DCC PLC: A Poor Man's Compounder

I recently discovered DCC PLC (LSE:DCC) through the Gurufocus All-in-One Screener, a Premium feature. I was looking for cheap companies with compounding potential. DCC stood out with a price-to-owner-earnings ratio of 8 and an owner earnings compound annual growth rate (CAGR) of 8% over the last 10 years.

Owner earnings is a cash flow concept introduced by Warren Buffett (Trades, Portfolio) in his 1986 Berkshire Hathaway (BRK.A)(BRK.B) letter to shareholders. At this time, companies were not required to produce a cash flow statement nor was stock based compensation such a big concern. Buffet's formulations of owner earnings removes non-cash distortions from earnings to focuses the investor's attention on how much cash they are getting as partial owners of the company at the end of the period. Buffet explained the concept as follows:

"Owner Earnings = (a) Net Income plus (b) depreciation, depletion, amortization, and other non-cash charges minus (c) average annual maintenance capital expenditures. Owners Earnings is like free cash flow, but I think a superior metric because it starts from net earnings, so takes stock-based compensation as well as maintenance capex into account. Unlike Free Cash Flow, owner's earnings includes stock based compensation which can be a significant expense for some companies."

About the company

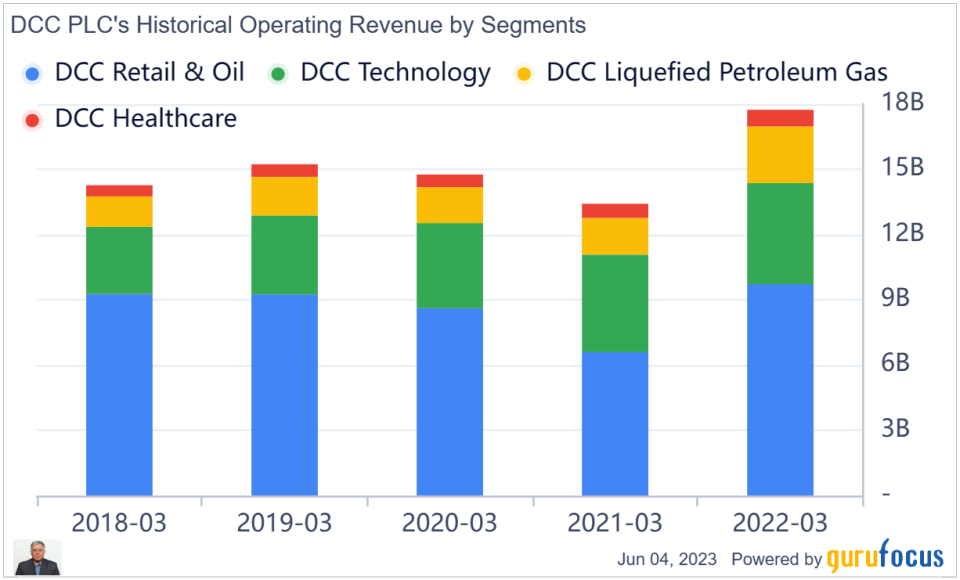

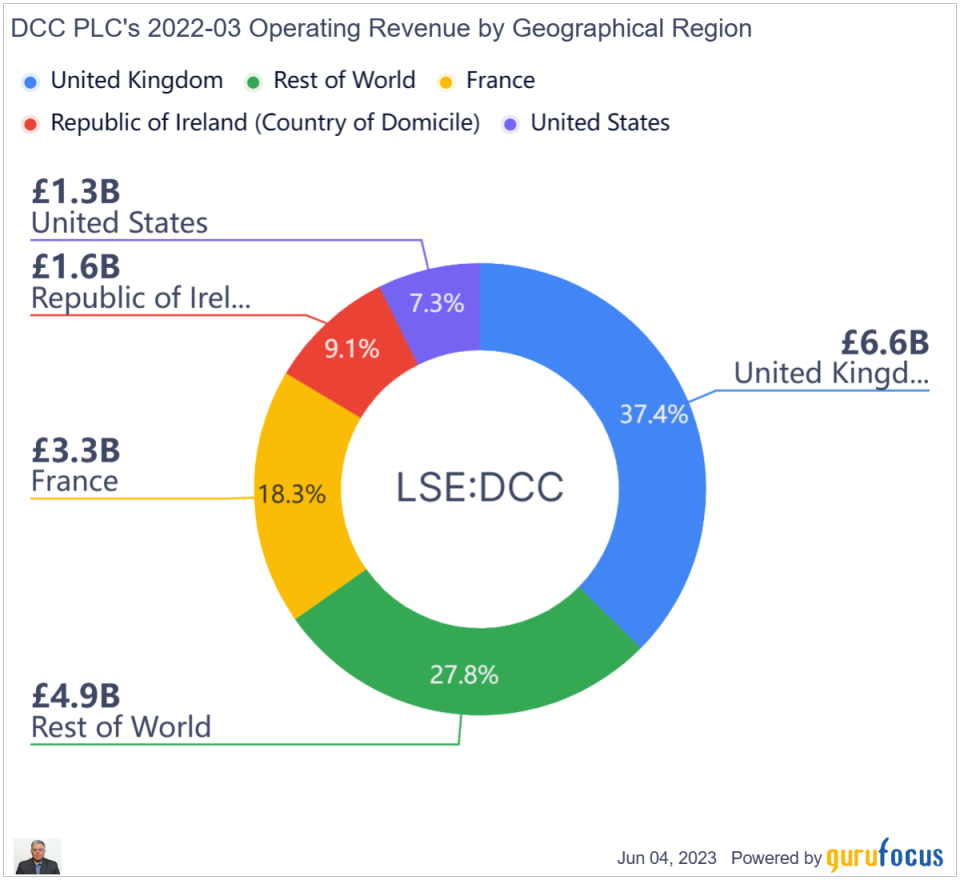

DCC is an Irish international sales, marketing and support services group operating in 22 countries and three sectors: energy, health care and technology. Its largest business is oil and LPG (Liquified Petroleum Gas) distribution. The company had revenue of 17.732 billion British pounds ($22 billion) and net income of 326 million in full-year 2022. It employs over 16,000 people.

