David Tepper's Top 5 Buys in the 2nd Quarter

David Tepper (Trades, Portfolio), leader of Appaloosa Management, disclosed this week that his top five buys for the second quarter were in T-Mobile US Inc. (NASDAQ:TMUS), AT&T Inc. (NYSE:T), Alibaba Group Holding Ltd. (NYSE:BABA), Visa Inc. (NYSE:V) and Mastercard Inc. (NYSE:MA).

Managing a portfolio of 30 stocks, Tepper became interested in the stock market watching his father trade stocks in his hometown of Pittsburgh. The guru, who likes to invest in distressed debt securities, has earned an international reputation for producing some of the highest returns among Wall Street fund managers.

Tepper announced in 2019 that he plans to convert his Appaloosa hedge fund into a family office now that he also manages the Carolina Panthers NFL football team.

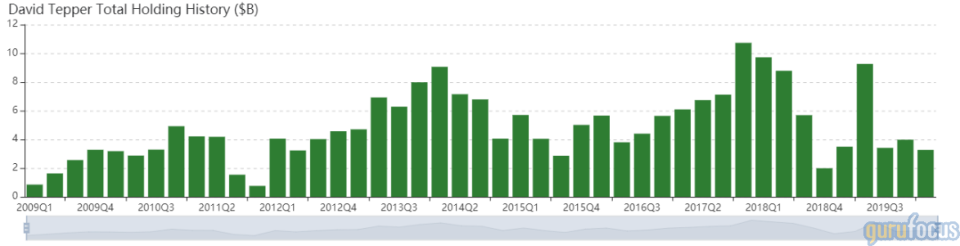

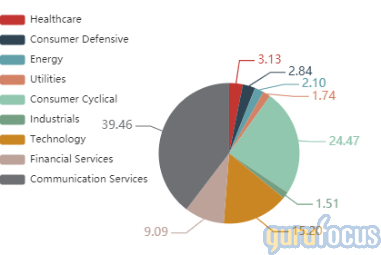

The $3.27-billion equity portfolio established a total of 13 new holdings during the second quarter with a turnover ratio of 16%. The top three sectors in terms of weight are communication services, consumer cyclical and technology, with weights of 39.46%, 24.47% and 15.20%, respectively.

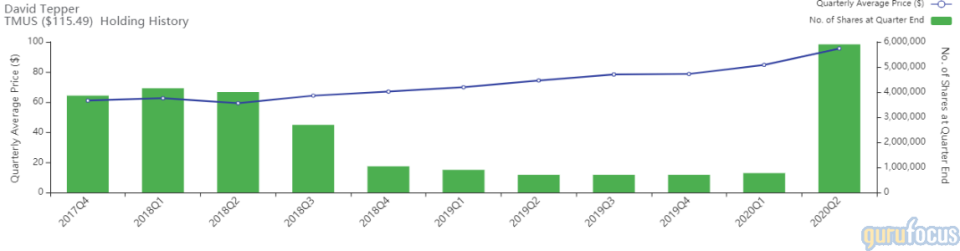

T-Mobile US

Tepper purchased 5.13 million shares of T-Mobile US, boosting the position 666.23% and the equity portfolio by 9.28%. Shares averaged $95.53 during the second quarter.

GuruFocus ranks the Bellevue, Washington-based telecom company's profitability 7 out of 10 on the back of expanding operating margins and a three-year revenue growth rate that outperforms 65% of global competitors.

AT&T

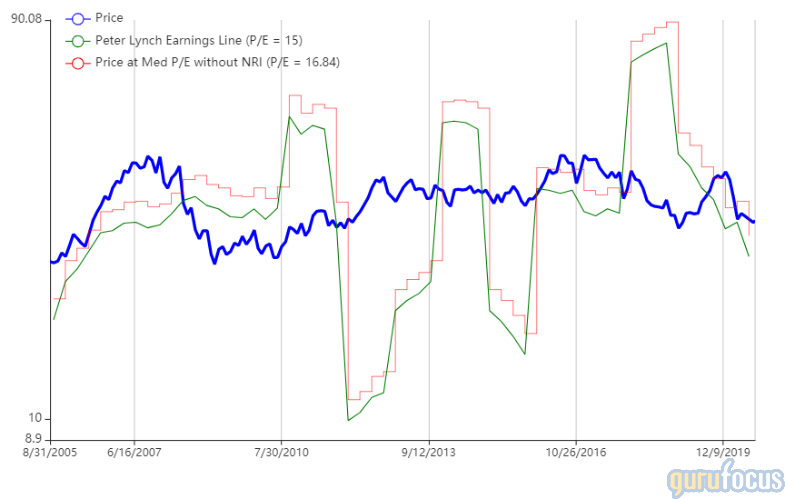

Tepper purchased 9,077,200 shares of AT&T, giving the position a 4.77% equity portfolio weight. Shares averaged $30.14 during the second quarter.

GuruFocus ranks the Dallas-based telecom company's profitability 7 out of 10 on several good signs, which include a high Piotroski F-score of 7 and an operating margin that has increased approximately 5% per year on average over the past five years and is outperforming over 70% of global competitors.

