December Top Cheap Stock To Invest In

Undervalued companies, such as Novra Technologies and Trican Well Service, are those that trade at a price below their actual values. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

Novra Technologies, Inc. (TSXV:NVI)

Novra Technologies, Inc. provides products, systems, and services for the distribution of multimedia broadband content. The company provides employment to 30 people and with the company’s market capitalisation at CAD CA$4.83M, we can put it in the small-cap group.

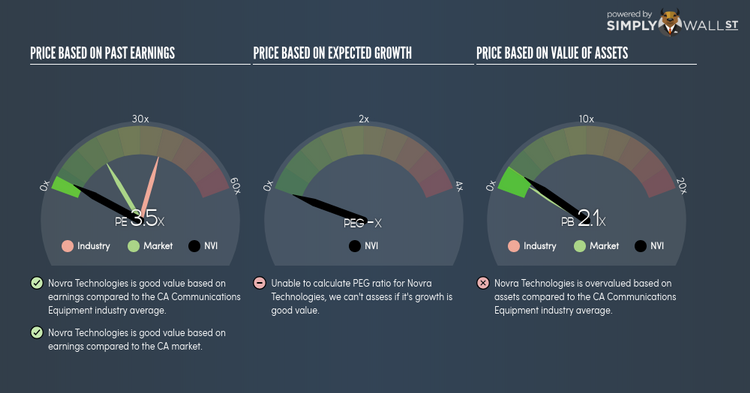

NVI’s stock is now floating at around -75% less than its actual level of $0.58, at the market price of $0.14, based on my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Moreover, NVI’s PE ratio is trading at 3.5x compared to its communications peer level of 37.6x, suggesting that relative to its comparable company group, NVI can be bought at a cheaper price right now. NVI is also robust in terms of financial health, with current assets covering liabilities in the near term and over the long run. Finally, its debt relative to equity is 65%, which has been declining over time, indicating its capability to reduce its debt obligations year on year.

Trican Well Service Ltd. (TSX:TCW)

Trican Well Service Ltd., an oilfield services company, provides various specialized products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells primarily in Canada. Formed in 1979, and currently run by Dale Dusterhoft, the company provides employment to 1,194 people and has a market cap of CAD CA$1.42B, putting it in the small-cap group.

TCW’s shares are currently hovering at around -15% under its intrinsic value of $4.83, at a price of $4.13, based on my discounted cash flow model. The discrepancy signals an opportunity to buy low. Also, TCW’s PE ratio is currently around 16.3x against its its energy services peer level of 22.6x, indicating that relative to its peers, TCW’s shares can be purchased for a lower price. TCW is also in good financial health, with short-term assets covering liabilities in the near future as well as in the long run. Finally, its debt relative to equity is 15%, which has been declining over the past couple of years indicating TCW’s capacity to reduce its debt obligations year on year.

George Weston Limited (TSX:WN)

George Weston Limited engages in food processing and distribution business in Canada and internationally. Started in 1882, and currently run by Galen Weston, the company now has 195,000 employees and with the company’s market capitalisation at CAD CA$14.13B, we can put it in the large-cap category.

WN’s stock is now trading at -55% lower than its intrinsic level of $243.02, at the market price of $110.45, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. What’s even more appeal is that WN’s PE ratio is around 18.3x against its its consumer retailing peer level of 21.4x, suggesting that relative to its comparable company group, WN can be bought at a cheaper price right now. WN is also strong in terms of its financial health, as current assets can cover liabilities in the near term and over the long run. The stock’s debt-to equity ratio of 89% has been diminishing over the past couple of years signifying its ability to pay down its debt.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.