Darden Restaurants Swings to a Loss as Coronavirus Pandemic Weighs on Earnings

Shares of Darden Restaurants Inc. (NYSE:DRI) gained around 2.2% in premarket trading on Thursday after the company announced its earnings for the fourth quarter and full fiscal 2020 as well as a positive outlook for the coming quarter.

The Orlando, Florida-based company, which owns restaurant brands like Olive Garden, LongHorn Steakhouse, The Capital Grille, Bahama Breeze and Cheddar's Scratch Kitchen, among others, posted an adjusted loss of $1.24 per share for the quarter, which topped Refinitiv analysts' estimates of a loss of $1.65 per share. Revenue declined 43% from the prior-year quarter to $1.27 billion, which was in line with expectations even though the impacts from the Covid-19 pandemic make these results difficult to compare to actual earnings.

Same-store sales across all of Darden's brands tumbled 47.7% during the quarter as a result of having to close its dining rooms in the wake of the coronavirus outbreak. Of those brands, Olive Garden, which contributes over half of the company's revenue, saw its same-store sales shrink 39.2%. Its fine dining segment recorded an even bigger decrease of 63.1%.

For the full year, the restaurant operator recorded adjusted earnings of $3.13 per share on $7.81 billion in revenue, which was down 8.3% from last year.

In statement, CEO Gene Lee said the company was able to "navigate one of the most challenging periods" in its history due to the strategy it implemented five years ago, which allowed its employees to "quickly react to constant change."

"When our dining rooms closed, our operators did an amazing job of reimagining the guest experience by staying true to our back-to-basics operating philosophy," he added.

Despite the challenging environment, Darden expects business will pack back up over the next three months as local and state governments begin to relax lockdown restrictions. For the first quarter of 2021, it is anticipating that sales will be approximately 70% of those from the prior year.

"As our industry continues to rebuild, there is significant opportunity to increase market share," Lee said. "Those executing at the highest level are going to win, and Darden is well positioned to take advantage of the opportunity."

As of June 22, 91% of Darden's locations had reopened their dining rooms with limited capacity.

For the first quarter, the restaurant operator is also projecting that net earnings per share from continuing operations will turn positive and that earnings before interest, taxes, depreciation and amortization will be at least $75 million.

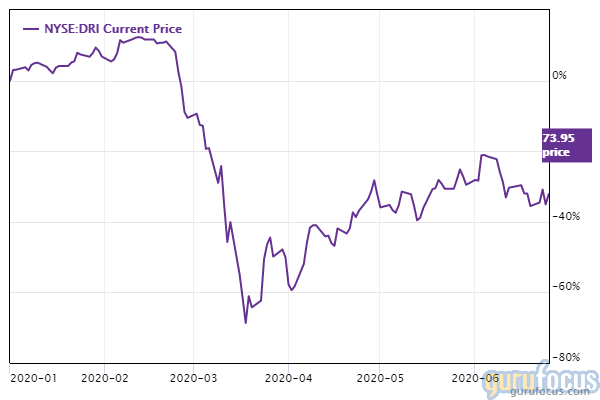

With a market cap of $9.6 billion, shares of Darden Restaurants were trading around $73.89 on Thursday. GuruFocus estimates the stock has tumbled over 30% year to date.

Gurus who own the stock as of March 31 include Steven Cohen (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Richard Snow (Trades, Portfolio), Bernard Horn (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio).

According to GuruFocus' Industry Overview, Darden Restaurants is the seventh-largest player in the sector, behind McDonald's Corp. (NYSE:MCD), Starbucks Corp. (NASDAQ:SBUX), Chipotle Mexican Grill Inc. (NYSE:CMG), Yum Brands Inc. (NYSE:YUM), Yum China Holdings Inc. (NYSE:YUMC) and Domino's Pizza Inc. (NYSE:DPZ).

Disclosure: No positions.

Read more here:

With the Coronavirus Wounding Traditional Retail, the Resale Market Is Set to Grow

Luckin Coffee's Luck Is Running Out as Nasdaq Issues Another Delisting Notice

Microsoft Expands IoT Capabilities With Acquisition of CyberX

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.