb invested in 1.3 million shares of the Swiss software company on March 23, impacting the equity portfolio by 0.13%. Shares traded for an average price of $12.70 each on the day of the transaction.

Loeb now holds 10.45 million shares total, which represent 1.02 of the equity portfolio. GuruFocus estimates he has gained 66.15% on the investment since establishing it in the third quarter of 2020.

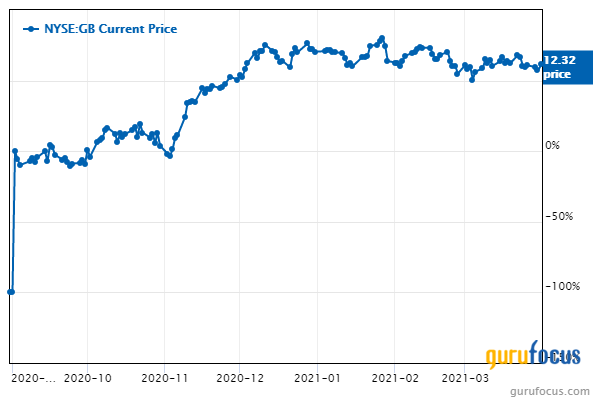

The technology company, which offers tax-free shopping and payment solutions, has a $2.31 billion market cap; its shares were trading around $12.32 on Wednesday with a price-sales ratio of 9.99.

According to the price chart, the stock has climbed over 50% since its public debut on Aug. 31, 2020.

Global Blue was one of the many entities to go public via special purpose acquisition company in 2020. Its combination with Far Point Acquisition Corp. closed on Aug. 28, 2020.

On March 3, the company reported its third-quarter 2021 results, posting an adjusted net loss of 20.9 million euros ($24.5 million) on 14.2 million euros in revenue.

After announcing the deal on March 8, Global Blue disclosed on March 23 it completed its acquisition of ZigZag, a leading software-as-a-service company that specializes in e-commerce returns, on March 19.

Global Blue's financial strength and profitability were both rated 3 out of 10 by GuruFocus. In addition to low debt ratios, the weak Altman Z-Score of 1.31 warns the company could be in danger of going bankrupt. It is also being weighed down by negative margins and returns that underperform a majority of industry peers. The Piotroski F-Score of 5, however, indicates business conditions are stable.

Loeb holds 5.57% of the company's outstanding shares.

Portfolio composition and performance

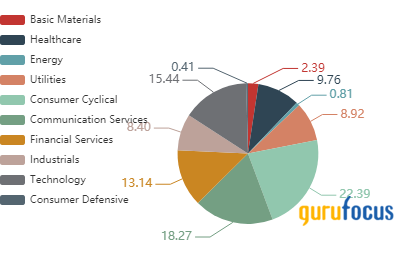

The guru's $12.97 billion equity portfolio, which was composed of 74 stocks as of the three months ended Dec. 31, is most heavily invested in the consumer cyclical (22.39%) and communication services (18.27%) sectors.

Other software stocks he holds currently include Intuit Inc. (NASDAQ:INTU), Fidelity National Information Services Inc. (NYSE:FIS), Microsoft Corp. (NASDAQ:MSFT), Adobe Inc. (NASDAQ:ADBE) and Salesforce.com Inc. (NYSE:CRM).

In his fourth-quarter letter, Loeb said the Third Point Offshore Fund posted a 20.5% return for full-year 2020, outperforming the S&P 500's 18.4% return.

Disclosure: No positions.

This article first appeared on GuruFocus.