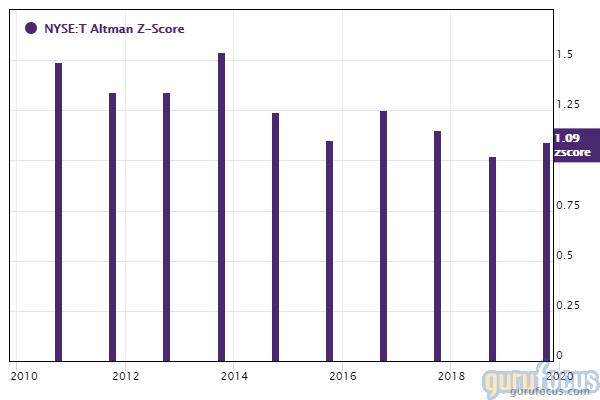

Despite high profitability, AT&T's financial strength ranks 3 out of 10 on the heels of interest coverage and debt ratios underperforming over 60% of global competitors, further weighed down by a weak Altman Z-score of 0.95.

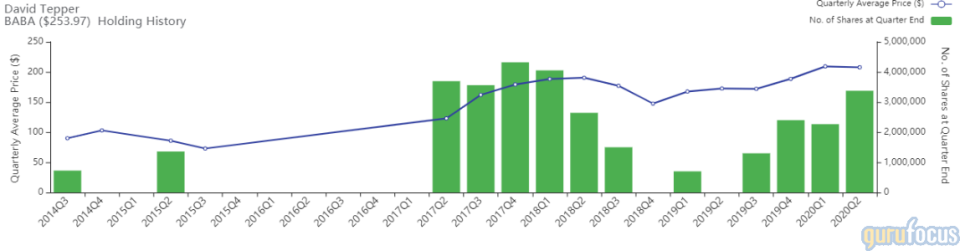

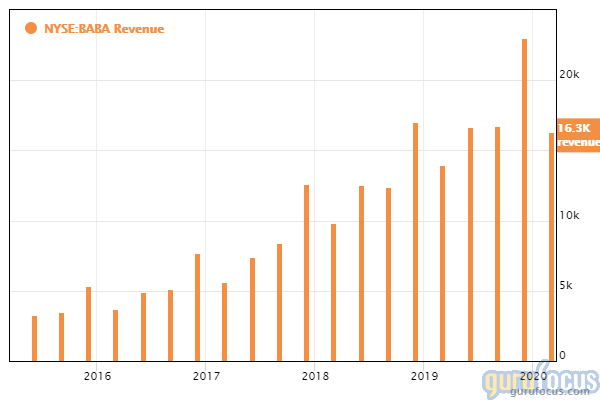

Alibaba

Tepper purchased 1.11 million shares of Alibaba, increasing the position 49.01% and the equity portfolio by 4.16%. Shares averaged $207.72 during the second quarter.

GuruFocus ranks the Chinese e-commerce giant's profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, consistent revenue growth and an operating margin that is outperforming over 94.5% of global competitors.

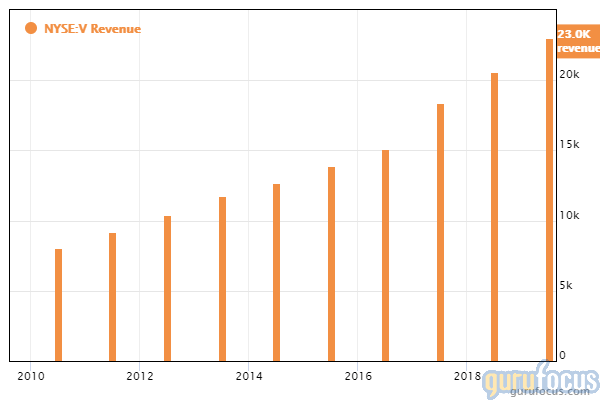

Visa

Tepper purchased 840,000 shares of Visa, giving the position a 2.82% equity portfolio weight. Shares averaged $182.35 during the second quarter.

GuruFocus ranks the San Francisco-based credit card company's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and an operating margin that has increased approximately 0.8% per year on average over the past five years and is outperforming over 92% of global competitors.

Mastercard

Tepper purchased 545,000 shares of Mastercard, giving the position a 2.80% equity portfolio weight. Shares averaged $281.32 during the second quarter.

GuruFocus ranks the Purchase, New York-based credit card company's profitability 10 out of 10 on several positive investing signs, which include a five-star business predictability rank, expanding operating margins and returns that are outperforming over 98% of global competitors.

See also

Tepper also established holdings in PayPal Holdings Inc. (NASDAQ:PYPL) and The Walt Disney Co. (NYSE:DIS), dedicating over 2% of the equity portfolio to each holding.

Disclosure: No positions.

Read more here:

Prem Watsa's Top 4 Trades in the 2nd Quarter

Ray Dalio's Bridgewater Dumps Treasury Bond ETF, Boosts 5 Positions in 2nd Quarter

Diamond Hill Capital's Top 5 Buys in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.