David Tepper Sells Micron Technology, Facebook, Alibaba

- By Tiziano Frateschi

David Tepper's (Trades, Portfolio) Appaloosa Management sold shares of the following stocks during the fourth quarter.

The guru sold 55.56% of his Micron Technology Inc. (MU) holding. The trade had an impact of -16.13% on the portfolio.

Warning! GuruFocus has detected 3 Warning Sign with ON. Click here to check it out.

The intrinsic value of MU

The company, which provides memory and storage solutions, has a market cap of $47.07 billion and an enterprise value of $46.51 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 51.56% and return on assets of 35.41% are outperforming 99% of companies in the Global Semiconductor Memory industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 1.35 is below the industry median of 1.69.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 5.16% of outstanding shares followed by Tepper with 1.43%, Donald Smith (Trades, Portfolio) with 0.69% and Pioneer Investments (Trades, Portfolio) with 0.54%.

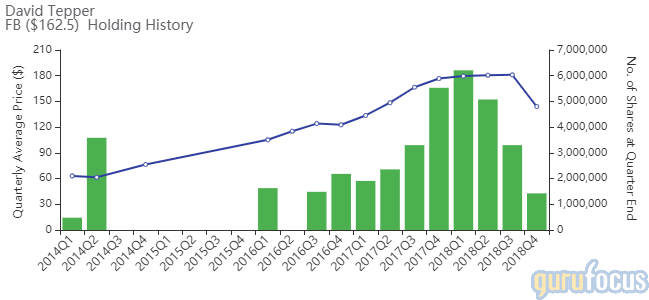

The guru reduced his class A shares of Facebook Inc. (FB). The trade had an impact of -5.50% on the portfolio.

The online social network has a market cap of $463.77 billion and an enterprise value of $423.65 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 27.93% and return on assets of 24.38% are outperforming 85% of companies in the Global Internet Content and Information industry. Its financial strength is rated 9 out of 10. The cash-debt ratio of 41.49 is above the industry median of 7.46

The company's largest guru shareholder is Steve Mandel (Trades, Portfolio)'s Lone Pine Capital with 0.23% of outstanding shares, followed by Jim Simons' (Trades, Portfolio) Renaissance Technologies with 0.21% and Spiros Segalas (Trades, Portfolio) with 0.21%.

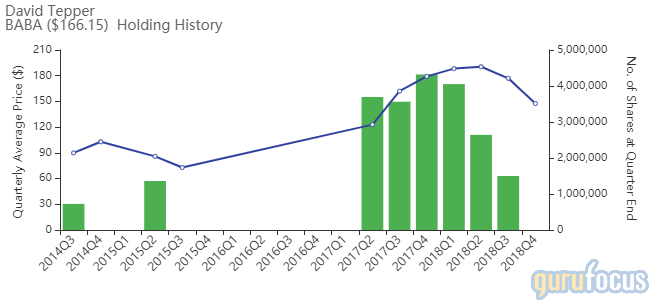

The holding of Alibaba Group Holding Ltd. ADR (BABA) was closed, impacting the portfolio by -4.41%.

The online and mobile commerce company has a market cap of $427.33 billion and an enterprise value of $433.52 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 17.09% and return on assets of 8.62% are outperforming 83% of companies in the Global Specialty Retail industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.47 is above the industry median of 0.99.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 0.59% of outstanding shares followed by Frank Sands (Trades, Portfolio) with 0.58% and Ken Fisher (Trades, Portfolio) with 0.44%.

The guru sold out of Lam Research Corp. (LRCX), impacting the portfolio by -3.18%.

The company, which supplies semiconductor processing systems, has a market cap of $27.63 billion and an enterprise value of $26.05 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 47.49% and return on assets of 23.87% are outperforming 93% of companies in the Global Semiconductor Equipment and Materials industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.77 is above the industry median of 1.69.

The largest guru shareholder is Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.51% of outstanding shares, followed by the Simons' firm with 0.5%, Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.13% and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.1%.

The guru's position in Allergan Plc (AGN) was trimmed by 42.29%. The trade had an impact of -2.86% on the portfolio.

The specialty pharmaceutical company has a market cap of $46.91 billion and an enterprise value of $68.81 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -7.28% and return on assets of -4.65% are underperforming 67% of companies in the Global Drug Manufacturers - Specialty and Generic industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.08 is below the industry median of 2.03.

The largest guru shareholder is Vanguard Health Care Fund (Trades, Portfolio) with 4.67 % of outstanding shares, followed by Seth Klarman (Trades, Portfolio)'s Baupost Group with 1.41% and Mason Hawkins' (Trades, Portfolio) Southeastern Asset Management with 0.64%.

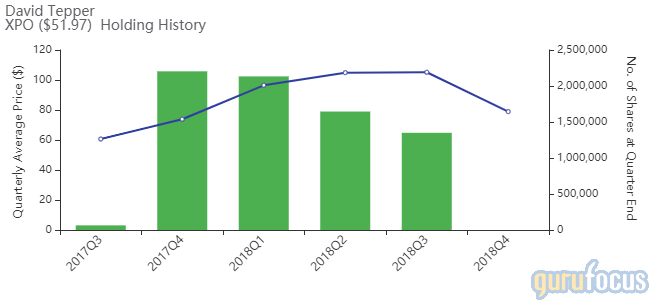

The guru sold out his shares of XPO Logistics Inc. (XPO). The trade impacted the portfolio by -2.75%.

The global transportation and logistics company has a market cap of $5.67 billion and an enterprise value of $9.88 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 10.39% and return on assets of 3.34% are outperforming 59% of companies in the Global Integrated Shipping and Logistics industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.30.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.35% of outstanding shares, followed by Michael Price (Trades, Portfolio) with 0.1%.

Disclosure: I do not own any stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with ON. Click here to check it out.

The intrinsic value of MU