The company's energy sector comprises LPG, retail, oil and renewables businesses. It sells and markets LPG, refrigerants and natural gas in Europe, Asia and the U.S. It also operates a network of petrol stations and motorway concessions in France under the Esso brand. The company's renewables business focuses on investing in solar power generation and synthetic jet fuel.

The health care sector provides products and services to health care providers and patients in Europe. It offers medical devices, pharmaceuticals and health and beauty products. It also provides contract manufacturing, packaging and regulatory services to the pharmaceutical industry.

The company's technology sector provides IT products and services to customers in Europe, Asia and North America. It distributes IT hardware, software, consumer electronics, gaming and mobility products. It also offers IT managed services, cloud solutions, cybersecurity and unified communications.

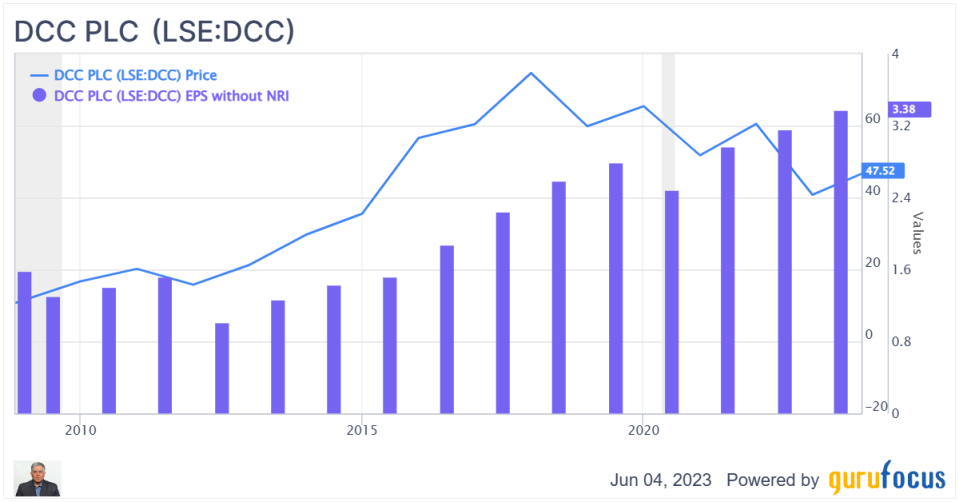

Long term track record of earnings

The company has a strong track record of growth and profitability, delivering consistent returns for its shareholders. One of the key financial metrics that reflects the company's potential for future performance is the forward price-earnings ratio, which measures the current share price relative to Morningstar analysts' esetimates of earnings per share (EPS) for the next 12 months. DCC's forward price-earnings ratio is attractive at only 10.22. This is especially remarkable when considering that the company's 10-year earnings per share growth is over 10%, indicating that DCC has been able to increase its earnings at a faster rate than its peers.

LSE:DCC Data by yield.

LSE:DCC Data by

Balance sheet

DCC is in a solid financial position. It has more short-term assets (5 billion) than either its short term (3.9 billion) or long term (2.9 billion) liabilities. It has also reduced its debt-to-equity ratio from 100.8% to 76.4% in the last five years. Its debt is easily covered by its operating cash flow (28.1%) and its interest payments are well within its Ebit.

Conclusion

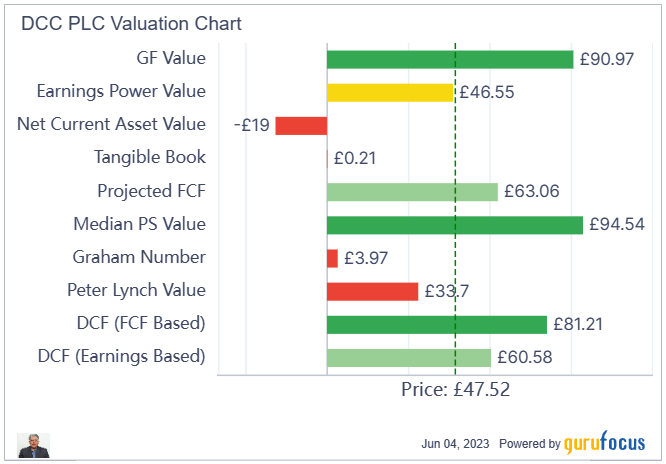

Overall, I believe DCC is undervalued by 20% to 30% based on my personal fair value estimate. The company has a consistent track record of earnings growth, with a nearly 8% annual increase over the past five years. It pays a reliable dividend yield of 3.94%, which is higher than the average of its peers. It also has an excellent balance sheet with manageable debt.

This article first appeared on GuruFocus.