Daniel Loeb's Top Trades of the 1st Quarter

- By Sydnee Gatewood

Third Point leader Daniel Loeb (Trades, Portfolio) released his first-quarter portfolio earlier this week.

Using an event-driven, value-oriented approach to picking stocks, the guru's New York-based firm is known for taking activist positions in underperforming companies that have a catalyst that will help unlock value for shareholders.

In his first-quarter shareholder letter, Loeb discussed Third Point's investment strategy.

"Many of our most profitable ideas over the past few quarters blurred the lines that previously delineated our investment strategies, particularly public versus private investing," he wrote. "Similarly, the 'activism' we have historically applied to public equity investments has brought valuable experience in being an engaged shareholder that has allowed us to add value in other strategies like venture capital, negotiated event-driven transactions, distressed credit workouts and structured credit offerings. As these different sources of return show, our longtime event -driven approach, applied in innovative ways, is creating compelling new means to generate alpha."

Keeping these considerations in mind, Loeb entered 65 new positions during the quarter, sold 32 holdings and added to or trimmed a slew of other existing investments. Notable trades for the three months ended March 31 included new investments in Paysafe Ltd. (NYSE:PSFE), CoStar Group Inc. (NASDAQ:CSGP) and Uber Technologies Inc. (NYSE:UBER) and the divestments of Alibaba Group Holdings Ltd. (NYSE:BABA) and Fidelity National Information Services Inc. (NYSE:FIS).

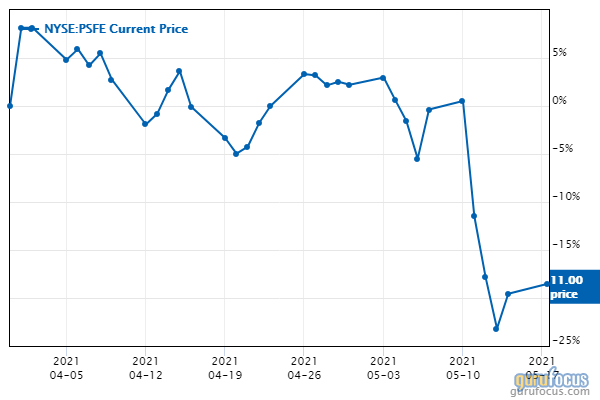

Paysafe

In his largest trade of the quarter, Loeb invested in 41.5 billion shares of Paysafe (NYSE:PSFE), dedicating 3.78% of the equity portfolio to the stake. It is now the guru's fifth-largest holding. The stock traded for an average price of $13.50 per share during the quarter.

The London-based payments company, which is the foremost payments facilitator for online gambling, has a $7.9 billion market cap; its shares were trading around $10.91 on Monday with a price-book ratio of 3.03 and a price-sales ratio of 10.72.

Since going public via special purpose acquisition company in March, the stock has tumbled nearly 20%.

In his quarterly, Loeb said his firm has "led a private placement investment" in the combination of FinTech Acquisition Corp. V with Paysafe, which was its "largest SPAC PIPE investment to date." He also noted Paysafe is an example of a quality company that meets the firm's investment criteria for companies "with leading positioning in their respective verticals, strong growth driven by industry tailwinds, and excellent management teams with the backing of experienced SPAC sponsors."

GuruFocus rated Paysafe's financial strength 3 out of 10. In addition to extremely weak interest coverage, the company is weighed down by a low Altman Z-Score of 1.02 that warns it could be at risk of going bankrupt if it does not improve its liquidity. The return on invested capital is also being eclipsed by the weighted average cost of capital, indicating issues with creating value.

The company's profitability scored a 2 out of 10 rating as a result of negative margins and returns on equity, assets and capital underperforming over half of its competitors.

Of the gurus invested in Paysafe, Loeb by far has the largest stake with 5.73% of outstanding shares. Leon Cooperman (Trades, Portfolio) also owns the stock.

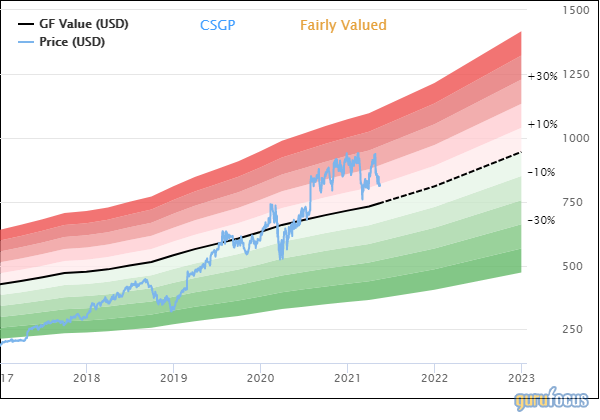

CoStar Group

The guru picked up 550,000 shares of CoStar Group (NASDAQ:CSGP), allocating 3.05% of the equity portfolio to the position. It is now Loeb's eighth-largest holding. Shares traded for an average price of $864.55 each during the quarter.

