DCP Midstream (DCP) Q4 Earnings Beat Estimates, Revenues Miss

DCP Midstream, LP DCP reported fourth-quarter 2021 adjusted earnings of 83 cents per unit, beating the Zacks Consensus Estimate of earnings of 79 cents. The bottom line increased from the year-ago quarter’s profit of 34 cents per unit.

Total quarterly revenues of $3,477 million missed the Zacks Consensus Estimate of $5,305 million. However, the top line increased from $1,785 million in the year-ago quarter.

The better-than-expected earnings were backed by increased wellhead volumes in the North and Midcontinent. The positives were partially offset by a decline in NGL pipelines throughput volumes as well as higher costs and expenses.

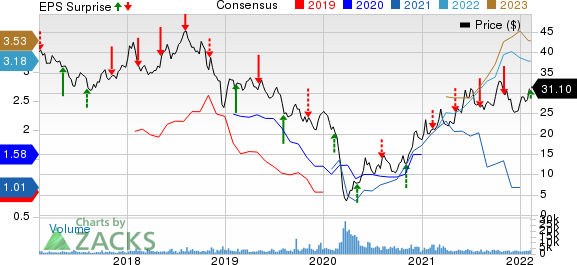

DCP Midstream Partners, LP Price, Consensus and EPS Surprise

DCP Midstream Partners, LP price-consensus-eps-surprise-chart | DCP Midstream Partners, LP Quote

Operations

Logistics and Marketing

The segment recorded adjusted EBITDA of $161 million in the fourth quarter, down from the year-ago period’s $183 million. Lower NGL pipelines throughput volumes affected the segment. The negatives were partially offset by higher Sand Hills, Southern Hills and Front Range volumes.

The average NGL pipelines throughput for the quarter was 692 thousand barrels per day (Mbpd), higher than the year-ago quarter’s level of 610 Mbpd. Fractionator throughputs were recorded at 57 Mbpd, up from the year-ago quarter’s level of 54 Mbpd.

Gathering and Processing

The segment reported adjusted EBITDA of $237 million in the fourth quarter, up from $181 million in the year-ago quarter. Increased wellhead volumes in the North and Midcontinent and favorable commodity prices aided the segment. The positives were partially offset by lower South region volumes.

Average natural gas wellhead volumes for the quarter declined to 4,151 million cubic feet per day (MMcf/d) from the year-ago period’s 4,442 MMcf/d. NGL gross production totaled 417 Mbpd, up from the year-ago quarter’s level of 414 Mbpd.

Total Expenses

Purchases and related costs significantly increased year over year in the quarter under review. Operating and maintenance expenses rose to $177 million from $160 million in the fourth quarter of 2020.

Total operating costs and expenses in the fourth quarter were $3,225 million, up from the year-ago quarter’s figure of $1,740 million.

Financials

For fourth-quarter 2021, total expansion capital expenditures and equity investments were $16 million. Sustaining capital for the quarter was $23 million. DCP generated an excess free cash flow of $122 million in the reported quarter.

At the end of fourth-quarter 2021, the partnership reported long-term debt of $5,078 million. Cash and cash equivalents were $1 million. It had current debt of $355 million, reflecting a debt to capitalization of 48.2%.

Guidance

For 2022, DCP Midstream projects adjusted EBITDA in the range of $1,350-$1,500 million. It expects a distributable cash flow of $900-$1,010 million, while excess free cash flow is projected to be $425-$585 million.

The partnership anticipates sustaining capital expenditures of $100-$140 million for the year. Growth capital expenditure is anticipated to be $100-$150 million.

Zacks Rank & Stocks to Consider

The partnership currently has a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that turned in strong bottom-line numbers in the fourth quarter and presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Murphy USA Inc. MUSA, based in El Dorado, AR, is a leading independent retailer of motor fuel and convenience merchandise in the United States. MUSA reported fourth-quarter 2021 adjusted earnings per share (EPS) of $4.23, beating the Zacks Consensus Estimate of $3.68.

Murphy USA currently has a Zacks Style Score of A for Growth, Value and Momentum. As of Dec 31, Murphy USA had cash and cash equivalents of $256.4 million. MUSA is committed to returning excess cash to shareholders through continued share buyback programs.

ConocoPhillips COP, based in Houston, TX, is primarily involved in the exploration and production of oil and natural gas. COP reported fourth-quarter 2021 adjusted EPS of $2.27, comfortably beating the Zacks Consensus Estimate of $2.20.

ConocoPhillips’earnings for 2022 are expected to soar 62.1% year over year. COP reported preliminary 2021 year-end proved reserves at 6.1 billion BoE. As of Dec 31, 2021, ConocoPhillips had $5,028 million in total cash and cash equivalents.

Exxon Mobil Corporation XOM, based in Irving, TX, is one of the leading integrated energy companies in the world. XOM reported fourth-quarter 2021 earnings per share of $2.05 — excluding identified items — beating the Zacks Consensus Estimate of $1.96 per share.

ExxonMobil is expected to see an earnings growth of 27.3% in 2022. ExxonMobil has initiated share repurchases at the beginning of the March quarter of this year. The buybacks are associated with the repurchase plan announced earlier, representing the program of repurchasing up to $10 billion over the next 12-24 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research