David Abrams Cuts Camping World Holdings

David Abrams (Trades, Portfolio) has revealed an 8.18% reduction in his holding of Camping World Holdings Inc. (NYSE:CWH), according to GuruFocus' Real-Time Picks, a Premium feature.

Abrams is the founder of Abrams Capital Management, which oversees nearly $8 billion in assets across three funds. Abrams Capital Management typically invests in public equity markets in the U.S. and utilizes a value investing approach. Abrams looks for companies in which the CEO has a significant stake, or where the CEO's salary is primarily stock-based.

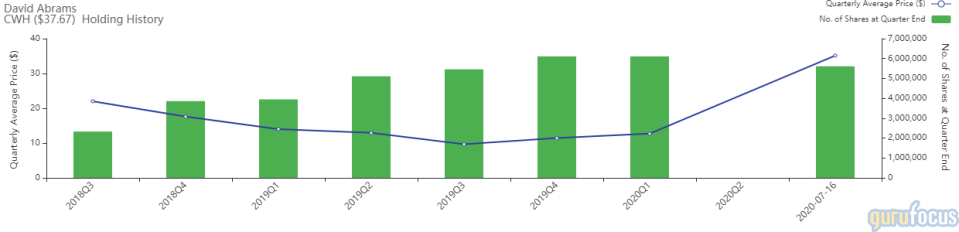

Abrams has held Camping World Holdings since 2018, when he purchased 2.38 million shares. Since then the guru has slowly been adding to the holding, racking up 6.10 million shares total prior to the sale.

On July 16, he sold 500,000 shares at an average price of $35.13. Overall, the sale represented a -0.69% impact on the portfolio.

Portfolio overview

At the end of the first quarter, Abrams' portfolio contained 22 stocks with two new holdings reported for the period. By weight, the portfolio is most invested in healthcare (23.95%), consumer cyclical (15.08%) and financial services (14.79%).

The new holdings for the portfolio were TransDigm Group Inc. (NYSE:TDG) and Energy Transfer LP (NYSE:ET).

Camping World Holdings

Camping World Holdings Inc provides services, protection plans, products and resources for recreational vehicle (RV) enthusiasts across the United States. The company operates its business through two reportable segments: Good Sam Services and Plans and RV and Outdoor Retail.

The RV and Outdoor Retail segment consists of all aspects of RV dealership operations, which includes selling new and used RVs, assisting with the financing, selling protection and insurance related services and plans, service and repair and installation of RV parts and accessories.

On July 22, the stock was trading at $36.74 per share with a market cap of $3.24 billion. According to the Peter Lynch Chart, the company was trading close to its intrinsic value in 2016, but by the end of 2018 it was grossly overvalued.

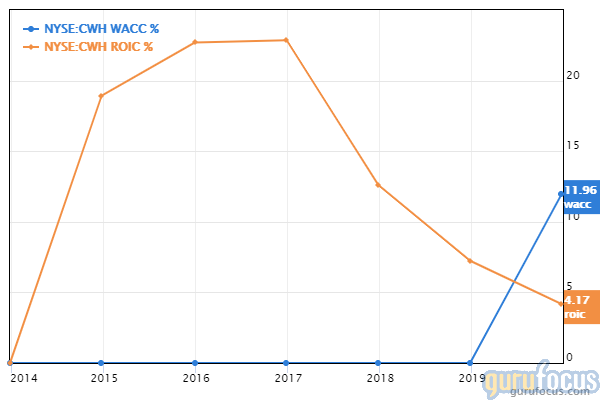

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rank of 6 out of 10. The company currently shows four severe warning signs, including increased long-term debt. The current cash-to-debt ratio of 0.04 places the company lower than 93.23% of competitors in the vehicle and parts industry. The weighted average cost of capital significantly outweighs the return on invested capital, which will continue to deteriorate the value of the company.

Even after the sale, Abrams remains the top shareholder with 6.36% of shares outstanding. Other top shareholders include Crestview Partners II GP, L.P. (Trades, Portfolio), Wasatch Advisors Inc. (Trades, Portfolio), BlackRock Inc. (Trades, Portfolio), Vanguard Group Inc. (Trades, Portfolio) and Newtyn Management, LLC (Trades, Portfolio).

Disclaimer: Author owns no stocks mentioned.

Read more here:

Jerome Dodson Reveals Major Portfolio Revision in 2nd Quarter

Boeing Gets Military Save Amidst Struggles

NWQ Managers Cuts Landec Corp Amdist Small Recovery

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.