The company headquartered in Washington D.C., which provides information, analytics and marketing services to the commercial property industry, has a market cap of $32.08 billion; its shares were trading around $812.35 on Monday with a price-earnings ratio of 138.39, a price-book ratio of 5.89 and a price-sales ratio of 18.36.

The GF Value Line shows the stock is fairly valued currently based on its historical ratios, past performance and future earnings projections.

The valuation rank of 1 out of 10, however, leans more toward overvaluation.

In his quarterly commentary, Loeb wrote, "We think CoStar is an exceptionally high-quality 'compounder' in the early innings of a transformational new opportunity which could meaningfully accelerate earnings growth. We also believe the business will be a direct beneficiary of the impending wave of Covid-induced disruption in the CRE market."

CoStar's financial strength was rated 7 out of 10 by GuruFocus on the back of adequate interest coverage and a robust Altman Z-Score of 14.03. Although assets are building up at a faster rate than revenue is growing, indicating it may be becoming less efficient, there is good value creation since the ROIC surpasses the WACC.

The company's profitability scored a 9 out of 10 rating, driven by an expanding operating margin and returns that outperform over half of its industry peers. CoStar also has a moderate Piotroski F-Score of 6, indicating its business conditions are stable. Despite recording consistent earnings and revenue growth, the predictability rank of five out of five stars is on watch. According to GuruFocus, companies with this rank return an average of 12.1% annually over a 10-year period.

With 4.91% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder. Other top guru investors include Baillie Gifford (Trades, Portfolio), Chuck Akre (Trades, Portfolio), Frank Sands (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Jerome Dodson (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio).

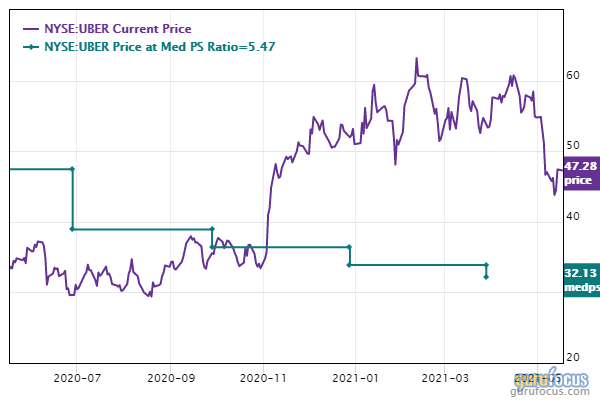

Uber

The investor entered a 6.75 million-share stake in Uber Technologies (NYSE:UBER), giving it 2.48% space in the equity portfolio. The stock traded for an average per-share price of $55.88 during the quarter.

The San Francisco-based ridesharing company, which also offers food and package delivery services, has an $88.23 billion market cap; its shares were trading around $47.28 on Monday with a price-book ratio of 6.47 and a price-sales ratio of 8.02.

According to the median price-sales ratio chart, the stock is overvalued currently.

GuruFocus rated Uber's financial strength 4 out of 10. As a result of issuing approximately $4.7 billion in new long-term debt over the past three years, the company has poor interest coverage. The low Altman Z-Score of 1.62 also warns it could be at risk of going bankrupt if it does not improve its liquidity.

The company's profitability did not fare as well, scoring a 1 out of 10 rating on the back of negative margins and returns that underperform a majority of competitors. Uber also has a low Piotroski F-Score of 2, indicating operations are in poor shape. The company has also recorded losses in operating income as well as declines in revenue per share over the past several years.

Sands is Uber's largest guru shareholder with a 1.79% stake. Chase Coleman (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Cohen and Pioneer also have significant investments in the stock.

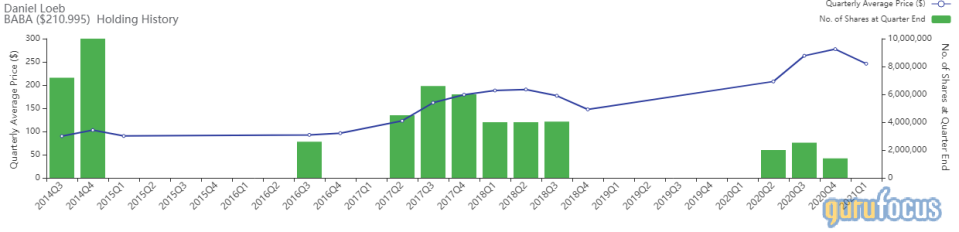

Alibaba

With an impact of -2.51% on the equity portfolio, Loeb sold his 1.4 million remaining shares of Alibaba (NYSE:BABA). The stock traded for an average price of $245.98 per share during the quarter.

