December Dividend Stock Picks

Dividend stocks such as Power Financial and TELUS can help diversify the constant stream of cash flows generated by your portfolio. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Here are other similar dividend stocks that could be valuable additions to your current holdings.

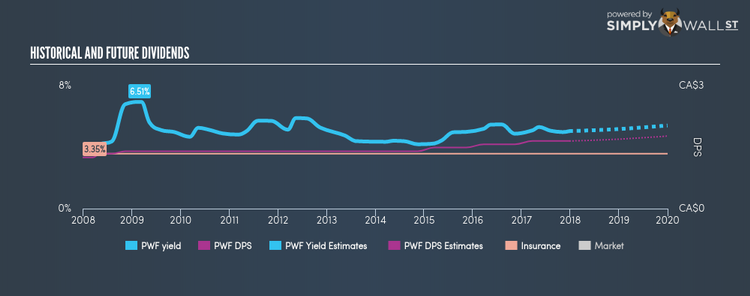

Power Financial Corporation (TSX:PWF)

Power Financial Corporation provides financial services in Canada, the United States, Europe, and Asia. Started in 1940, and currently headed by CEO Robert Orr, the company currently employs 26,879 people and with the stock’s market cap sitting at CAD CA$24.92B, it comes under the large-cap stocks category.

PWF has a large dividend yield of 4.73% and their current payout ratio is 55.15% . PWF has increased its dividend from $1.25 to $1.65 over the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend.

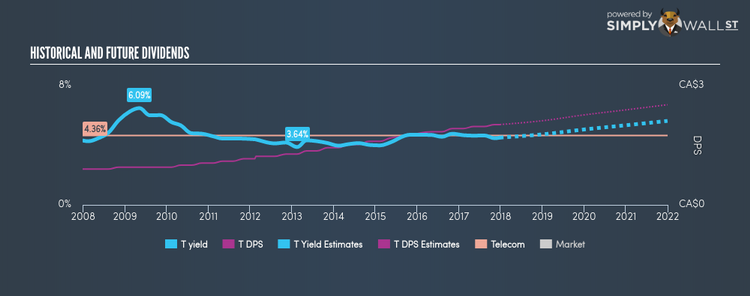

TELUS Corporation (TSX:T)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications products and services in Canada. Formed in 1993, and currently run by Darren Entwistle, the company provides employment to 50,475 people and with the company’s market cap sitting at CAD CA$28.38B, it falls under the large-cap category.

T has an appealing dividend yield of 4.23% and the company has a payout ratio of 91.27% . T’s dividends have increased in the last 10 years, with DPS increasing from $0.9 to $2.02. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. TELUS’s future earnings growth looks strong, with analysts expecting 52.21% EPS growth in the next three years.

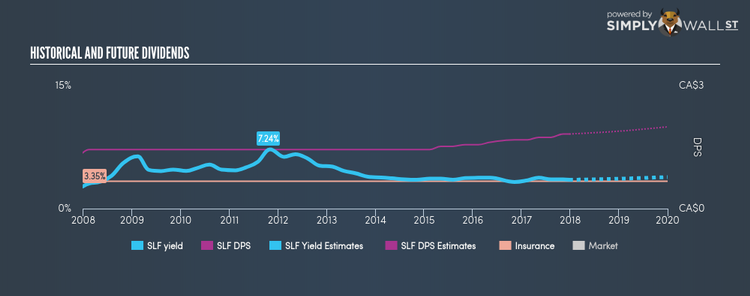

Sun Life Financial Inc. (TSX:SLF)

Sun Life Financial Inc., a financial services company, provides protection and wealth products and services to individuals, businesses, and institutions worldwide. Established in 1999, and now run by Dean Connor, the company now has 20,980 employees and with the company’s market capitalisation at CAD CA$31.71B, we can put it in the large-cap stocks category.

SLF has a solid dividend yield of 3.51% and distributes 39.26% of its earnings to shareholders as dividends , with an expected payout of 42.47% in three years. The company’s DPS has increased from $1.36 to $1.82 over the last 10 years. They have been consistent too, not missing a payment during this 10 year period. The company’s latest earnings per share figure was CA$3.74, up 16.39% from the previous year.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.