Declining DeFi use and weak stocks weigh on Ethereum price

Declining DeFi use and weak stocks are keeping Ethereum price below $2000. Ethereum is the second-largest cryptocurrency after Bitcoin. Like other cryptocurrencies, Ethereum follows the lead of Bitcoin in its rise and fall.

Ethereum price has been on the decline for the past 7 weeks. It was selling as high as $3580 in the last week of March while dropping almost 100% in price, hitting the 6-month lowest price of $1712 earlier today. The 8.6% drop in the price of Ethereum in the past 24hrs was enough to accumulate a total of $543.45 million in liquidation in future contracts, according to Coinglass data.

Crumbling Tech stocks and Russian regulation worsening the situation

The crumbling tech stock prices are pressuring Ethereum prices. The Nasdaq Composite Index on May 24 downturn by 2.5% caused Ethereum price to drop. In addition to this, the highly tech-driven crypto market was pressured by the tumbling of the Snap (SNAP) social media platform by 40%. Other factors like post-Covid conditions, rising poverty all over the world, supply chain restrictions, and disruptions in labor have inhibited the growth of Ethereum. The share value of Meta Platforms (FB) also fell by 10% limiting Ethereum growth.

The Russia Ukraine war has had a huge negative impact on the crypto market. On May 20, the updated version of the Russian mining law proposal incremented the burden on investors weighing on Ethereum’s price. The document now excludes the registry of a crypto mining operator and the one-year tax amnesty. This further affects the price of all cryptocurrencies including Ethereum. The uncertainty caused by the war and the damage to property together with the disruption of day-to-day activities is the reason for the decline in markets all around the world.

On-chain data favors the bears

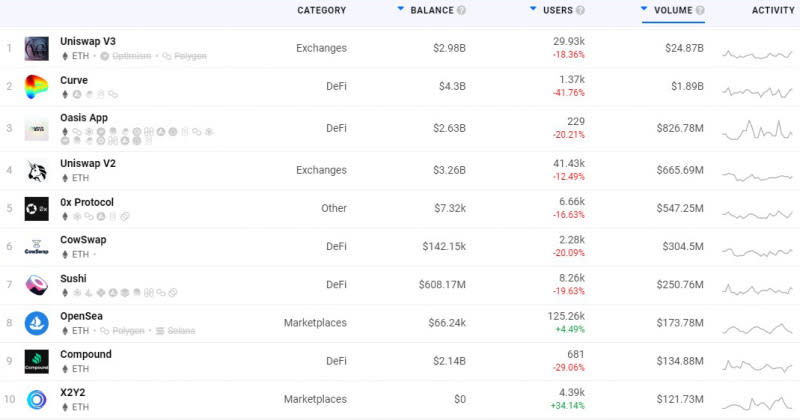

Even though the number of active addresses on the Ethereum network’s decentralized applications (DApps) has improved compared to the previous week, they are 20% lower than previous numbers.

Many DApps faced a reduction in their active users this week. The network’s most active decentralized application the name Uniswap V3 having a total value of DApps smart contracts around $24.87 billion faced a drop of 18.36% in its active users. While the number two DApp, Curve lost a whopping 41.76% of users this week.

To better understand the position of whales, professional traders, and market makers we will have a look at the futures.

Crypto quarterly futures are used mostly by arbitrage, whales, and market makers mainly because the funding rate is more stable as compared to the spot market. The futures markets sell at a slighter premium compared to spot markets. Futures help investors to earn profits while they can invest long term. Usually in the stock market futures trade at 5% to 12% per year in a healthy market. When the futures market price is higher than the spot market it is called “contango”. This might not always be the case when we talk about crypto markets. Crypto markets are highly volatile and unpredictable.

Ethereum’s future 3-month contracts premium dropped below the 5% market threshold on April 6. It has struggled since as shown by the data in figure 3 from 3 of the top crypto trading platforms BINANCE, FTX and HUOBI. We can see that the future contract premium varies from as low as 2.25% to as high as 5.75%.

Ethereum has gained 2% after testing the $1750 resistance on May 26, but the on-chain data trends show that there is a lack of user growth pointing towards bearish behavior. But as we say Ethereum is highly unpredictable like all other crypto markets there is always a chance for tremendous growth.

The chances for growth in the near future seem minimal but in the long term, there is a lot of hope as Ethereum is planning to move from proof-of-work (POW) to proof-of-stake (POS). Tim Beiko an Ethereum developer tweeted on April 13 “It won’t be June, but likely in a few months after. No firm date yet, but we’re definitely in the final chapter of PoW on Ethereum”. This shift can give Ethereum the much-needed boost it needs to regain its 5% neutral level and break the $2150 resistance in the coming future.

This article was originally posted on FX Empire