GuruFocus estimates he gained 9.82% on the investment since establishing it in the second quarter of 2020.

The Chinese e-commerce company has a market cap of $572.88 billion; its shares were trading around $211.12 on Monday with a price-earnings ratio of 24.65, a price-book ratio of 4 and a price-sales ratio of 6.13.

Based on the GF Value Line, the stock is significantly undervalued currently.

Driven by a good cash-debt ratio, a comfortable level of interest coverage and a robust Altman Z-Score of 5.35, Alibaba's financial strength was rated 8 out of 10 by GuruFocus. The ROIC also eclipses the WACC, indicating good value creation.

The company's profitability also scored an 8 out of 10 rating. Although the operating margin is in decline, Alibaba has strong returns that outperform a majority of industry peers as well as a moderate Piotroski F-Score of 4. Despite recording consistent earnings and revenue growth, the 2.5-star predictability rank is on watch. GuruFocus says companies with this rank return an average of 7.3% annually.

Baillie Gifford (Trades, Portfolio) is Alibaba's largest guru shareholder with a 0.98% stake. Other top guru investors include Ken Fisher (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Sands, Pioneer, Coleman, Chris Davis (Trades, Portfolio), Dodge & Cox, Sarah Ketterer (Trades, Portfolio), Baron, David Tepper (Trades, Portfolio), Dalio, Al Gore (Trades, Portfolio), Laffont, Tom Russo (Trades, Portfolio), Tweedy Browne (Trades, Portfolio) and Grantham.

Fidelity National Information Services

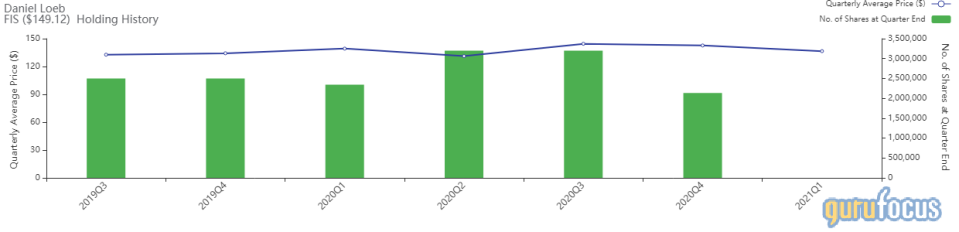

Impacting the equity portfolio by -2.33%, the guru dumped his 2.14 million remaining shares of Fidelity (NYSE:FIS). During the quarter, shares traded for an average price of $136.55 each.

GuruFocus data shows he gained an estimated 4.74% on the investment, which was established in the third quarter of 2019.

Headquartered in Jacksonville, Florida, the financial services company, which is a leading core bank and payment processor, has a $92.18 billion market cap; its shares were trading around $148.88 on Monday with a price-book ratio of 1.9 and a price-sales ratio of 7.32.

The GF Value Line suggests the stock is significantly overvalued currently.

The valuation rank of 2 out of 10 supports this assessment since the share price and price-sales ratio are both closing in on 10-year highs.

GuruFocus rated Fidelity's financial strength 4 out of 10. As a result of issuing approximately $6.8 billion in new long-term debt over the past three years, the company has weak interest coverage. The Altman Z-Score of 1.83 also indicates it is under some pressure since the ROIC has fallen below the WACC.

The company's profitability fared better with a 6 out of 10 rating. In addition to a declining operating margin, Fidelity has negative returns that underperform over half of its competitors. It also has a moderate Piotroski F-Score of 4, but the one-star predictability rank is on watch as a result of revenue per share declining over the past five years. GuruFocus data shows companies with this rank return, on average, 1.1% annually.

Of the gurus invested in Fidelity, Halvorsen has the largest stake with 1.91% of outstanding shares. Diamond Hill Capital (Trades, Portfolio), Steve Mandel (Trades, Portfolio), Pioneer and Ruane Cunniff (Trades, Portfolio) also have significant positions in the stock.

Additional trades and portfolio performance

Other new positions Loeb established during the quarter included DuPont de Nemours Inc. (NYSE:DD), Dell Technologies Inc. (NYSE:DELL) and Shopify Inc. (NYSE:SHOP). He also exited his holdings of Adobe Inc. (NASDAQ:ADBE) and Salesforce.com Inc. (NYSE:CRM) as well as added to The Estee Lauder Companies Inc. (NYSE:EL) investment.

The guru's $14.84 billion equity portfolio, which is composed of 125 stocks, is most heavily invested in the financial services (20.98%) and technology (17.42%) sectors.

The Third Point Offshore Fund posted a 20.5% return for full-year 2020, outperforming the S&P 500's 18.4% return. Loeb noted in his letter that it returned 11% for the first three months of 2021.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.