David Carlson Buys 2 Stocks, Sells 1 in 1st Quarter

- By Sydnee Gatewood

David Carlson (Trades, Portfolio), manager of the Elfun Trusts, disclosed in his first-quarter portfolio earlier this week that he entered two new positions and exited another.

Warning! GuruFocus has detected 1 Warning Sign with ELAN. Click here to check it out.

The intrinsic value of ELAN

With the goal of generating long-term capital growth and future income, the guru's fund, which is part of Boston-based State Street Global Advisors, picks stocks based on the company's potential to increase net income and dividends over time.

Based on these criteria, Carlson established holdings in Elanco Animal Health Inc. (ELAN) and Lyft Inc. (LYFT) during the quarter. He sold out of Biogen Inc. (BIIB).

Elanco Animal Health

The guru invested in 550,000 shares of Elanco Animal Health, dedicating 0.67% of the equity portfolio to the holding. The stock traded for an average price of $30.78 per share during the quarter.

The Indiana-based company, which produces pharmaceutical products for household pets as well as livestock, has an $11.55 billion market cap; its shares were trading around $31.55 on Wednesday with a price-earnings ratio of 287.18, a price-book ratio of 2.22 and a price-sales ratio of 4.94.

Shares of the company, which spun off of Eli Lilly (LLY) last September, have declined approximately 12% since their debut. Regardless, the Peter Lynch chart suggests the stock is overpriced since it is trading above its fair value.

GuruFocus rated Elanco's financial strength 6 out of 10. Despite having adequate interest coverage, the Altman Z-Score of 2.51 indicates the company is under some fiscal pressure. Its profitability and growth did not fare as well, scoring a 3 out of 10 rating as a result of margins and returns underperforming a majority of competitors.

Of the gurus invested in Elanco, the Vanguard Health Care Fund (Trades, Portfolio) has the largest stake with 2.86% of outstanding shares. Pioneer Investments (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Steven Cohen (Trades, Portfolio), the Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio), the Signature Select Canadian Fund (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and Ron Baron (Trades, Portfolio) are also shareholders.

Lyft

Carlson picked up 21,300 shares of Lyft, which went public on March 29, allocating 0.06% of the equity portfolio to the position. The shares traded for an average price of $78.29 during the quarter.

The ride-hailing service, which is headquartered in San Francisco, has a market cap of $17.12 billion; its shares were trading around $59.95 on Wednesday with a price-book ratio of 7.96.

Since its initial public offering, the stock has tumbled 23%.

Driven by no long-term debt, Lyft's financial strength was rated 8 out of 10 by GuruFocus. The company's profitability and growth scored a 2 out of 10 rating, weighed down by negative margins and returns.

Carlson holds 0.01% of Lyft's outstanding shares.

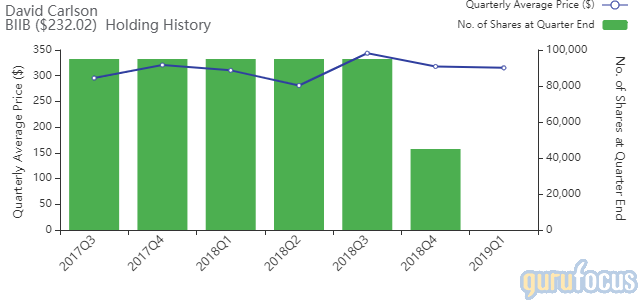

Biogen

The investor divested of 45,000 share of Biogen, impacting the equity portfolio by -0.57%. The stock traded for an average price of $315.30 during the quarter. GuruFocus estimates Carlson gained 7.2% on the investment since establishing it in third-quarter 2017.

The Cambridge, Massachusetts-based biotechnology company has a $44.33 billion market cap; its shares were trading around $231.56 on Wednesday with a price-earnings ratio of 9.85, a price-book ratio of 3.26 and a price-sales ratio of 3.33.

According to the Peter Lynch chart, the stock is undervalued.

GuruFocus rated Biogen's financial strength 7 out of 10. In addition to sufficient interest coverage, the Altman Z-Score of 4.61 indicates the company is fiscally stable.

The company's profitability and growth fared even better, scoring a 9 out of 10 rating. In addition to operating margin expansion, Biogen is supported by strong returns, consistent earnings and revenue growth and a moderate Piotroski F-Score of 6, which suggests business conditions are stable. It also has a business predictability rank of a perfect 5 out of 5 stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 12.1% per year.

With 7.48% of outstanding shares, PRIMECAP is the company's largest guru shareholder. Other guru investors include Vanguard, Jim Simons (Trades, Portfolio)' Renaissance Technologies, Pioneer, Hotchkis & Wiley, Richard Snow (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Eaton Vance and Ray Dalio (Trades, Portfolio).

Additional trades

During the quarter, Carlson also expanded several positions, including UnitedHealth Group Inc. (UNH), Applied Materials Inc. (AMAT) and Microsoft Corp. (MSFT), among others. Among the holdings he reduced were Boston Scientific Corp. (BSX), Salesforce.com Inc. (CRM) and PepsiCo Inc. (PEP).

The guru's $2.63 billion equity portfolio, which is composed of 44 stocks, is largely invested in the technology, financial services and health care sectors. According to its website, the fund posted a -3.39% return in 2018, outperforming the S&P 500's return of -4.38%.

Disclosure: No positions.

Read more here:

Steve Mandel's Lone Pine Gets in the Ring With World Wrestling Entertainment

David Abrams Ventures Further Into Camping World Holdings

Starbucks Posts 1st-Quarter Earnings Beat

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with ELAN. Click here to check it out.

The intrinsic value of ELAN