December Dividend Stock Picks

One of the best paying dividend stock on our list is IG Group Holdings. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

IG Group Holdings plc (LSE:IGG)

IG Group Holdings plc engages in online trading business worldwide. Established in 1974, and now run by Peter Hetherington, the company currently employs 1,546 people and with the stock’s market cap sitting at GBP £2.44B, it comes under the mid-cap stocks category.

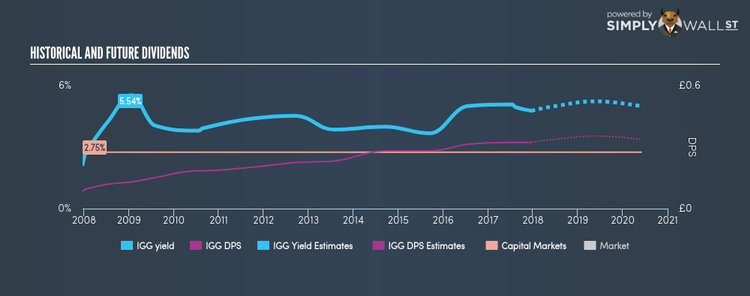

IGG has a substantial dividend yield of 4.78% and is distributing 69.95% of earnings as dividends , with analysts expecting the payout in three years to be 70.36%. In the case of IGG, they have increased their dividend per share from £0.085 to £0.323 so in the past 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. The company has a lower PE ratio than the GB Capital Markets industry, which interested investors would be happy to see. The company’s PE is currently 14.7 while the industry is sitting higher at 17.6.

Capita plc (LSE:CPI)

Capita plc provides customer management, administration, and professional support services to clients in the private and public sectors. Established in 1984, and currently run by Jonathan Lewis, the company currently employs 73,000 people and with the market cap of GBP £2.70B, it falls under the mid-cap category.

CPI has a juicy dividend yield of 7.88% with a large payout ratio. . CPI’s dividends have increased in the last 10 years, with DPS increasing from £0.1064 to £0.317. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Analyst estimates for Capita’s future earnings are certainly promising, predicting a triple digit earnings growth over the next three years.

Tate & Lyle plc (LSE:TATE)

Tate & Lyle PLC, together with its subsidiaries, provides ingredients and solutions to the food, beverage, and other industries in the United States, the United Kingdom, other European countries, and internationally. Started in 1903, and currently lead by Javed Ahmed, the company currently employs 4,146 people and with the company’s market cap sitting at GBP £3.27B, it falls under the mid-cap category.

TATE has a wholesome dividend yield of 3.99% and is paying out 52.27% of profits as dividends , with analysts expecting the payout ratio in three years to be 57.19%. The company’s DPS have increased from £0.215 to £0.282 over the last 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Tate & Lyle’s earnings per share growth of % over the past 12 months outpaced the GB Food Products industry’s average growth rate of 0.1667%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.