December Best Energy Dividend Paying Stocks

The cyclicality of the energy industry makes it hard for income investors to find high yielding stocks. However, as oil prices recover from lows in 2014, energy stocks have benefited through increased profitability and cash flows. As a result, shareholders are paying more attention to companies like Alliance Resource Partners and Genesis Energy, and have rising expectations for dividend payments as well. Below is my list of huge dividend-paying stocks in the energy industry that continues to add value to my portfolio holdings.

Alliance Resource Partners, L.P. (NASDAQ:ARLP)

ARLP has a enticing dividend yield of 9.07% and pays out 52.85% of its profit as dividends , with analysts expecting this ratio in three years to be 107.65%. While there’s been some level of instability in the yield, ARLP has overall increased DPS over a 10 year period from $1.12 to $1.75. Alliance Resource Partners’s earnings growth over the past 12 months has exceeded the us oil and gas industry, with the company reporting an EPS growth of 112.90% while the industry totaled 17.75%.

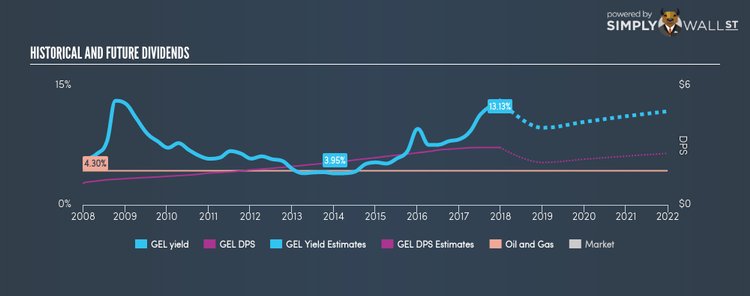

Genesis Energy, L.P. (NYSE:GEL)

GEL has an appealing dividend yield of 13.13% with a generous payout ratio . Over the past 10 years, GEL has increased its dividends from $1.08 to $2.89. It should comfort existing and potential future shareholders to know that GEL hasn’t missed a payment during this time. Over the next 12 months, analysts are predicting double digit earnings growth of 91.33%.

NuStar Energy L.P. (NYSE:NS)

NS has a substantial dividend yield of 14.77% with a generous payout ratio . NS’s DPS have risen to $4.38 from $3.94 over a 10 year period. It should comfort existing and potential future shareholders to know that NS hasn’t missed a payment during this time. Analysts are expecting an impressive triple digit earnings growth over the next year.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.